With the 2025 freight market around the corner, leading transportation economists weighed in on what we can expect. On a recent DAT Freight & Analytics iQ show, Paul Bingham, Director of Global Intelligence & Analytics S&P Global Market Intelligence, suggested a return to more “normal” market behavior. Paul suggests “that growth in the US is slowing and will continue to slow on into 2025, and there are signs that in the fourth quarter that we’re in now, we’ll see growth slower than we saw in the third quarter.”

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

At the recent American Trucking Associations Management Conference in Nashville, Chief Economist Bob Costello highlighted how the freight market is set to improve as equipment and demand rebalance slowly. The theme of Costello’s presentation is a return to a more normal time in trucking, something we haven’t seen since before the pandemic. Costello said, “It’s far from robust, but even though the macroeconomy is going to slow back to normal, I think the truck freight drivers are going to get a little bit better.”

“One of the things a lot of people have underestimated is just how important the factory sector is to freight. And it’s one of the reasons why freight has been pretty slow. Because manufacturing activity, really the lack thereof, has hurt volumes this year. I think it’s going to get a little bit better.”

Market watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

This week, we are focusing on the e-commerce distribution freight market in Allentown, PA. Allentown is strategically located to meet the growing demand for same-day or next-day deliveries in densely populated urban areas in the Northeast. It is within a short distance of major metropolitan areas such as Boston, New York City, Philadelphia, and Washington, D.C. Over 100 million people live within a day’s drive of the region, making it an ideal location for companies aiming to deliver goods quickly to a large customer base.

Key highways, including Interstate 78, Interstate 80, and Interstate 476, run through Allentown, establishing it as a crucial supply line for freight movement. The Lehigh Valley International Airport (ABE) facilitates significant air cargo, making it vital for companies requiring quick air shipping. Furthermore, Allentown boasts strong rail connectivity through providers like Norfolk Southern, which links the region to major ports, including the Ports of New York and New Jersey, the Ports of Philadelphia, and the Ports of Baltimore.

E-commerce has increased the demand for large fulfillment centers to store and distribute products swiftly. Companies like Amazon, FedEx, UPS, and Walmart have established substantial distribution hubs in Allentown. Outbound truckload volumes are about 25% higher than last year, leading to a 12% increase in dry van spot rates. Notably, in the high-volume lane from Allentown to Charlotte, NC, spot rates have reached their highest in 12 months, averaging $1.77 per mile, and are forecasted to peak around $2.00 per mile during the Christmas season—$0.35 per mile higher than last year.

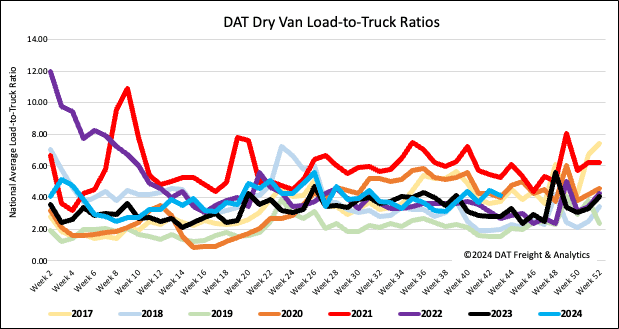

Load-to-Truck Ratio

Last week, the volume of dry van load posts declined by 9% compared to the previous week, although it remains 15% higher year-over-year (y/y). When excluding the years affected by the pandemic (2021 and 2022), load posts for Week 43 are 27% higher than in previous years, indicating a renewed strength in the spot market.

Carrier capacity in the spot market remained mostly flat last week, leading to a 7% decrease in the dry van load-to-truck ratio (LTR). The ratio reached 4.11, the second-highest in the past eight years, with only 2021 showing a higher ratio of 5.25.

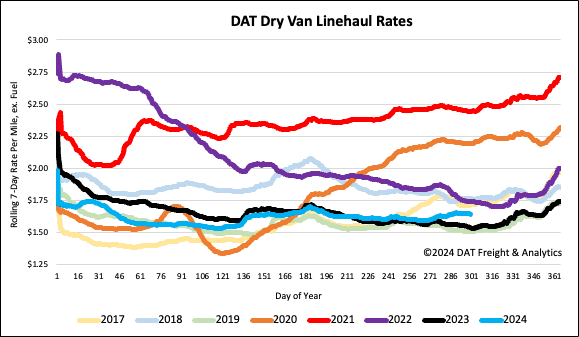

Linehaul spot rates

Last week, the volume of loads transported decreased by less than 1%, remaining similar to the levels from the previous year. Nationally, average linehaul rates have remained unchanged for the fourth consecutive week, averaging $1.65 per mile. This figure is $0.03 per mile lower than the three-month trailing average but $0.11 per mile higher than the same time last year.