The September Logistics Manager’s Index reads in at 58.6, up (+2.2) from August’s reading of 56.4 and at its highest level since two years ago in September 2022. The overall index has increased for ten consecutive months, proving the logistics industry is back on solid footing. The LMI report noted inventory Levels increased (+4.1) to 59.8, driven by the long-expected restocking of Downstream retailers. After several months of contraction, Downstream respondents are reporting expansion for Inventory Levels at a rate of 55.7. This represents some modicum of relief for Upstream supply chains, where goods had been building up like rainclouds waiting for the eventual downstream release as we move into Q4.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

According to Prof Zac Rogers from Colorado State University, “The fact that peak season is happening at all should be a bit of a relief for the logistics industry – and the economy as a whole – since we have not seen a traditional seasonal peak since 2021 (or possibly even 2019 if you don’t consider 2020 or 2021 to be “normal”). This activity results in Transportation Capacity returning to 50.0 and “no movement” for the second time in 2024. Transportation Capacity has not contracted since March of 2022. This metric is already contracting at the Downstream level (4.50). It will be interesting to see if the current trajectory continues and moves back to contraction at any point in Q4.”

The LMI score combines eight unique components of the logistics industry, including inventory levels and costs, warehousing capacity, utilization, and prices, and transportation capacity, utilization, and prices. The LMI is calculated using a diffusion index, where any reading above 50.0 indicates that logistics is expanding, and any reading below 50.0 indicates a shrinking logistics industry. The latest LMI results summarize the responses of supply chain professionals collected in August 2024.

Market watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

This week, we are concentrating on the inbound capacity in Southeastern freight markets, particularly in Georgia and Florida. Hurricane Milton made landfall in Florida, and the cleanup from Hurricane Helene has intensified, substantially impacting truckload capacity. Hurricane Milton made landfall in Florida, and the cleanup from Hurricane Helene has intensified, substantially impacting truckload capacity. Georgia’s farmers are still assessing the extensive damage left behind by Hurricane Helene. The severe flooding and high winds destroyed large portions of Georgia’s cotton, peanut, and pecan crops, causing significant losses across the state.

According to the Georgia Department of Agriculture, “One-third of the state’s cotton crop is a total loss. Nearly 30% of the peanut crop has been destroyed, and 50,000 pecan orchards have suffered severe damage. Over 200 chicken houses were also affected, and roughly four million acres of timberland have been impacted.” According to preliminary estimates released last week by the University of Georgia College of Agriculture & Environmental Science, Hurricane Helene caused at least $6.46 billion in losses to Georgia farmers.

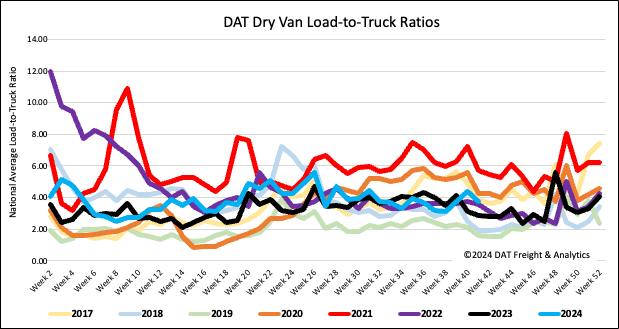

Load-to-Truck Ratio

Following the pre-hurricane surge in positioning freight in key Southeast markets, load post volumes erased the prior week’s gains, dropping 14% last week. However, volumes are around 2% higher than last year. Carrier equipment posts were mostly flat, decreasing the dry van load-to-truck ratio (LTR) by 14% to 3.78, a third higher than last year.

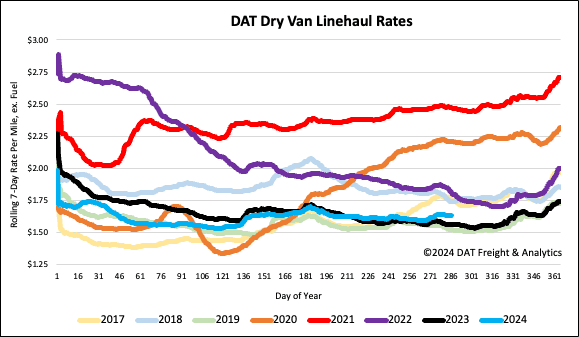

Linehaul spot rates

The national average dry van spot rate remained at $1.65/mile last week, $0.07/mile higher than last year. The volume of loads increased by 2%, but linehaul rates dropped by $0.06/mile as carriers returned to the market and roads in the Southeast became passable.

In Florida, outbound volumes in the Lakeland freight market dropped by 24% week-over-week, while inbound volumes dropped by 27%. Volumes on the Atlanta to Lakeland lane decreased by 22%, and rates increased to an average of $2.70/mile. On the Lakeland to Atlanta route, volumes dropped by 26%, and rates remained flat at $0.76/mile.