The December Truckload Ton-Mile Index (TTMI) produced by Michigan State University showed that truckload demand rebounded slightly to levels last seen in September and October. 2024 ended with a slight increase in for-hire trucking demand from Q3 2024 (0.1%), but “not enough to declare that a meaningful trend has emerged,” according to Professor Jason Miller.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

January’s ATA For-Hire Truck Tonnage Index was up 0.3% from the same month last year, the first year-over-year increase since August. After declines in November and December totaling 1.7%, tonnage remained unchanged in January. ATA Chief Economist Bob Costello states that “softness in manufacturing and retail sales continue to be a drag on truck freight volumes.

The economic outlook for truckload carriers remains unclear, given the new administration’s sheer volume of new policy stances. An extended trade war is of most concern, with the likely outcome being lower freight volumes as shippers adopt a wait-and-see attitude in the first half of 2025.

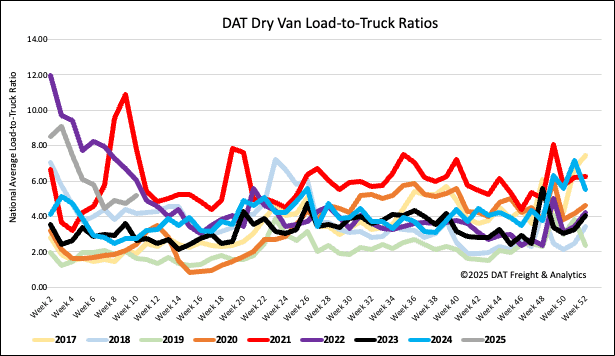

Load-to-Truck Ratio

Load post volumes continue to trend around 22% higher than last year, following last week’s 3% w/w gain. Last week’s dry van load-to-truck ratio (LTR) ended at 5.19.

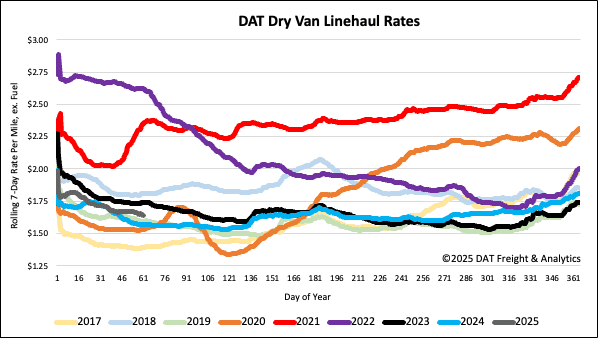

Linehaul spot rates

Following last week’s brief pause in the decline in dry van linehaul rates, spot rates dropped again, making it seven of the last eight weeks that dry van rates have fallen. Excess capacity continues to weigh on the spot market despite the volume of loads increasing by 11% last week and almost 2% in the last month.

At $1.66/mile, the national 7-day rolling average is $0.07/mile higher than last year and $0.04/mile higher than 2019. On DAT’s Top 50 lanes, ranked by the volume of loads moved, carriers were paid an average of $1.92/mile, down $0.02/mile w/w. However, this average is $0.26/mile higher than the national 7-day rolling average spot rate.