Located on the US / Mexico border along the Pacific Rim, just minutes south of San Diego, Tijuana captures every manufacturing sector, from aerospace to medical devices and everything in between. Tijuana is ideal for OEMS, turnkey contract manufacturing, and assembly operations.

Over 604 active maquiladora (foreign-owned) plants employ 264,744 employees dedicated to the manufacturing industries, including one of North America’s largest concentrations of electronics manufacturers. Truckload carriers have easy access to the San Ysidro-Tijuana border crossing, which connects to Interstates 5 and 10. The Otay Mesa commercial truck crossing zone handled just over one million trucks from Mexico last year, 14% of total truck crossing and the second busiest along the southern border.

Find dry van loads and trucks on the largest on-demand freight marketplace in North America.

Tijuana is often called the “television capital of the world” due to its significant role in manufacturing televisions and related electronic components. Many maquiladoras are dedicated to assembling televisions and electronic components, including companies like Samsung, LG, Foxconn, and others that have established significant manufacturing facilities in the region. The city produces millions of television sets annually (plasma, HDTV, and LCD), many of which are exported to the United States and other global markets. At one point, Tijuana accounted for nearly 40% of the televisions sold in the United States.

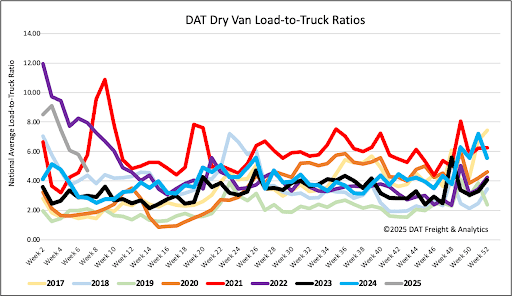

Load posts are sitting around 2% higher than last year, 4% higher than this time in 2018, and 27% higher than the Week 6 average going back to 2016 (excluding 2020. 2021 and 2022). Last week’s dry van load-to-truck ratio (LTR) ended at 4.77.

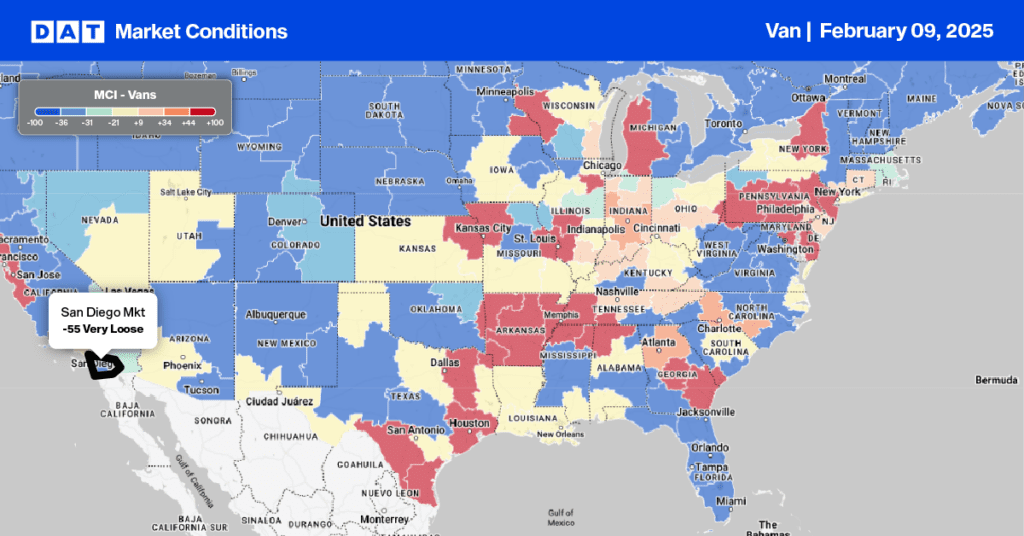

Available capacity continues to ease following another $0.04/mile decrease to a national 7-day rolling average of $1.68/mile (excluding fuel). Volumes were down 2% last week at the start of February. On the top 50 lanes ranked by the volume of loads moved, carriers received an average of $2.00/mile. This represents a decrease of $0.03/mile week-over-week. However, this average remains $0.32/mile higher than the national 7-day rolling average spot rate.