The August for-hire trucking ton-mile index (TTMI) indicates that freight volumes are still languishing at the bottom of a trough, with little sign of significant improvement. Prof. Jason Miller states, “We are in the 29th month of a freight recession, using the March 2022 peak as the reference point. Year-on-year, freight volumes have declined slightly, but there are no indications of an upswing at this time. The trend shows fluctuations, with some months up and others down, but overall, volumes remain stable.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

The TTMI’s current freight volumes align closely with those observed in 2019. According to Miller estimates, supply is likely at comparable levels, suggesting a typical seasonal tightening as we approach November and December, followed by a loosening in January. If interest rates are cut further, we may see a genuine increase in freight demand beginning in March or April.

Market watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

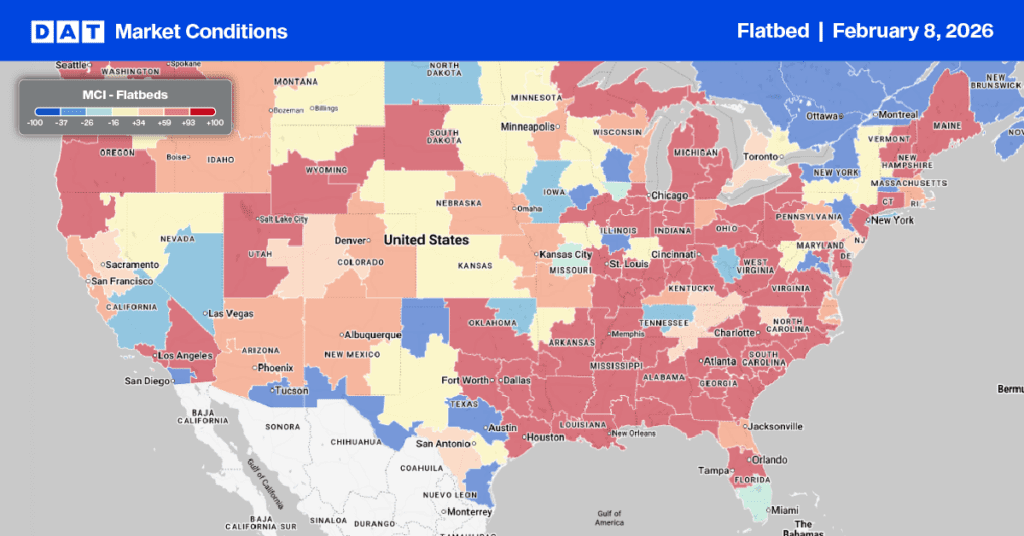

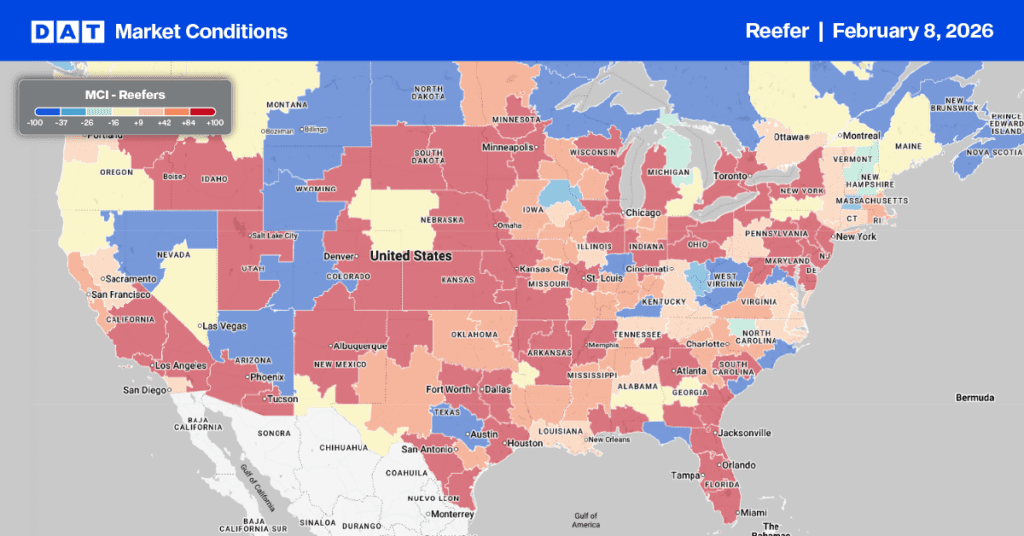

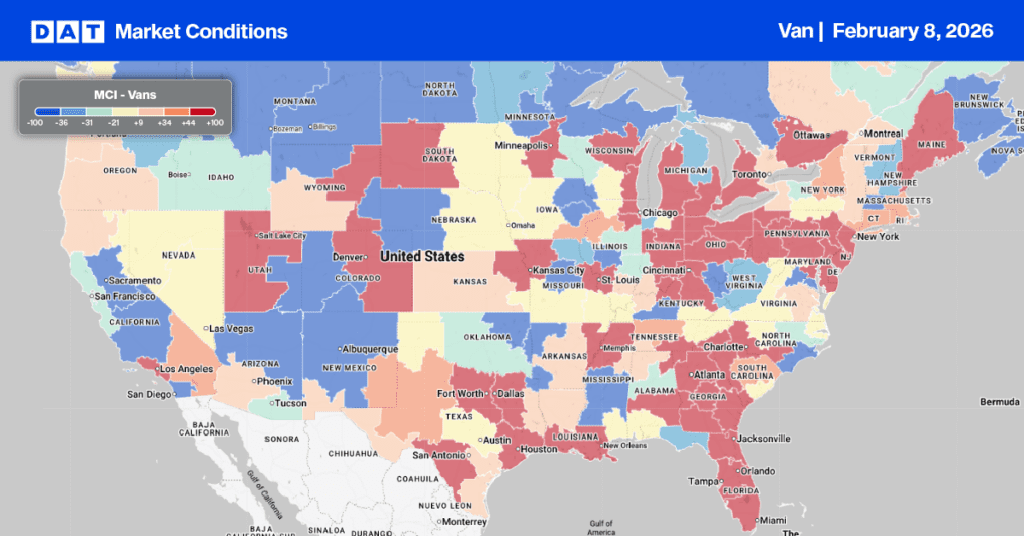

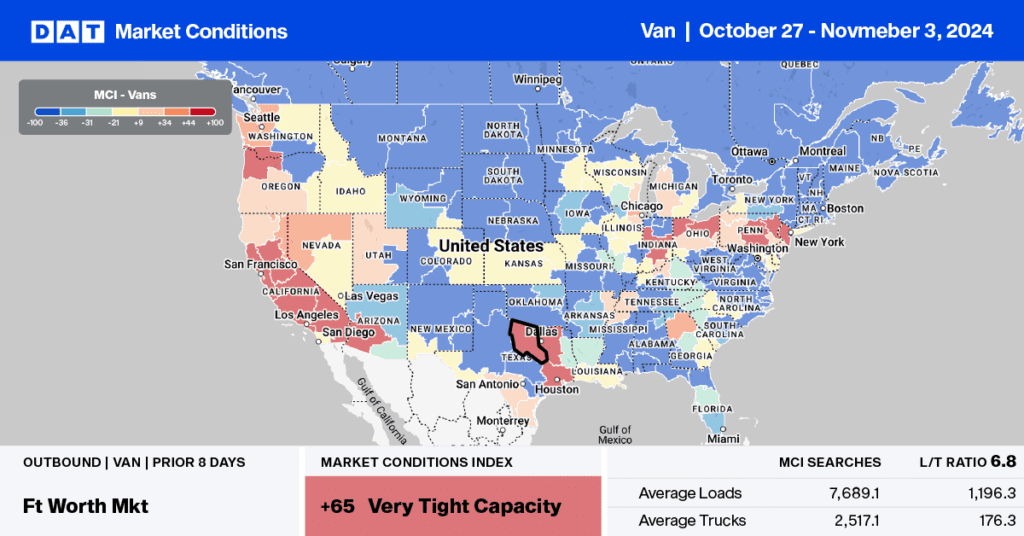

This week, we are focusing on the California freight market, which celebrated the annual Diwali Festival, with many Sikh (a religion that originated in the Punjab region of India in the 15th century) drivers in California, particularly in the Stockton freight market, took time off to celebrate the festival of lights. The five-day celebration is observed every year in early Fall after the summer harvest’s conclusion, typically resulting in an observable reduction in truckload capacity. According to the DATs Market Condition Index, outbound truckload capacity was very tight last week and is expected to remain well into this week.

