By Christina Ellington

The American Trucking Associations’ (ATA) advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 0.5% in May after falling 1.4% in April. Compared with May 2021, the SA index rose 3.7%, the ninth straight year-over-year gain. Year-to-date and compared with the same period in 2021, tonnage was up 2.7%.

“The transition in the freight market continued in May with the index hitting the second-highest level since the pandemic started. Specifically, on the market transition, ATA’s tonnage index is dominated by contract freight. The traditional spot market has slowed as freight softens, but these contract carriers are backfilling any losses in freight with loads from shippers that are reducing spot market exposure,” said ATA Chief Economist Bob Costello. “Essentially the market is transitioning back to pre-pandemic shares of contract versus spot market.”

The Cass Freight Index rose 5.4% m/m in May, more than recovering the 2.6% decline in April. On a tough comparison, the y/y decline worsened to 2.7%, as expected, but the result was 1% ahead of the ACT Research estimate. Normal seasonality from here would have the shipments component back up 2% y/y in June and flat to up 1% for 2022. The news from the retail sector and in the oil markets suggest that’s probably optimistic, but at this point, it’s a pretty stable environment. No major downturn.

The April 2022 reading of the for-hire trucking ton-mile seasonally adjusted index produced by Yemisi Bolumole and Jason Miller at Michigan State University (MSU) shows that even though the index declined 3% from March, volumes are up 2.4% y/y. The ton-mileage index is derived from the physical quantity output for 41 different industry sectors that generate freight.

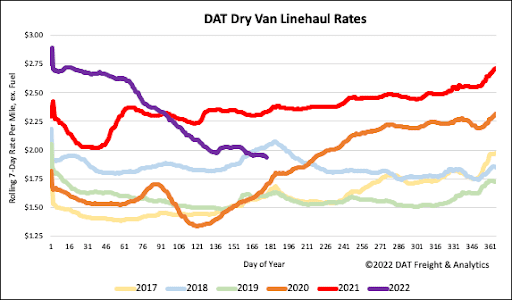

All rates cited below exclude fuel surcharges unless otherwise noted.

Even though freight volumes in Los Angeles and Ontario have been relatively flat for the previous three weeks, capacity continued to tighten for the third week. At $2.29/mile, the average outbound rate for these two markets is up $0.06/mile over the same timeframe. On the long-haul lane east to Chicago, dry van linehaul rates are $0.78/mile lower at an outbound average of $1.76/mile this week but $0.12/mile higher than the May average.

In the number one dry van spot market of Atlanta, with a 4% market share, volumes increased by 4% w/w while capacity continues to loosen, with spot rates dropping for the fourth week in succession to an average of $2.12/mile. In contrast, capacity tightened on high-volume lanes, including Atlanta to Orlando, where spot rates are averaging $3.12/mile this week, up $0.18/mile on the May monthly average and $0.31/mile lower y/y.

In the number two market in Houston, outbound capacity tightened for the first time in a month following last week’s $0.02/mile increase to an average of $2.07/mile. Loads north to Dallas were paying $663/load last week, which is on par with the May average linehaul rate and around $10/load lower than the previous year. In Elizabeth, NJ,the number seven outbound market, capacity continues to loosen, with spot rates dropping by $0.10/mile in the last month to an average of $1.65/mile. Elizabeth to Atlanta loads paid even less at $1.43/mile, while loads to Dallas were even lower, averaging $1.36/mile last week.

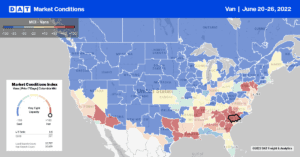

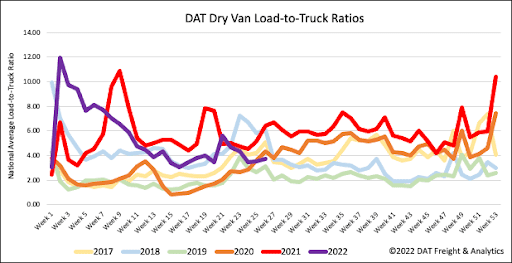

Dry van load post volumes increased by 5% last week but remain 10% lower than this time in 2018 and 32% lower than in 2021. Equipment post volumes in the DAT freight network are running around 17% higher than last year and, as a measure of how oversupplied the dry van market is, are at the highest level in the previous six years for the middle of June. As a result, last week’s dry van LTR increased slightly to 3.75.

Dry van linehaul spot rates on the top 50 lanes averaged $2.36/mile last week, or $0.40/mile higher than last week’s national average rate of $1.96/mile. Dry van linehaul rates dropped by less than a penny per mile last week and are also $0.40/mile lower compared to the previous year and even $0.10/mile lower than in 2018. Dry van linehaul rates excluding fuel have dropped by over 29% or $0.82/mile YTD but are still $0.26/mile higher than the average of pre-pandemic years.