The contract freight market continues to soften following last month’s 3.5% m/m drop in the American Trucking Associations’ (ATA) advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index. The ATAs tonnage index, which includes truckload and LTL freight, is dominated by contract freight with minimal spot market loads. Compared to January 2023, the SA index fell 4.7%, the eleventh straight y/y decrease.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

“January’s data was a snap back to reality for anyone thinking the freight market was about to turn the corner,” said ATA Chief Economist Bob Costello. “Bad winter weather in January likely hurt volumes, not to mention sharp drops in several drivers of tonnage, including retail sales, housing starts, and manufacturing output.”

ATA has calculated the tonnage hauled index based on surveys of its membership since the 1970s. Regarding the split between contract and spot freight, the latest data from DAT’s contract shipper consortium indicates around 16% of all loads are moving on the spot market this quarter, with the remainder on the contract market.

Market watch

All rates cited below exclude fuel surcharges unless otherwise noted.

After dropping by 10% over the last month, outbound loads moved jumped in California last week, increasing by 12% as shippers sought to move loads ahead of Winter Storm Orzelle, which closed large sections of I-80 in the Sierra Nevadas late last week. Inbound loads into California were also up 4% w/w. With sufficient outbound capacity to meet demand, linehaul rates were flat at a state average of $1.55/mile, down $0.10/mile in the last month.

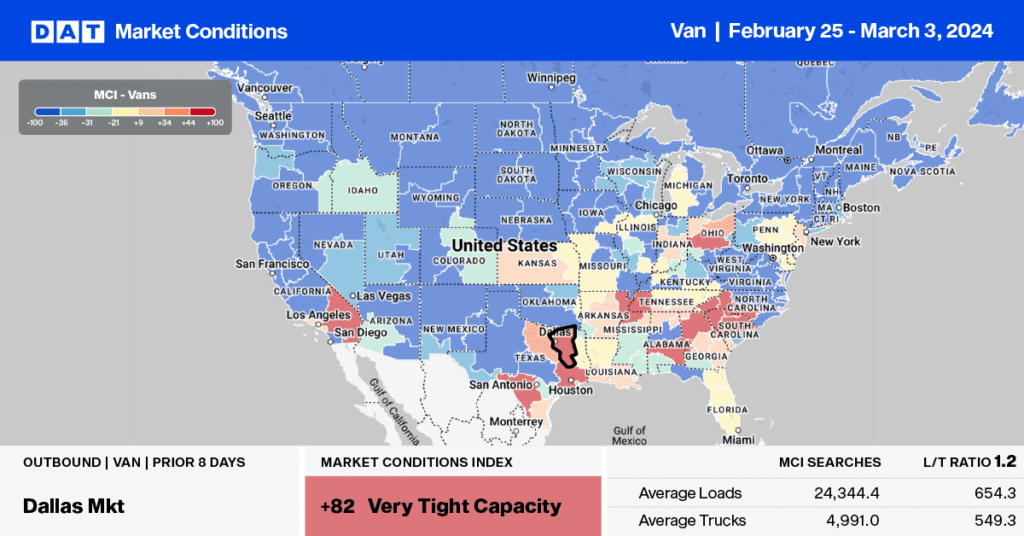

In Texas, linehaul rates increased $0.03/mile to a state average of $1.46/mile following a 1% week-over-week (w/w) increase in loads moved. In the combined Dallas/Ft. Worth area volumes were up 1.5% w/w while outbound spot rates were flat, with the reverse being the case in Houston, where volumes were down by just under 1% and spot rates were up 4%. The Houston to Dallas/Ft. Worth lane accounted for 18% of the volume of loads moved last week in Texas, while loads to Houston only accounted for 17%. Reflecting the slight imbalance on this lane, carriers were paid an average of $1.98/mile between Houston and Dallas/Ft. Worth and $1.77/mile for the return journey south to Houston.

Linehaul spot rates

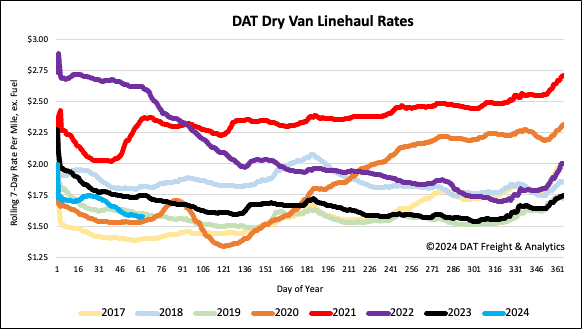

After dropping $0.15/mile over the prior four weeks, the slide in dry van linehaul rates slowed considerably last week. At just over $1.58/mile, linehaul rates were down less than a penny per mile last week, although that correction may be short-lived after a 5% higher volume of loads moved due to end-of-month shipping. Dry van linehaul rates are $0.17/mile lower than last year, and based on the volume of loads moved, DAT’s Top 50 lanes averaged $1.83/mile last week, maintaining the $0.25/mile spread above the national average.