The controversial vaccine mandate announced by the Canadian Government, which came into effect on January 15th has sent shockwaves through the cross-border freight market ever since. The mandate requires Canadian truckers to be doubly vaccinated in order to avoid having to quarantine for 14 days when returning from the United States. Truckers had previously been exempt from border vaccination requirements as essential service providers. The U.S. also implemented a similar mandate, which went into effect on Jan. 22 with a different freight market impact expected on either side of the border.

According to the Canadian Trucking Alliance (CTA), only vaccinated drivers will be permitted to move the $650 billion in trade that crosses the Canada-US border. The CTA reported, “that when it comes to the U.S.-Canada freight market, approximately 75% of the estimated 160,000 cross-border truck drivers are Canadian with 10-15% (est. 16,000 drivers) of cross-border truck drivers expected to quit or seek work elsewhere as a result of the vaccine mandate.” That could equate to upwards of 16,000 fewer drivers that would normally support the growing volumes of freight moving between the U.S. and Canada.

“In the Canadian domestic freight market there’s an expectation freight the rates will go down because remember, this is all about supply and demand and if we have more drivers that can’t cross the border or won’t cross the border, then that will make more trucks and drivers available to haul domestic loads,” according to Chuck Snow, Traffix CEO and asset-based third-party logistics provider who spoke to DAT Freight & Analytics to gauge the impact of the mandate.

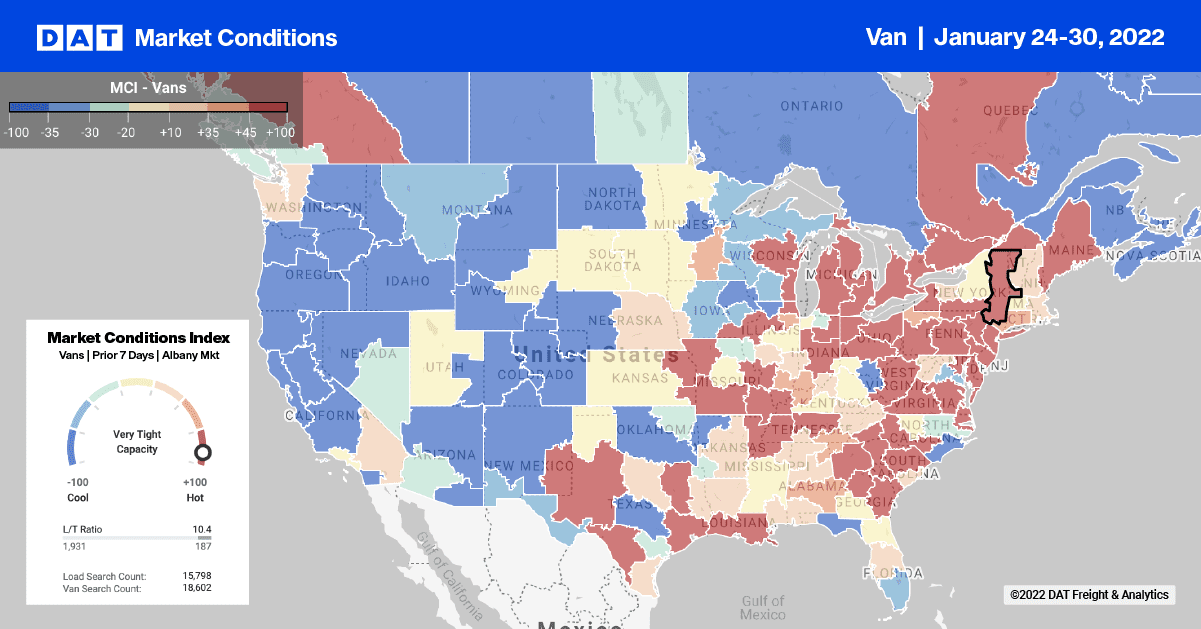

The other major impact according to Snow is the disruption to weekly freight patterns, “because no one sends a truck from Montreal or Toronto to Phoenix on a Friday unless they’ve got a return load already scheduled with the freight already sitting on a dock for a pickup the following Wednesday”. Fewer trucks and drivers moving southbound from Canada into the U.S. will decrease available capacity to move loads destined for Canadian markets forcing contract freight into the spot market. Spot rate volatility is already evident in markets including Phoenix and Philadelphia, which ship considerable volumes into Canada.

