For some time now, we’ve been wondering if and when Class 1 railroads will take advantage of the shift in imports from the West Coast to the East Coast. Wait no longer. Ari Ashe at the Journal of Commerce reports Norfolk Southern Railway (NS) will launch a new international intermodal service between the Port of Virginia and Memphis beginning April 1. The goal is to capture trans-Atlantic business from Europe and Asia as more cargo owners shift freight to ports along the US East Coast. According to PIERS, a sister product of the Journal of Commerce within S&P Global. February import volumes in Virginia were 101,940 TEUs, down 18% m/m and 25% y/y. Import volume for the east coast is down 14% YTD y/y, 15% m/m, and 20% y/y for February.

Norfolk Southern already serves Memphis from ports in Charleston, S.C., and Savannah, GA. The proposed Norfolk to Memphis 900-mile daily trip will take five days compared to two days for a solo truck driver or one day for a team. Trains moving the approximately 900 miles between Norfolk and Memphis will take five days, about a day longer than Savannah trains but a day shorter than trips from Charleston. PIERS reports the West Coast market share of Asian imports dropped to 54.1% y/y in January, while the East Coast share of 36.2%in January was up from 34.8% a year ago. The well-documented shift in import cargo away from the West Coast is largely the result of port congestion throughout 2021 and into 2022 and the failure of the International Longshore and Warehouse Union and marine terminal operators to reach a new labor agreement, which expired in July last year.

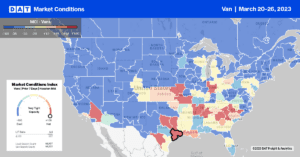

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

At $1.80/mile for outbound loads, state average spot rates in California were identical to 2019 last week; only 2016 and 2017 were lower. The San Francisco market, hardest hit by devastating rain in recent weeks, was one of two markets in the state to post an increase in spot rates. Outbound loads were up $0.01/mile to $1.59/mile, while in San Diego, linehaul rates increased by the same amount to $1.65/mile. San Diego to Las Vegas loads at $3.03/mile was up $0.03/mile last week, reversing a three-month slide.

Looking at two high-volume lanes directly linked to import volumes, the number of loads moving from Los Angeles to Stockton, the busiest spot market lane on the West Coast, was down 2% last week. Spot rates at $2.49/mile were the lowest in 12 months. Los Angeles to the growing warehouse market in Phoenix reported were also the lowest in 12 months at $2.20/mile, 45% lower than a year ago.

In Texas, spot rates were up $0.01/mile to $1.66, around $0.08/mile lower than in 2018. Outbound linehaul rates in Houston increased by $0.02/mile to $1.75/mile. Loads moving between Houston and Dallas are almost $250/load, lower than the previous year at $506/load last week.

Load-to-Truck Ratio (LTR)

Dry van load posts dropped 8% last week and are now down by 25% in the last month and 57% compared to the previous year. Volumes are tracking directionally, with 2017 and 2019 as we end the first quarter. Spot market capacity was flat last week and almost at the same level as last year. The net result was an 8% w/w decrease in the dry van load-to-truck ratio (LTR) from 2.09 to 1.92, slightly above the LTR in 2019.

Linehaul Spot Rates

Dry van linehaul rates dropped below $1.70/mile last week for the first time since mid-March 2020. At $1.69/mile, dry van rates are $0.70/mile lower than the previous year following last week’s $0.02/mile decrease. Based on the volume of loads moved the average rate for the top 50 dry van lanes was $0.22/mile higher at $1.91/mile last week. On DATs Top 100 dry van lanes, linehaul rates decreased on 68% of lanes, increasing on only 11% with the balance remaining neutral.