The Logistics Manager’s Index (LMI), produced by Zac Rogers at Colorado State University, came in at 56.5 in February 2024, up (+0.9) from January’s reading of 55.6 and is tied with October 2023 for the highest reading for the overall index in the last year. This growth is bolstered by expansion in all eight sub-metrics captured in the index for the second month in a row, including continued expansion in Inventory Levels (58.5), which has led to a tightening in Warehousing Capacity (52.8) and growth across all three transportation metrics. Transportation Capacity was also up this month to 60.9, bumping it higher than Transportation Prices and suggesting that we have not yet entered an actual growth period in the freight market.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

The LMI score combines eight unique components of the logistics industry, including inventory levels and costs, warehousing capacity, utilization, and prices, and transportation capacity, utilization, and prices. The LMI is calculated using a diffusion index, in which any reading above 50.0 indicates that logistics is expanding; a reading below 50.0 indicates a shrinking logistics industry. The latest results of the LMI summarize the responses of supply chain professionals collected in February 2024.

Market watch

All rates cited below exclude fuel surcharges unless otherwise noted.

Capacity tightened slightly on a 3% lower volume of loads moved last week in the Top 5 spot market states (California, Georgia, Illinois, New Jersey, and Texas). The combined average linehaul rate in these states increased by $0.01/mile to $1.70/mile, identical to the same time in 2019, $0.07/mile higher than in 2020 and $0.09/mile lower than last year.

Even though loads moved were down 4% last week in Dallas/Ft. Worth outbound linehaul rates increased by $0.02/mile to an average of $1.37/mile. In Houston, volumes were primarily flat with spot rates up $0.01/mile to $1.61/mile. In Atlanta, spot rates were flat at $1.62/mile on a 4% lower volume, while in Chicago, linehaul rates average $1.99/mile, down $0.02/mile on an 8% lower volume of loads moved.

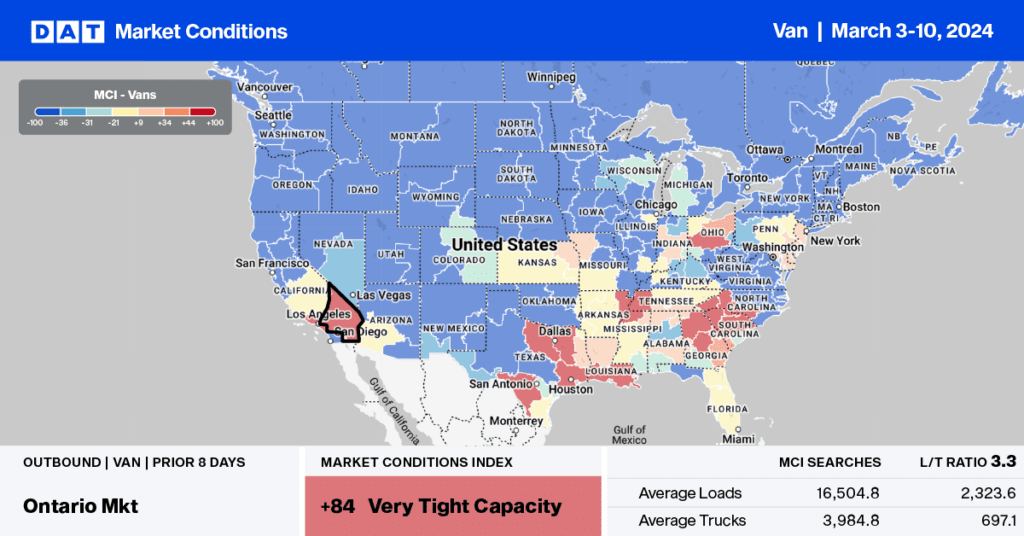

After dropping for nine weeks, outbound California linehaul rates increased by $0.05/mile to $1.82/mile last week, led by solid gains in the combined Los Angeles and Ontario market, where spot rates increased by $0.05/mile to $1.94/mile on 1% lower volume.

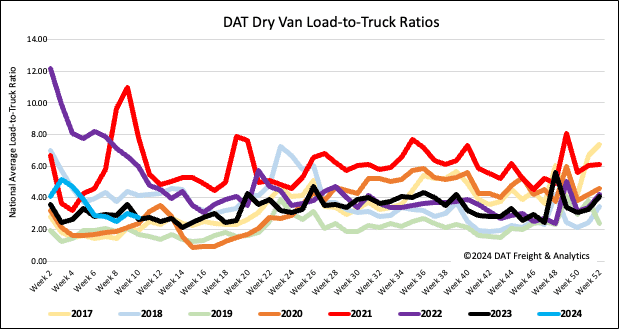

Load-to-Truck Ratio

Dry van load post volume increased by 2% last week but trailed last year by 4%. Volumes are 16% lower than in 2020, the week before the global pandemic was declared four years ago. Available capacity increased following last week’s 11% increase in equipment posts, resulting in the load-to-truck ratio decreasing by 8% to 2.74.

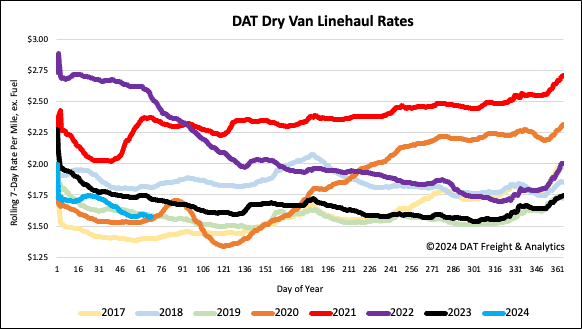

Linehaul spot rates

Two weeks of flat spot rates do not make a trend, but considering dry van linehaul rates were flat in the weeks on either side of month-end, there’s a glimmer of hope the market may have finally bottomed out. At just over $1.58/mile, linehaul rates were flat last week on a 4% lower volume of loads. Dry van linehaul rates are $0.14/mile lower than last year, and based on the volume of loads moved, DAT’s Top 50 lanes averaged $1.84/mile last week, $0.26/mile above the national average.