Phoenix to Montreal and Quebec spot rates are currently averaging $1.94/mile excl. FSC this week, which is up $0.34/mile y/y and up $0.27/mile in just the last four weeks. Capacity impacts on the Phoenix to Vancouver, BC, lane are not as obvious – spot rates are only $0.05/mile higher than the December average at $2.09/mile excl. FSC this week. On the East Coast the impact is far more visible for loads north across the border, especially from Elizabeth, NJ, to Toronto. Dry van spot rates are currently averaging $3.05/mile excl. FSC, which is up $0.84/mile in the last month and up almost $1.00/mile over the 2021 12-month average spot rate.

The Philadelphia to Toronto lane is behaving much the same this week and after averaging around $2.00/mile excl. FSC last year, loads this week are averaging $2.77/mile excl. FSC, which is 38% higher than the 12-month average. On the southern border in Texas where the majority of Mexican manufactured auto parts cross into the U.S. before heading to Canada, spot rates from McAllen to Toronto have surged to an average of $2.22/mile excl. FSC this week. After averaging around $1.55/mile for all of last year, spot rates this week are already $0.67/mile higher than the December average.

Load-to-Truck Ratio (LTR)

Dry van load post volumes dropped for the third week in a row and are now down by 20% in the last month following last week’s 12% w/w decrease. Carrier equipment posts increased by 8% w/w and as a result, the dry van load-to-truck ratio dropped by 19% w/w from 9.39 to 7.63.

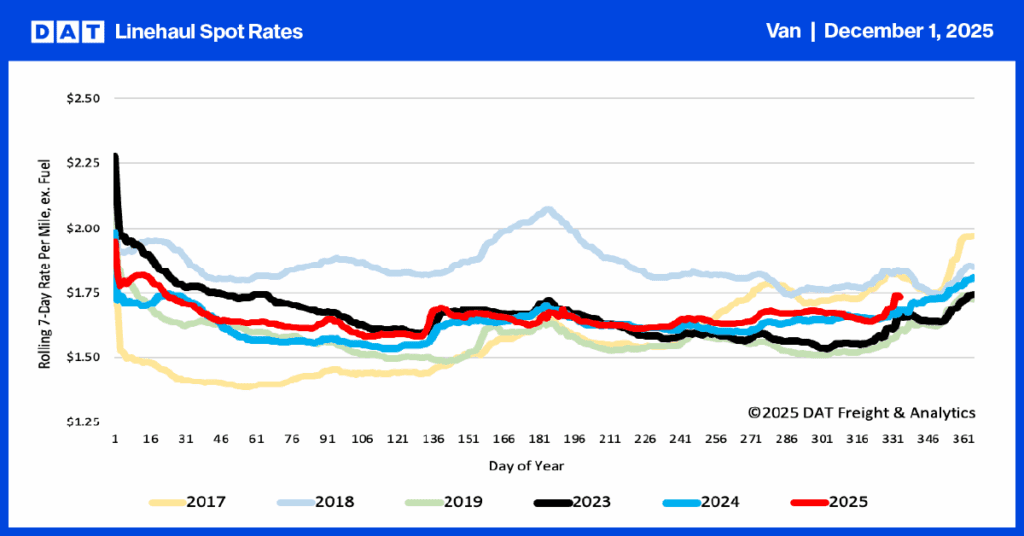

Spot Rates

More seasonality emerged last week as spot rates dropped for the second week in a row, decreasing by just over $0.03/mile to a national average of $2.73/mile excl. FSC. Spot rates have now dropped by $0.05/mile in the last two weeks but are still $0.69/mile higher than the same week last year.