The American Trucking Association’s advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index fell 1.7% in April after decreasing 2.8% in March. Compared with April 2022, the SA index decreased 3.4%, which was the largest year-over-year decrease since February 2021.

“While the broader economy continues to surprise and thus far stave off an expected recession, the freight economy is starkly different,” said ATA Chief Economist Bob Costello. “The goods portion of the economy is soft, and as a result, even contract truck freight is now falling, albeit not nearly as much as the spot market. The tonnage index hit the lowest level since September 2021 in April and has now fallen on a year-over-year basis for two straight months.”

ATA’s For-Hire Truck Tonnage Index is dominated by contract freight instead of spot market freight. It serves as a barometer of the U.S. economy, representing 72.2% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods.

All rates cited below exclude fuel surcharges unless otherwise noted

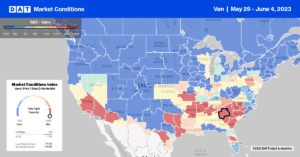

Our MCI reported that the available dry van capacity along the southern border was tighter last week. Mexico has been the United States’ top trading partner since December last year, with the Port of Laredo the number one commercial crossing zone for trucks and imports. Dry van linehaul rates were flat last week at $1.85/mile in Laredo after increasing for the four weeks prior. At $2.53/mile, loads from Laredo to Dallas are the highest since last October and around $0.20/mile higher than the average for May.

Truckload capacity continued to tighten in Ontario, CA, where spot rates increased by $0.07/mile to $1.97/mile last week, the fourth week of gains. Los Angeles outbound linehaul rates increased by $0.03/mile to an outbound average of $1.84/mile. Houston outbound spot rates have also increased for the last month following last week’s increase of $0.03/mile to $1.71/mile. The Texas state average stands at $1.66/mile for all outbound loads, and even though spot rates have been on the rise since the start of May, they are close to $0.30/mile lower than in 2018. In Atlanta and Chicago, spot rates were up by $0.02/mile to $1.88/mile and $1.94/mile, both markets increasing for the fourth week. Elizabeth, NJ, outbound spot rates were flat at $1.41/mile.

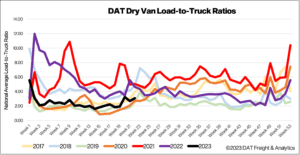

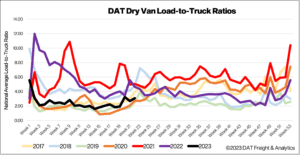

Volumes predictably dropped last week following the short work week post-Memorial Day. Load posts were down 6% w/w and remained around half what they were a year ago. Carrier equipment posts plunged dropping by just over 18% w/w, resulting in the dry van load-to-truck ratio (LTR) increasing by 15% w/w from 2.68 to 3.07.

Dry van linehaul rates inched higher for the third week, increasing by almost a penny per mile last week. The 7-day national average ended the week just over $1.71/mile following, which was $0.33/mile lower than the previous year. Based on the volume of loads moved the average rate for the top 50 dry van lanes was $0.31/mile higher at $2.02/mile last week.