Strong retail sales continue to fuel demand for dry van carriers. That trend looks set to continue well into 2022.

According to the National Retail Federation (NRF), retail sales during 2021’s November-December holiday season grew 14.1% year over year to $886.7 billion, exceeding forecasts and setting a new record in the process. That’s also more than double the retail sales volume of $416.4 billion way back in 2002 and 56% higher than just 10 years ago. The November-December number includes online and other non-store sales, which were up 11.3% y/y and exclude automobile dealers, gasoline stations and restaurants to focus on core retail.

From a commodity mix perspective, November-December holiday sales saw year-over-year gains across all categories, led by increases at clothing (up 33%), sporting goods (up 21%), general merchandise (up 15%), furniture (up 15%) and electronics (up 14%).

“Despite supply chain problems, rising inflation, labor shortages and the omicron variant, retailers delivered a positive holiday experience to pandemic-fatigued consumers and their families,” according to Matthew Shay, NRF President and CEO Matthew Shay. “Consumers were backed by strong wages and record savings and began their shopping earlier this year than ever before.”

NOTE: Spot rates reported below do not include fuel surcharges

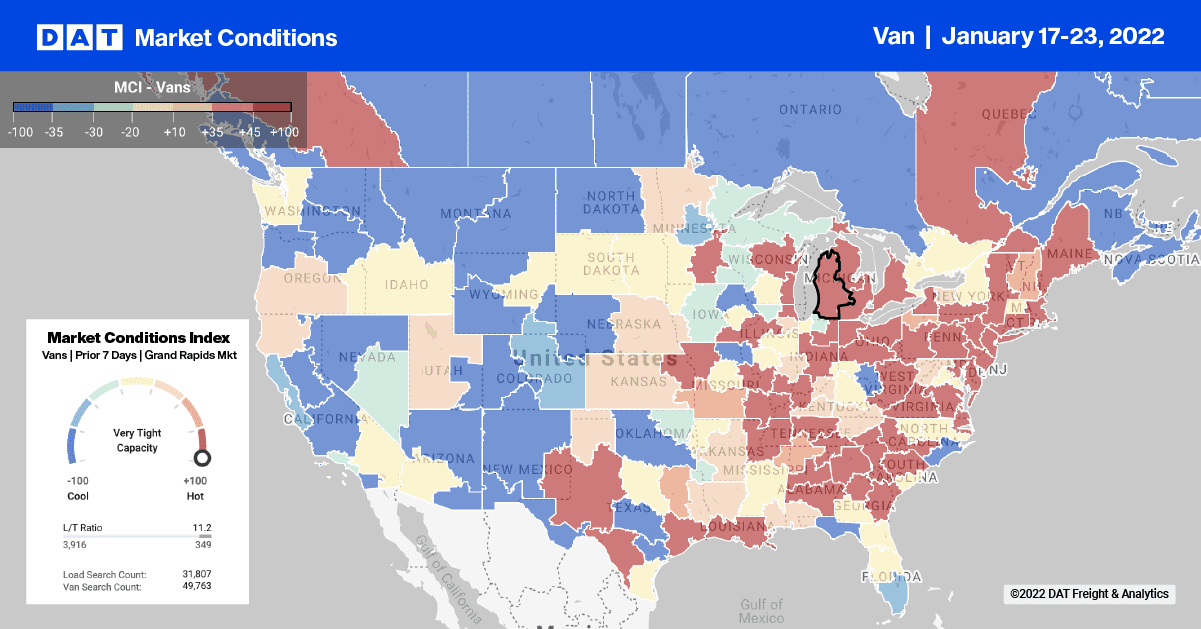

Even though national dry van volumes decreased 1% last week, volumes and spot rates continued to climb in regional markets like the Northeast. As Winter Storm Izzy moved through the region, spot rates rose 4 cents to an average of $2.98/mile.

Capacity continues to tighten in Philadelphia, where spot rates increased 7 cents after dropping for the three weeks prior. Volumes have been climbing all year and have more than doubled in the last four weeks following last week’s 14% w/w increase. Loads moved from Philadelphia to Atlanta are up 15% w/w and up by a similar amount for loads to Chicago (up 13% w/w). Spot rates are up on both lanes – Atlanta loads are averaging $2.57/mile and Chicago rates are at $2.34/mile.

On the West Coast, capacity eased on the Los Angeles-to-Chicago lane. Loads on this heavy freight lane are currently averaging $3.00/mile, which is 28 cents lower than the December average but still $1.11/mile higher than the same time last year.

Spot market demand appears to be cooling off also. Outbound volumes in Los Angeles have steadily dropped throughout January (down 40% in the last three weeks), which is most likely related to the worsening port congestion crisis. According to The Marine Exchange, there were 106 container vessels waiting 18 days on average to unload, triple the volume of vessels waiting compared to mid-June last year.

Load-to-Truck Ratio (LTR)

After surging for the prior two weeks, load posts on the DAT Load Board dropped by just over 6% last week but are still close to triple the volume recorded this time last year. Carrier equipment posts also dropped 3% w/w. As a result, the dry van load-to-truck ratio dropped from 9.72 to 9.39.

Spot rates

After going against seasonal January trends the week prior, the national average dry van spot rates decreased by just under 2 cents to end last week at $2.76/mile. One could easily assume a rate decrease points to capacity easing and that may well be the case, but spot rates are still 70 cents higher than the same week last year and 81 cents higher than the third week in 2018.