In November, the ISM (Institute for Supply Management) Manufacturing PMI registered at 48.4%, an increase of 1.9 points compared to October. This indicates that the manufacturing sector is showing directional improvement, although the market still needs to be in the expansionary territory associated with a strong market cycle.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Timothy Fiore, chair of the ISM’s manufacturing business survey committee, notes, “Of the five subindexes that contribute to the Manufacturing PMI, only one—new orders—was in expansion territory, the same number as in October.” The new orders index entered expansion for the first time in seven months last month, with a reading of 50.4%.

In November, three industries reported growth: Food, beverage, and tobacco products; computer and electronic products; and electrical equipment, appliances, and components. Fiore adds, “Two of the six largest manufacturing industries—food, beverage, and tobacco products, and computer and electronic products—expanded in November, the same number of industries that reported growth in October.”

Market watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

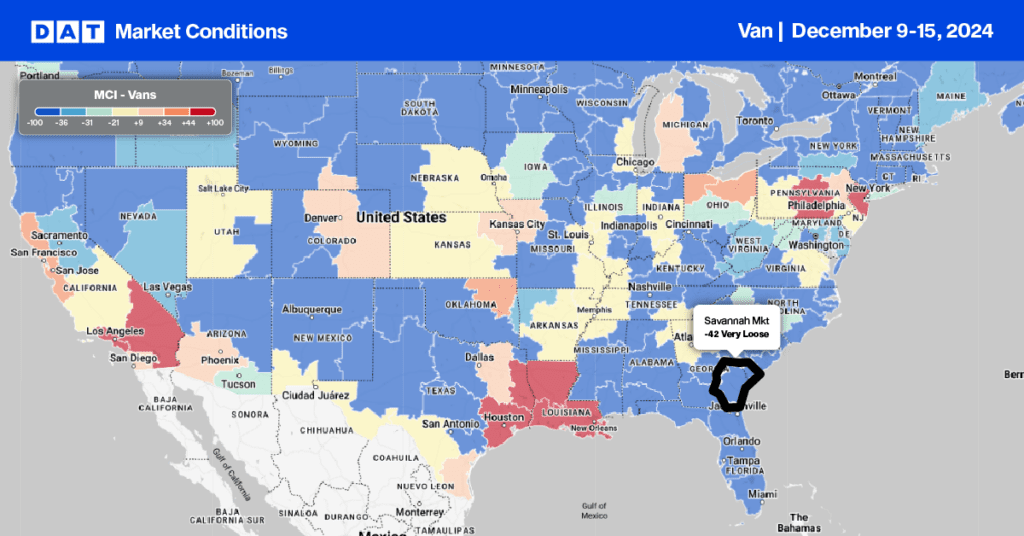

This week, we focus on the Savannah freight market, where outbound truckload capacity is expected to loosen in the coming week. The fourth largest (9% of national volume) and one of the fastest-growing container ports in the U.S., it is a critical node for global trade, connecting the Southeast to markets worldwide. The port handles various goods, from agricultural to manufactured goods, making it a major driver of Georgia’s economy.

Even though November import volumes were down 4%, they were still 12% higher than last year, driving up outbound truckload volumes by 16% year over year. Located near major interstates (I-95 and I-16), Savannah serves as a logistics hub for the southeastern United States, facilitating the transport of goods regionally and nationally. Atlanta is the top destination for Savannah truckload volume; volumes on that lane are up 9% y/y, while spot rates are 13% higher but showing signs of cooling off now peak import shipping season has passed.

