Just when the West Coast freight market was looking forward to a return to normalcy, the latest omicron surge threatens to create an even bigger backlog of container vessels waiting to unload.

According to the Pacific Maritime Association, which secures labor for terminal operators on the West Coast, about 800 dockworkers – roughly 10% of the 8,000-person workforce at the ports of Los Angeles and Long Beach – were unavailable for Covid-related reasons as of the start of last week.

There are currently just over 1.217m containers on 106 vessels waiting an average of 17.6 days to unload their much-needed cargo, 62% of which comes directly from China. The vessel that has been waiting the longest is the Pinocchio, which arrived off the coast of Los Angeles on November 15, 2021. That’s 58 days waiting at anchor to unload!

It’s not all bad news, as both ports have been making progress. The wait time at anchor has dropped 20% in the last three weeks, while the volume of containers processed through ports of Los Angeles and Long Beach increased by 14% and 3% m/m respectively. Both ports moved an additional 63,263 import containers in the month of December compared to November, according to IHS Markit PIERS.

With workers in China expected to work through the Chinese New Year period again this year, barring any major Covid-19 outbreaks in China, we should see a continuation of container vessels making their way to the U.S. for the next four to six months. For carriers and brokers working into and out of the Southern California freight market, expect strong demand for dry van loads and inflationary pressure on outbound spot rates for loads to Seattle, Denver, Phoenix, Chicago and Dallas over the same timeframe.

Find van loads and trucks on the DAT Load Board.

NOTE: Market rates reported below do not include fuel surcharges

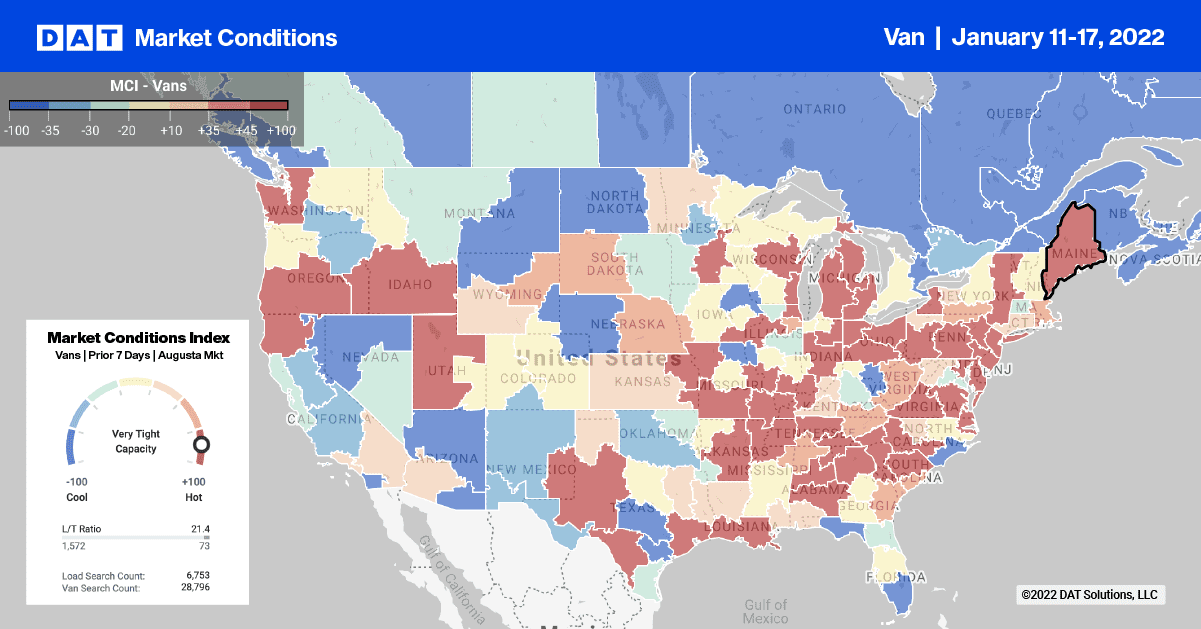

Van volumes and spot rates surged ahead of Winter Storm Izzy arriving in the Northeast last week, with the Pennsylvania Department of Transportation taking precautions and shutting down interstates last Sunday afternoon for truckers. The PennDOT closure of major highways forced many carriers to delay appointments by at least a day, which will no doubt reverberate throughout Northeast freight markets this week. Volumes increased by 22% w/w in the large Pittsburgh market with a corresponding effect on outbound spot rates, which increased by $0.11/mile to an average of $3.01/mile.

After being relatively flat for the five months, spot rates for loads from Pittsburgh to Boston increased by 43 cents above the December 2021 average to end the week at $4.53/mile. Loads south to Atlanta did much the same thing, increasing 68 cents to $3.50/mile.

Just north in Erie, PA, spot rates increased 31 cents to $3.37/mile following a 21% w/w increase in volume. Further south in Charleston, WV, spot market volumes increased 43%, pushing outbound spot rates by 9 cents to an average of $3.06/mile.

Load-to-Truck Ratio

Load posts on the DAT Load Board dropped 3% last week, but volumes are still 140% higher than at this point last year. There were 10% fewer carrier equipment posts over the same timeframe, though. As a result, the dry van load-to-truck ratio dropped from 11.97 to 9.72.

Spot Rates

Van rates rose 4 cents per mile, regaining the losses from the prior week. The last time spot rates increased in the month of January was way back in 2018 when the bull market was just getting started. The national average dry van spot rate ended last week at $2.78/mile, which is 63 cents higher than the same week last year and 83 cents higher than the third week of 2018.