Despite a 17% decrease in fuel prices last year, carrier profitability only rose above breakeven in November. Boosted by freight seasonality and higher spot rates, small carriers should end in the black this quarter but will still be in the red when operating costs and spot rates are averaged over the entire year.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

For small carriers or owner-operators running 100,000 loaded miles and 15,000 empty miles yearly, the national dry van breakeven operating cost was just over $1.77/mile in November, down $0.01/mile sequentially. With dry van spot rates averaging $2.02/mile, the estimated gross profit per mile is around $0.01/mile, equivalent to an annual profit of $1,000, a long way from the $64,000/year gross profit in 2021.

Year-to-date, small carriers are still running at a loss, losing the equivalent of $2,000/year. Even with an increase in spot rates in the lead-up to Christmas and New Year, the typical carrier operating in the spot market should end the year slightly below breakeven, around $0.02/mile below breakeven.

Market watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

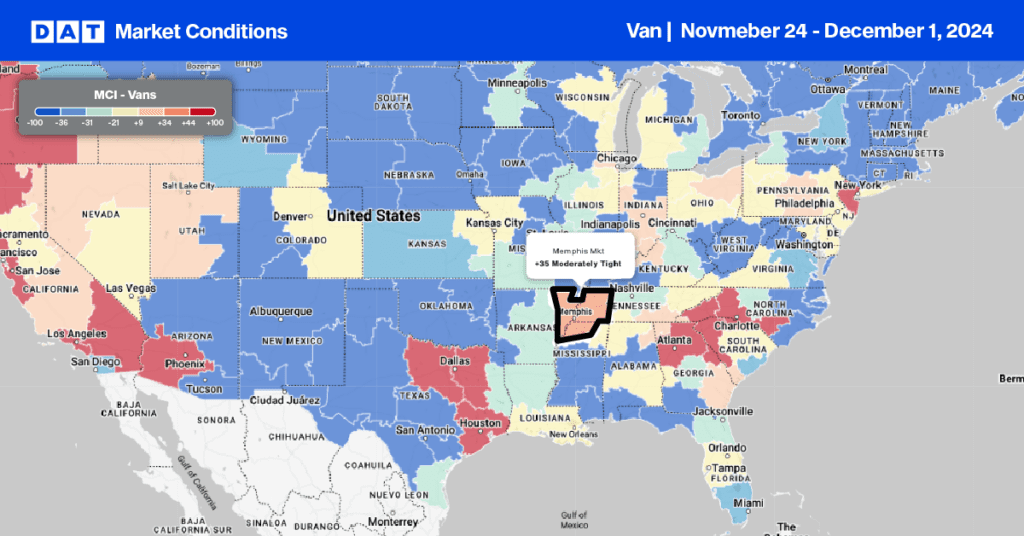

This week, we focus on the Memphis market, “America’s Distribution Center,” which has earned its title as a strategically positioned hub for transportation and commerce. Memphis International Airport is the largest in the country for cargo and freight and second globally, following Hong Kong. The city lies along the nation’s third-busiest trucking route, linking the Atlantic and Pacific coasts on Interstate 40, and is the third-largest rail center in the U.S., featuring five Class-One railroads. Additionally, Memphis is the fourth-largest inland port in the U.S.

Regarding road freight volume, Memphis is the 16th largest outbound truckload market in the nation and is considered a slight headhaul market, with 1.14 outbound loads for every load inbound. Truckload volumes are almost 20% higher than last year and have increased by 11% in the last week as peak shipping season gets underway ahead of the holiday shopping season. According to DATs Market Condition Index (MCI), truckload capacity is expected to be moderately tight over the next week.

Load-to-Truck Ratio

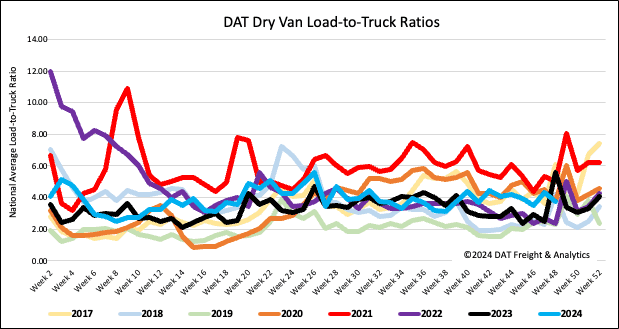

The volume of dry van load posts decreased almost identically to last year during the short workweek before Thanksgiving. Last week’s load post volume was 13% higher than last year. Carrier capacity tightened in the spot market following last week’s 31% decrease in equipment posts, resulting in a 14% decrease in the dry van load-to-truck ratio (LTR) to 3.76.

Linehaul spot rates

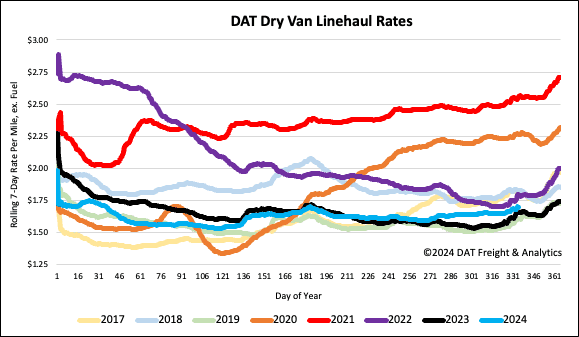

Even though the volume of loads moved dropped by 18% on last week’s pre-Thanksgiving three-day week, there was a shortage of available capacity to meet demand, resulting in a $0.04/mile increase in the national average dry van linehaul rates. At $1.71/mile, spot rates are $0.05/mile higher than last year and $0.10/mile lower than 2022.

On DATs’ Top 50 lanes, based on the volume of loads moved, carriers were paid an average of $2.05/mile, up $0.07/mile w/w and $0.34/mile higher than the national 7-day rolling average spot rate. Dry Van linehaul rates remained $0.06/mile higher than the three-month trailing average.