The freight market experienced a 3% increase in tonnage in February, marking its second consecutive year-over-year gain, according to the American Trucking Associations (ATA) report on March 18. The ATA For-Hire Truck Tonnage Index rose to 115.2 in February, up from 111.9 in January, with a 0.6% increase compared to 2024. This is the first instance of consecutive year-over-year increases since early 2023.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

“After a slight decline of 0.1% in January—attributable to harsh winter weather and wildfires—truck tonnage saw a strong gain in February,” said ATA Chief Economist Bob Costello. The not seasonally adjusted index also decreased by 4.7% sequentially to 104.8 in February. Costello noted that part of the February gain stemmed from shippers bringing in products ahead of tariffs, but overall, the first two months of the year indicate that freight recovery is underway.

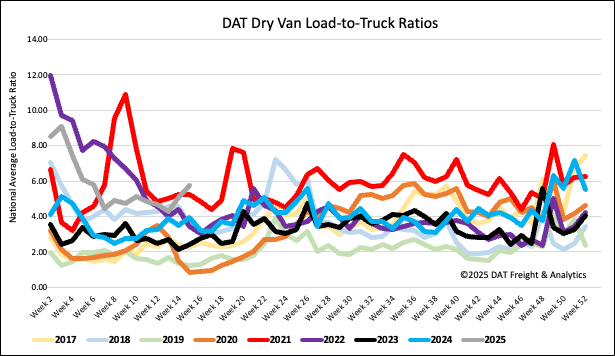

Load-to-Truck Ratio

Load post volumes were up for the third week, increasing by 8% w/w and 21% y/y. Volumes are just over 4% higher than last year. Last week’s dry van load-to-truck ratio (LTR) was up 14% to 5.77.

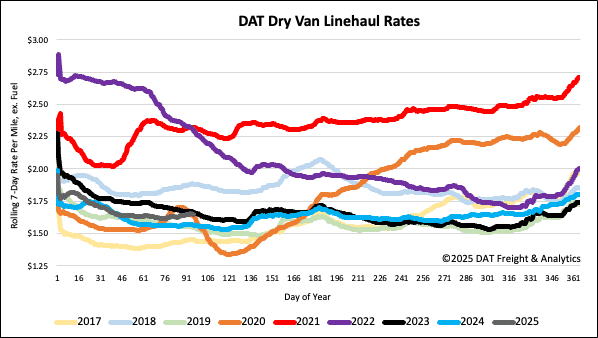

Linehaul spot rates

Dry van linehaul rates increased by just over $0.02/mile last week, with the national 7-day rolling average paying carriers an average of $1.66/mile on a 2% lower load volume. At $1.66/mile, linehaul rates are $0.08/mile higher than last year and $0.10/mile higher than 2019. On DAT’s Top 50 lanes, ranked by the volume of loads moved, carriers were paid an average of $1.94/mile, up $0.03/mile last week and still $0.28/mile higher than the national 7-day rolling average spot rate.

In our Midwest Region bellwether states, which have the highest correlation to the national average, outbound spot rates increased by $0.04/mile on a 2% lower volume of loads moved. Carriers were paid an average of $1.89/mile, $0.23/mile higher than the national 7-day rolling average.