Every year, a different national forest is selected to provide a tree to appear on the west lawn of the U.S. Capitol building for the holiday season. The 2022 tree will come from the National Forests in North Carolina. After almost a year of planning, the U.S. Capitol Christmas Tree, a 78-foot red spruce affectionately called “Ruby,” was harvested from the Pisgah National Forest (118 miles west of Charlotte, NC) on November 2, 2022, before beginning the 505-mile journey to Washington, D.C on November 5. The official tree lighting on the Capitol’s West Lawn on November 18.

This year’s carrier, based in Siloam, NC, is family-owned Hardy Brothers Trucking, specializing in coast-to-coast reefer haulage involving over 100 drivers and 60 trucks. Hauling this year’s U.S. Capitol Christmas Tree is the husband-and-wife driver team of Harold “Ed” Kingdon Jr. and Deborah Z. Kingdone in a specially designed Kenworth T680. The theme of the truck this year is “From the Mountains to the Sea,” along with “From the National Forests in North Carolina,” which are prominently displayed on the truck’s driver and passenger sides. Courtesy of the flatbed trailer tracking technology from Spireon, “Ruby’s” journey to Washington, D.C., can be tracked here.

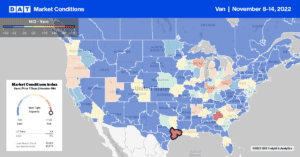

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

The same storm system that produced record-setting rain and heavy mountain snow in California set up the season’s first significant winter storm in the Pacific Northwest, Northern Plains, and Upper Midwest last week. Dry van capacity tightened, following a $0.07/mile increase to $1.49/mile in the three regions combined. Most regional rate gains occurred in Pendleton, OR, where rates increased by $0.11/mile to an outbound average of $1.57/mile. In the largest spot market in the Pacific Northwest, rates in Seattle increased by $0.02/mile to $1.29/mile, making it four straight weeks of gains.

In the Midwest, capacity tightened slightly in three of the four markets in Indiana, where linehaul rates for outbound loads increased by a penny per mile to $2.02/mile, reversing a three-week slide. Spot rates for loads from Indianapolis to Atlanta dropped to $2.22/mile last week after increasing for the prior four months. Rates on this lane are now $1.17/mile lower than the previous year. In the two largest Midwest markets in Chicago and Joliet, IL, outbound spot rates dropped $0.03/mile to $2.19/mile last week, which is the first decrease in four months and now $1.22/mile lower than the previous year. In the New York Finger Lakes Region, rates increased by $0.08/mile to $2.04/mile in the Elmira and Syracuse markets.

Load-to-Truck Ratio (LTR)

Dry van spot market load posts followed declining seasonal trends after last week’s 13% w/w decrease. It’s not unusual to see dry van volumes decrease in the middle of November before picking up right after Thanksgiving. Volumes remained 45% lower than the previous year and 23% lower over the last month. The number of carriers posting their equipment in search of loads is a more concerning statistic. Volumes hit a new record high last week, 6% more than in the middle of April 2020, as the world went into lockdown and demand crashed. As a result, the dry van load-to-truck ratio (LTR) decreased to 2.13 last week.

Linehaul Spot Rates

The downward direction of dry van spot rates is in stark contrast to the two prior pandemic-driven years as the market gravitates back to more seasonal trends. The record number of new small fleet operators, including owner-operators, that entered the industry in the last two years has resulted in another oversupplied freight market, just like we saw in 2019. Dry van linehaul rates dropped by just over $0.02/mile last week to a national average of $1.72/mile, now $0.05/mile lower than in 2017. Last week’s national average is almost $0.80/mile lower than the previous year, and $0.30/mile lower than the top 50 dry van lanes based on the volume of loads moved, which averaged $2.02/mile again last week.