According to Professor Jason Miller, a supply chain expert at Michigan State University, trucking companies need more good news as demand remains weak. The latest release of the for-hire trucking ton-mile and revenue indexes (TTMI), based on output across 41 freight-generating industries, showed March’s seasonally adjusted ton-mile reading decreased 0.5% from February but remains down just over 1% year-over-year (y/y).

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Miller’s analysis notes that March 2024 featured Easter, usually in April. Consequently, this year’s March seasonal adjustment factor looks quite different from last year’s. According to Prof. Miller, “the weak March seasonally adjusted reading indicates demand conditions remain weak, though, for perspective, ton-miles remain 2.5% above the average we saw in 2017. These data prove my argument that year-over-year growth in containerized imports is a poor proxy for trucking demand.”

The Michigan State University trucking ton-mile index points towards weak demand conditions, a sentiment shared by many shippers, brokers, and carriers. The CASS Shipments Index also reflected softer demand. Although the freight mix differed from the TTMI, the index reported shipment volume down 4% year over year for April 2024.

Market watch

All rates cited below exclude fuel surcharges unless otherwise noted.

Truckload capacity tightened for the fourth week in Chicago following last week’s penny-per-mile increase to an outbound average of $1.68/mile. Illinois state average rates at $1.92/mile are identical to 2019, influenced by solid gains in the neighboring Joliet market, where linehaul rates increased by $0.03/mile to $1.71/mile.

A similar month-long trend was reported in Atlanta, where rates increased by $0.02/mile to $1.77/mile, up $0.20/mile in the last month on a 22% lower volume of loads moved. On the benchmark Atlanta to Lakeland high-volume lane, linehaul rates ended May at $2.52/mile, $0.06/mile higher than the prior month. Linehaul rates were also elevated on the return journey, where at $0.83/mile, they are $0.13/mile higher than the long-term average, yielding an average round trip rate of $1.79/mile excluding fuel. At this level, regional carriers are operating slightly under breakeven.

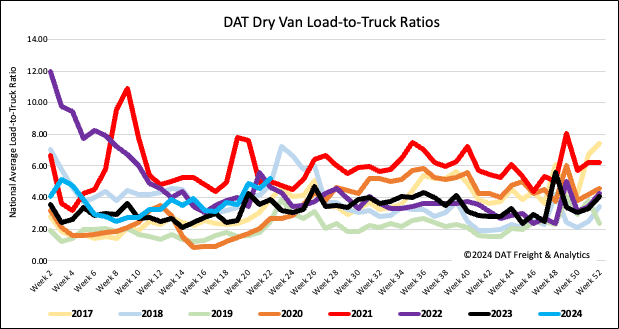

Load-to-Truck Ratio

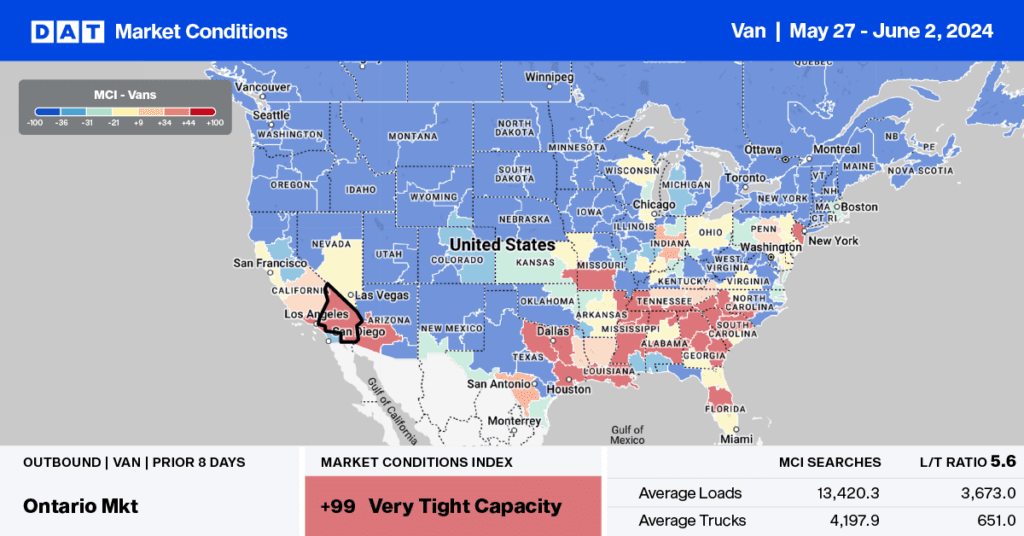

Dry van load post volume was within 3% of last year following last week’s short shipping week following Memorial Day. The week-over-week (w/w) change in volume was also identical to last year at 8%. Carrier equipment posts were 24% lower than last year following last week’s 20% w/w decrease, resulting in the dry van load-to-truck ratio increasing by 14% w/w to 5.23.

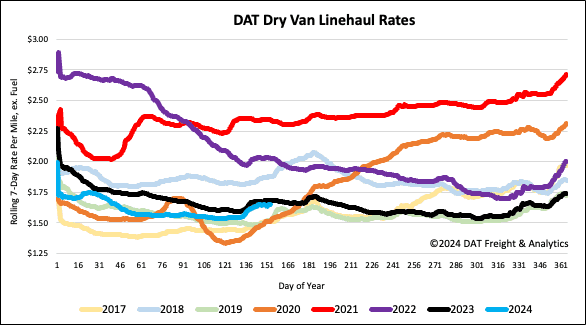

Linehaul spot rates

The national average dry van linehaul rate increased by just over a penny per mile to $1.66/mile as shippers pushed more volume into the market at month-end. Compared to last year, linehaul rates are $0.03/mile lower on an 8% higher volume of loads moved in Week 22. DAT’s Top 50 lanes, based on the volume of loads moved, averaged $2.01/mile last week, up $0.04/mile w/w and $0.35/mile higher than the national average.