The Logistics Management Index (LMI) fell to 57.3 in December, down 1.1 points from November’s 58.4, mainly due to seasonal inventory drawdowns and associated holding costs. Downstream retailers showed mild contraction with an index of 51.9, while upstream firms enjoyed a strong expansion at 60.3, a shift from October when downstream firms were more active in logistics.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Retailers successfully stocked up ahead of the holiday season, with sales from November to Christmas Eve rising 3.8% year-over-year, driven by a 6.7% increase in e-commerce and a 2.9% rise in in-person spending. The National Retail Federation (NRF) estimates that U.S. shoppers spent nearly a trillion dollars during this period, making it the busiest holiday season ever.

Transportation price growth rose by 3.0 to 66.8 in December, the fastest rate since April 2022. The 13.7-point gap between transportation prices and capacity is the highest since that month. Transportation capacity increased slightly by 0.6 to 53.2 and has remained above 50.0, avoiding contraction. This consistency reflects the high levels of capacity built from 2020 to 2021, despite the freight recession that began in March 2022.

Market watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

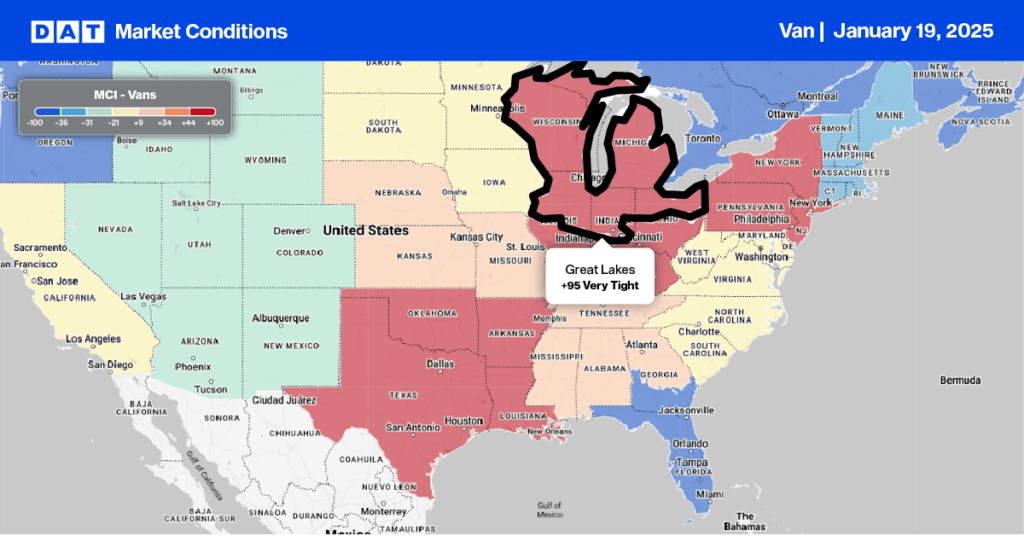

This week, we focus on the Great Lakes Region, where spot rates continue to rise as available capacity tightens. Seasonal cold weather has slowed freight networks and reduced available capacity earlier this year, with average regional temperatures in the low 20s for the first 15 days of January. Illinois temperature dropped to a freezing cold ten degrees late last week. Outbound spot rates in the larger Chicago freight market have risen $0.13/mile in the first half of January to an average of $2.51/mile. This is $0.07/mile higher than last year, although the cold snap in the Great Lakes region occurred in the second half of January.

Further to the east in South Bend, IN, the winter peak in outbound rates also came earlier, rising $0.15/mile to $2.32/mile last week. In Michigan, the impact of cold weather on spot rates was less pronounced, with rates up just a penny per mile to $2.36/mile last week. DAT’s Market Condition Index (MCI) expects available capacity to remain tight well into this week while freezing cold temperatures persist region-wide.

Load-to-Truck Ratio

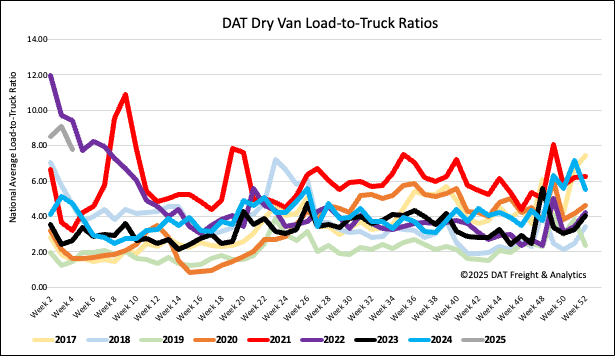

The freight market stabilized last week as Winter Storms Blair and Cora moved out, allowing available capacity to start moving again. Load post volumes were identical to last year, with last week’s dry van load-to-truck ratio (LTR) ending the week at 7.76.

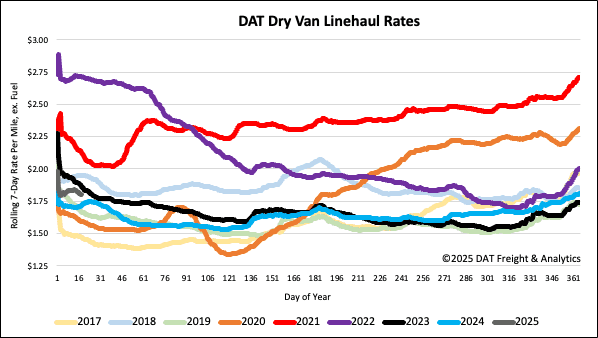

Linehaul spot rates

The national average dry van linehaul rate ended last week at $1.81/mile, down $0.03/mile, erasing most of the prior week’s gains driven by the cold snap. At $1.81/mile, spot rates are $0.09/mile (5%) higher than last year. On DATs’ Top 50 lanes, based on the volume of loads moved, carriers were paid an average of $2.14/mile, down $0.04/mile w/w and $0.33/mile higher than the national 7-day rolling average spot rate.