On the most recent episode of the Freightvine podcast, Dr. Chris Caplice spoke to Dr. Zac Rogers, Assistant Professor at Colorado State University in Supply Chain Management, and his father, Dr. Dale Rogers, Professor of Business at Arizona State University. The topic was a multi-generational perspective on the logistics industry, the bullwhip effect, and excessive warehouse inventory levels.

According to Dale Rogers, “companies like Target or Walmart had a choice in 2021 – increase our inventories so that we can make all the sales we need to at the end of the year (and run the risk of ending up with too much inventory) or not order enough inventory and leave sales on the table during the last quarter of 2021. This year many smaller companies are choosing the latter path because they don’t think they can get next season’s inventory over here quickly enough.”

According to Zac Rogers, “Utilization levels are also higher for all upstream, so companies like Target are canceling orders and pushing them back towards their suppliers who are holding a lot of inventory right now. So our warehouses are full, and even though the long lines of ships waiting to unload in ports have gone down significantly, we still aren’t moving things through the supply chain all that quickly. Because that middle step in upstream warehousing is invisible, you can’t see, but the congestion is just as bad one step away from the ports as it was all through last year. And until we work through all that extra inventory, we’re still not going to see the optimal throughput we’re used to. We’ll work through a lot of the excess we have this year in inventory.”

In the latest publication of The Logistics Managers’ Index (LMI) for June, the Inventory Level value was 71.8, up 2.5 from last month but down 8.4 from the index’s highest value four months ago. According to Zac Rogers, “Upstream respondents reported greater inventory growth by 7.9 pts, (75.0 vs. 67.1). Upstream inventories seem to be increasing faster than downstream. Inventories often begin to build in June in anticipation of back-to-school and holiday shopping; with reports of a large group of ships heading from Shanghai towards Southern California, we might expect continued growth throughout the next few months.”

All rates cited below exclude fuel surcharges unless otherwise noted.

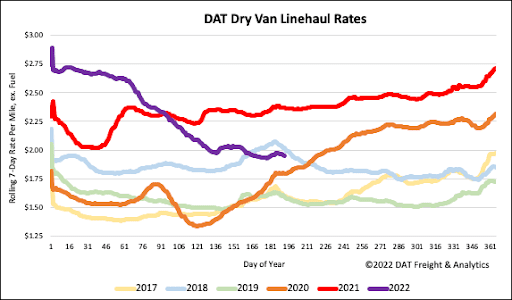

Containerized import volumes decreased by 5% in June, and even though that’s 8% higher than the previous year, lower volumes last month translated into lower load post volumes in Los Angeles last week. Volumes were down 35% w/w for the first time in the previous month resulting in outbound spot rates dropping by $0.02/mile to a market average of $2.25/mile. The opposite was the case on the intermodal-heavy Los Angeles to Chicago lane, where spot rates increased by $0.14/mile to an average of $1.81/mile or $0.90/mile lower than the previous year.

In Atlanta, load post volumes and spot rates were down by 16% and up by $0.03/mile, respectively, last week. On the short-haul lane to Charlotte, spot rates dropped by $52/load to an average of $728/load or $2.97/mile. Loads west Houston were flat at $1.62/mile but $0.67/mile lower than last year. Outbound volumes in Chicago have increased by 13% in the previous month following last week’s 2% w/w increase. Chicago spot rates also increased for the third week following last week’s 0.06/mile increase to an average outbound rate of $2.21/mile. Capacity tightened in the Elizabeth market last week – spot rates increased by $0.03/mile to an average of $3.72/mile. On the Atlanta lane, rates increased by a penny per mile to $1.50/mile after dropping by $1.36/mile since February.

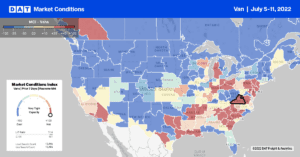

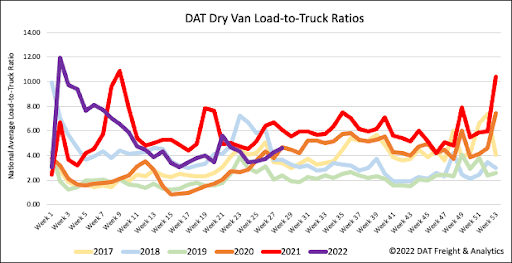

Dry van load posts predictably decreased during the short work week following the Independence Day celebrations. Volumes dropped by 11% w/w with carriers taking time off, resulting in equipment posts decreasing by 18% last week. The net effect on last week’s dry van load-to-truck ratio slightly increased to 4.61.

Dry van linehaul spot rates on the top 50 lanes averaged $2.42/mile last week, or $0.44/mile higher than last week’s national average rate of just over $1.98/mile. Dry van linehaul rates were mostly flat last week and, compared to the previous year, are $0.42/mile lower than the previous year but are still $0.28/mile higher than the average of pre-pandemic years.