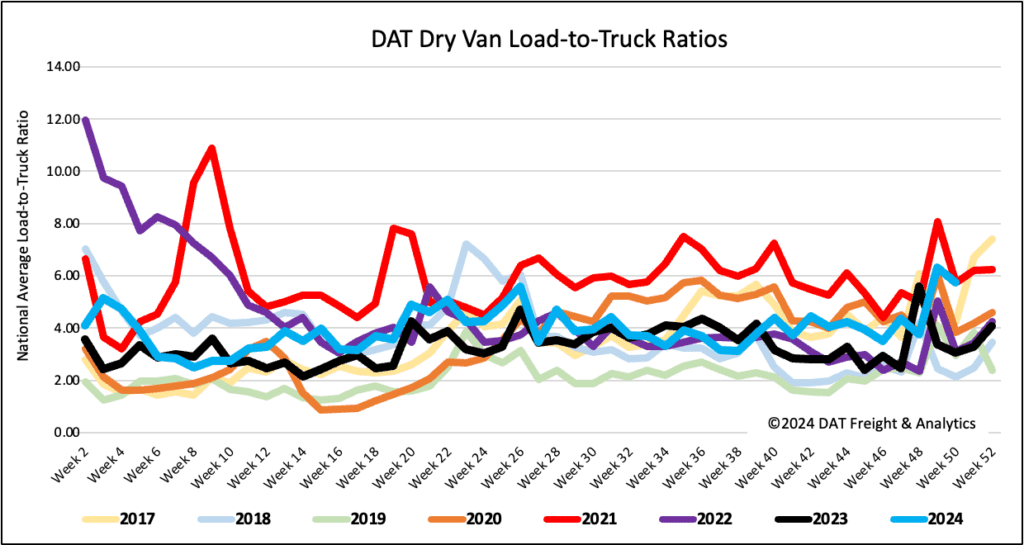

Load-to-Truck Ratio

Even though load post volumes decreased 12% last week, they are still 24% higher than last year in the second last full shipping week of the year. Compared to prior years, volumes are currently on par with the sort of spot market activity we observed during the pandemic and 27% higher than the Week 50 average back to 2016. Carrier equipment posts were 15% lower than last year, resulting in a dry van load-to-truck ratio (LTR) of 5.74, almost double last year’s LTR of 3.05.

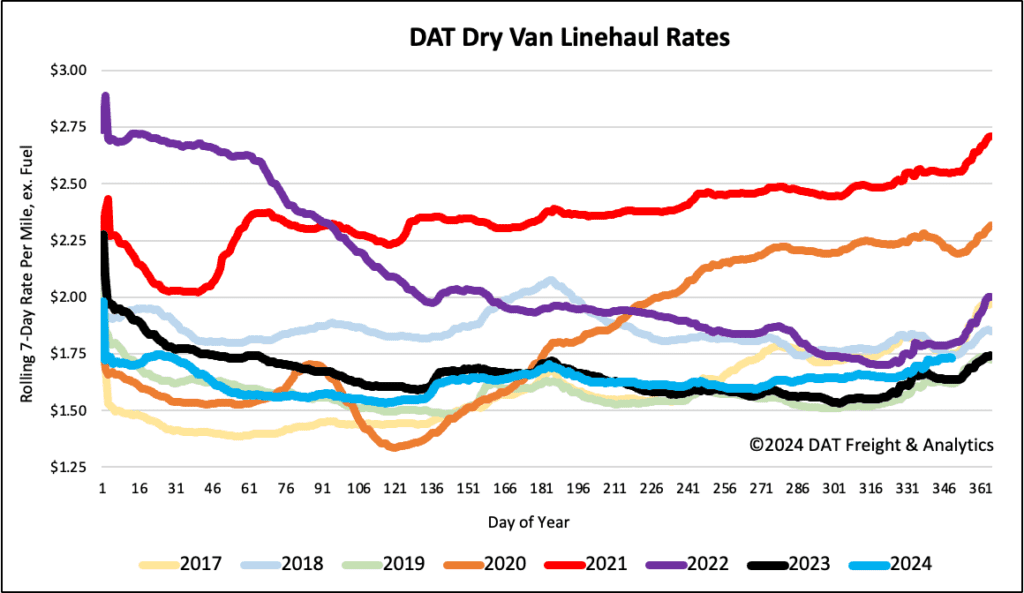

Linehaul spot rates

There was a noticeable surge in the volume of loads moving last week, up 24% compared to the prior week and 18% y/y. The ongoing exodus of small carriers was evident as available capacity tightened, resulting in a $0.02/mile increase in the national average dry van linehaul rate. At $1.74/mile, spot rates are $0.09/mile higher than last year and $0.06/mile lower than 2022.

On DATs’ Top 50 lanes, based on the volume of loads moved, carriers were paid an average of $2.08/mile, up $0.02/mile w/w and maintaining the $0.35/mile spread over the national 7-day rolling average spot rate. Dry Van linehaul rates are almost $0.08/mile higher than the three-month trailing average.