According to Raman Dhillon, chief executive of the North American Punjabi Trucking Association (NAPTA), “Punjabi Sikhs make up 20% of the country’s truckers and control as much as 40% of the industry in California.” The Stockton freight market is one of many areas typically impacted by reduced capacity during the Diwali Festival. San Antonio, Texas, is also expected to see a truckload capacity reduction as it hosts the country’s largest city-sponsored and city-sanctioned Diwali Festival.

Load-to-Truck Ratio

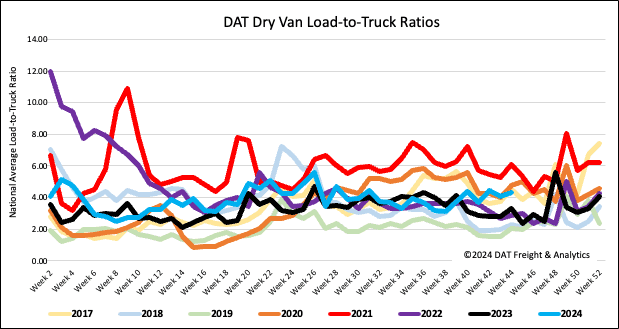

Last week, the volume of dry van load posts declined by 3% at the end of the month, which is a shift from the typical trend where shippers clear their loading docks. Nevertheless, compared to the same period last year, the volume remains 4% higher year-over-year (y/y). Excluding the pandemic-affected years of 2021 and 2022, load posts for Week 44 are 11% higher than in previous years, indicating sustained strength in the spot market.

Additionally, carrier capacity in the spot market has decreased, resulting in a 7% increase in the dry van load-to-truck ratio (LTR), which reached 4.35 last week.

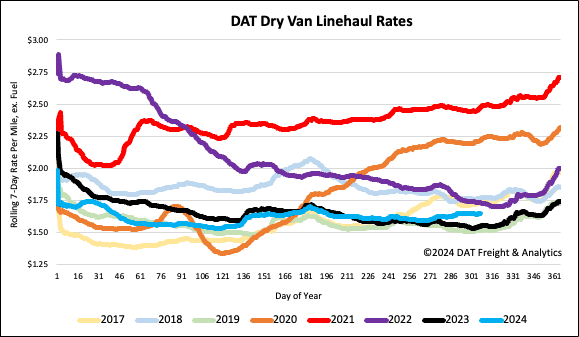

Linehaul spot rates

Last week, the volume of loads moved decreased by just over 1%, but it was still 4% higher than the same time last year. After remaining stable for the previous four weeks, with an average rate of $1.65 per mile, national average linehaul rates edged up last week to just under $1.66 per mile. This figure is $0.02 per mile above the three-month trailing average and $0.10 per mile higher than at the same time last year.