The question most are asking is about the 2023 freight outlook following what can only be described as an unprecedented and volatile three-year period. Two-thirds the way through the first quarter of 2023, traditionally the quietest on the freight calendar, some early signs are emerging. Last week the Cass Shipments Index reported shipment volumes were up 4.3% y/y against fairly easy comparisons. The Cass reports notes, “last year the Omicron wave of COVID was in full swing last January, which led to widespread absenteeism and supply-side pressure on shipments, and weather was more severe last January.” making a y/y comparison less than meaningful. Sequentially, the shipments index decreased by 3.2% in January.

The much-awaited Michigan State University Truckload Ton-Mile Index (TTMI) produced by Prof. Jason Miller and Yemisi Bolumole, Ph.D., paints a more bearish outlook. According to Prof. Miller, “the seasonally adjusted ton-mile index in December 2022 slid 0.8% from November, and November slid 0.4% from October. Importantly, the not-seasonally adjusted decline in December was 1.6% from November, indicating that ton-miles fell even more than anticipated due to seasonality. The decline in ton-miles was broad-based across industry sectors in both manufacturing and wholesaling”. Compared to December 2022, ton-miles were down 1.9% from the March 2022 peak, even with December 2021.

The MSU TTMI is regarded as the most comprehensive trucking demand and revenue index that integrates information across 41 freight-generating sectors. Prof Miller concludes the 2022 summary by noting, “whereas I wasn’t on the “steep freight recession” bandwagon in 2022 (which ultimately appears to have been the correct call based on the ton-mile index and employment data in the trucking sector), I’m also not yet sold that the second half of 2023 will shape up to be a good market for trucking companies. We need to see a rebound in manufacturing activity for that to occur, and until single-family housing recovers, I’m not sure a good case can be made on that front.”

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

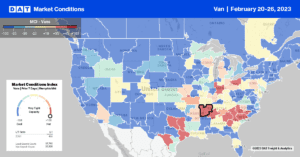

Winter Storm Olive left hundreds of truckers stranded on I-80 last week, reminding us Mother Nature still has a few tricks for those of us thinking an early Spring was around the corner. The first blizzard warning in California in 30 years also resulted in widespread road closures and crop losses for strawberry farmers due to freezing temperatures. Olive blanketed Minnesota and Michigan with up to a foot of snow, with Winter Storm Piper due to drop another six to ten inches of snow this week. Outbound dry van rates in Minneapolis increased by $0.02/mile to $1.93/mile last week, and while load posts increased 20% w/w across markets impacted by Olive, dry van spot rates remained relatively flat compared to the previous week.

Based on last week’s data, the weather’s impact on major freight lanes in California is also minimal. At $1.86/mile for all outbound California loads, last week’s state average was identical to 2018 levels and seasonally close to the low point. Only the San Diego market reported a gain the previous week – rates increased by a penny-per-mile to $1.74/mile. Dry van loads from Los Angeles to Stockton, one of the busiest in the spot market, are at their lowest in 12 months at $2.37/mile, 40% lower than they were a year and $0.40/mile lower than last month’s average. Loads east to Phoenix at $2.33/mile are $1.65/mile lower y/y and the weakest in 12 months.

Load-to-Truck Ratio (LTR)

Dry van load posts dropped 10% last week, and although volumes are 18% higher than the long-term average going back seven years, they were still 65% lower than a year ago. Carriers’ equipment posts were also down last week, decreasing by 3% w/w and, while at the highest level over the same timeframe, are around 8% higher than the previous year. With fewer load and carrier posts last week, the dry van load-to-truck ratio (LTR) decreased slightly from 2.48 to 2.29.

Linehaul Spot Rates

Another penny-per-mile decrease last week placed the dry van linehaul at $0.90/mile lower than the previous year at a national average of $1.74/mile. Dry van linehaul rates have decreased by around 12% year-to-date. Based on the volume of loads moved, the average rate for the top 50 dry van lanes was $0.22/mile higher, which averaged $1.96/mile last week.