The contract freight market, a key indicator of the trucking industry’s health, showed signs of life following last month’s 3.6% sequential increase in the American Trucking Association’s (ATA) advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index. The ATAs tonnage index, which includes truckload and LTL freight, is dominated by contract freight with minimal spot market loads. Compared to May 2023, the SA index rose 1.5%, the first year-over-year gain in fifteen months.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

May was the first month since February 2023 that tonnage increased sequentially and from a year earlier,” said ATA Chief Economist Bob Costello. “While there was clearly an increase in freight before the Memorial Day holiday, it is still too early to say whether this is the start of a long-awaited recovery in the truck freight market.”

ATA has calculated the tonnage hauled index based on surveys of its membership since the 1970s. In calculating the index, 100 represents the year 2015. Regarding the split between contract and spot freight, the latest data from DAT’s contract shipper consortium indicates around 17% of all loads are moved on the spot market in May, with the remainder on the contract market.

Market watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

Cross-border carriers between Canada and the U.S. are concerned about excess capacity and historically low linehaul rates. Since the start of March this year, linehaul rates between the two countries have become increasingly decoupled. This is due to the Canadian market dealing with excess capacity from record-high spot rates during the pandemic. Since the high in April ’22 of $3.51/mile for dry van loads between the U.S. and Canada, linehaul rates have dropped 53% and 5% year-over-year (y/y). Canada to the U.S. spot rates have dropped 48% and 7% over the same time frame.

Excluding fuel, contract shippers paid 5.25% lower year-over-year in Canada during April, according to TMS provider Nulogx. The Base Rate Index, which excludes fuel, increased by 2.29% in March but was still 9% lower than the August ’22 peak. The Canadian General Freight Index (CGFI) indicates that the total cost of ground transportation for Canadian shippers increased by 1.89% in April compared with March. Doug Payne, President & COO of Nulogx, stated, “Canadian Domestic LTL remains above last year while Domestic Truckload, Cross Border TL & Cross Border LTL segments continue to remain below the costs for the same period last year.”

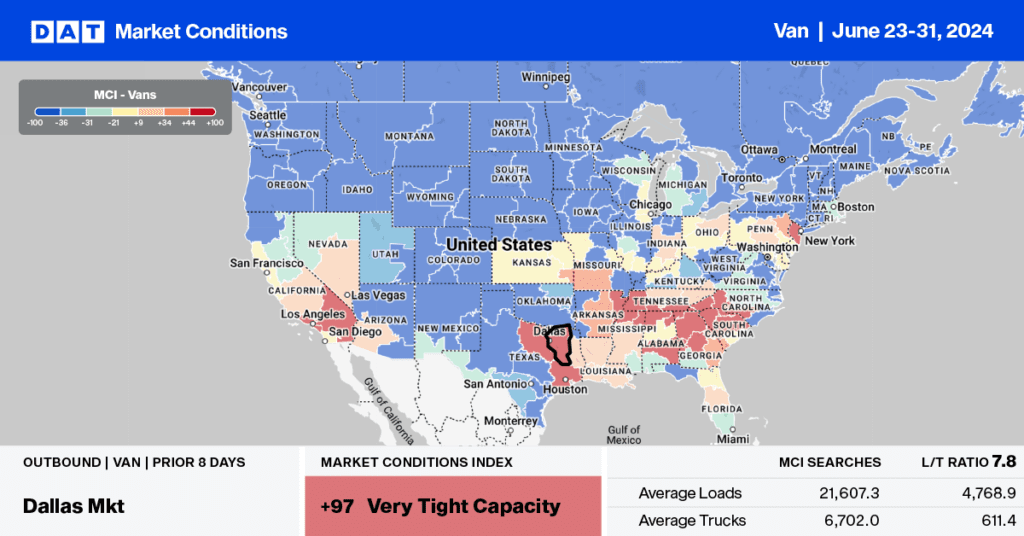

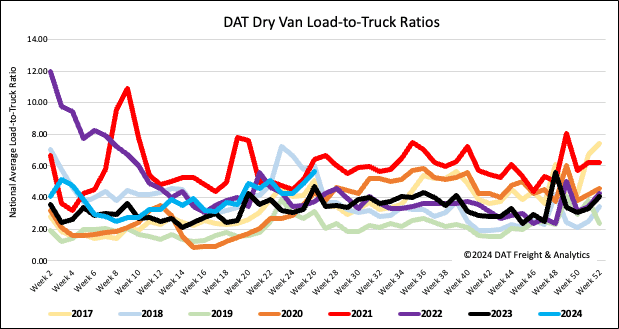

Load-to-Truck Ratio

Dry van load post volume followed the pre-July 4 surge in freight volumes, increasing 13% w/w, identical to the average over the last eight years. Volumes are 3% higher than last year, while carrier equipment posts were 14% lower, increasing the dry van load-to-truck ratio by 16% w/w to 5.66, the third-highest reading in eight years. Only 2018 and 2021 recorded higher LTR for the week before Independence Day.

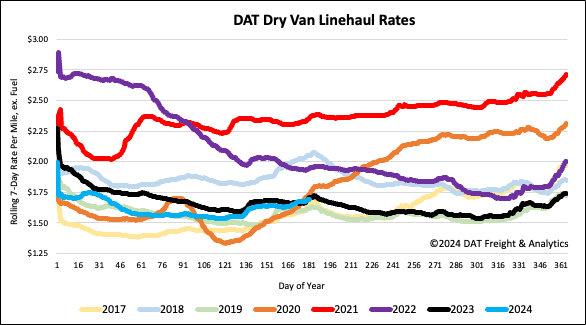

Linehaul spot rates

The national average dry van linehaul rate increased by just under $0.01/mile to $1.70/mile last week, the highest since the mid-January Polar Vortex event. Compared to last year, spot rates are within a penny per mile on a 6% higher volume of spot market loads moved in Week 26, the last week of the shipping month. DAT’s Top 50 lanes, based on the volume of loads moved, increased by $0.03/mile, averaging $2.06/mile last week, which is $0.36/mile higher than the national average.