The contract freight market continues to soften despite the American Trucking Associations’ (ATA) advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index increasing by 1.1% in October. ATA’s tonnage index, which includes truckload and LTL freight, is dominated by contract freight with minimal spot market loads. “After hitting a floor in April, tonnage has slowly and inconsistently improved but remains 3% below its recent peak in September 2022,” said ATA Chief Economist Bob Costello. “Despite the monthly gain, truck freight remains soft as it continues to contract year-over-year (y/y).”

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Compared to October 2022, the SA index fell 2.1%, the eighth straight y/y decrease. In September, the index was down 4.1% from a year earlier. ATA has calculated the tonnage hauled index based on surveys of its membership since the 1970s. Regarding the split between contract and spot freight, the latest data from DAT’s contract shipper consortium indicates around 15% of all loads are moving on the spot market this quarter, with the remainder on the contract market.

Market watch

All rates cited below exclude fuel surcharges unless otherwise noted.

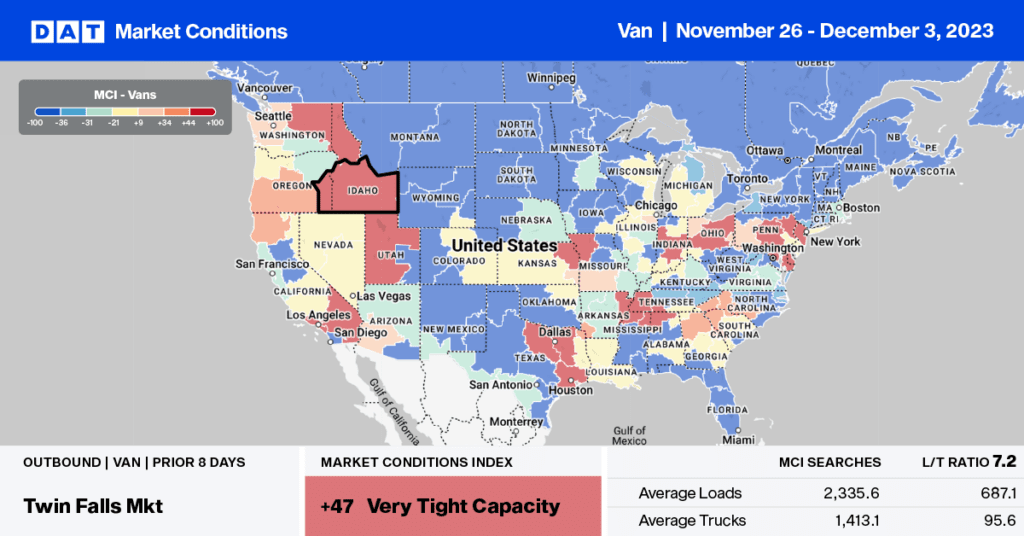

Dry van linehaul spot rates increased in all lower 48 states except for Wyoming last week. In Los Angeles, outbound spot rates increased by $0.05/mile to $1.76/mile after being flat for several weeks. Loads north to the large warehouse market in Stockton, CA, paid carriers an average of $2.59/mile last week, while loads east to Phoenix, another warehouse market, averaged $2.97/mile, the highest in 12 months.

In the combined Joliet and Chicago markets, linehaul rates jumped by $0.16/mile last week to an average outbound rate of $2.02/mile. Last week’s volume of outbound moved loads was almost 7% higher than last year, while linehaul rates are $0.22/mile lower. On the high-volume regional lane from Chicago to Detroit, moved load volume was 11% lower week-over-week (w/w), although capacity was tight, pushing up spot rates to $3.49/mile, the highest in 12 months.

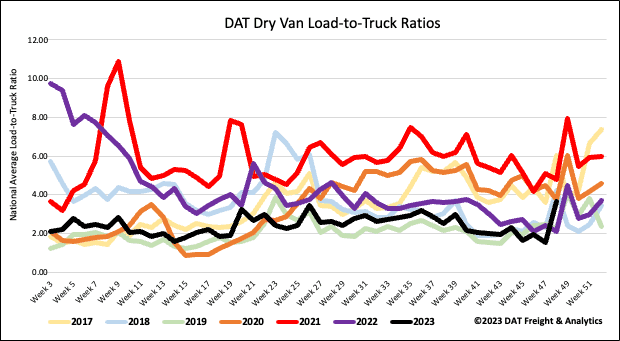

Load-to-Truck Ratio (LTR)

The dry van spot market load post (LP) volume spiked last week following seasonal trends in the week after Thanksgiving. Volumes almost tripled last week compared to a doubling observed in past years for Week 48. Carrier equipment posts increased by 16% w/w as drivers returned to the market following the Thanksgiving break, resulting in last week’s dry van load-to-truck ratio (LTR) increasing to 3.64.

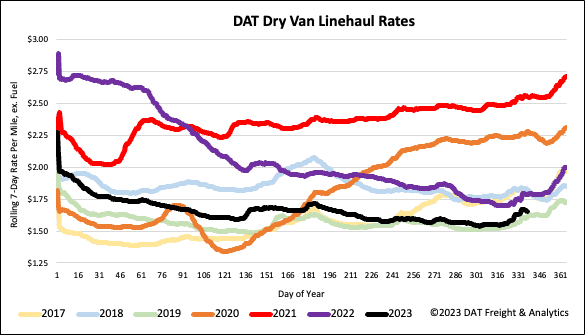

Linehaul spot rates

Dry van linehaul rates have increased by just over $0.10/mile in the last two weeks, following last week’s $0.04/mile gain. At $1.67/mile, dry van spot rates are $0.13/mile lower than last year and $0.05/mile higher than in 2019. DAT’s Top 50 lanes, based on the volume of loads moved, averaged $1.97/mile last week, $0.30/mile lower than the national average.