Importers eager to avoid West Coast port congestion and disruptions caused by labor disagreements look to have made the right call regarding cargo routing. One of the more significant trends that have developed over the last year is the import shift away from the West Coast and towards Gulf and East Coast ports. Reasons for the shift cited by importers included minimizing supply chain disruption during this year’s peak shipping season due to port congestion and the expiration of the International Longshore and Warehouse Union (ILWU) contract on July 1, 2022.

News reported by the Journal of Commerce (JOC) would suggest shippers are spot on with their concerns of a repeat of the 2014-15 contract negotiations in which ILWU locals “took action on their own initiative to disrupt cargo movements to advance various local agendas, causing six months of disruption before then-Labor Secretary Tom Perez mediated a settlement in early 2015.” JOC reports that contract negotiations have entered a new and potentially more volatile phase, potentially disrupting cargo movements during top-level negotiations between the union and employers.

According to the JOC, a union representing security guards at Los Angeles and Long Beach ports authorized a strike last week following three years of negotiating for a new contract. Even though the security guard union contract is separate from the coast-wide longshoreman contract, dockworkers would likely honor any security officer picket lines, thus shutting down port terminals.

Import volumes on the West Coast have been decreasing for various reasons, and according to IHS Markit/PIERS, import volumes in August were down again on the West Coast, decreasing by 2.9% m/m, however, west coast volume is up 3.9% y/y as we start to lap the significant port slowdowns of 2021. The East and Gulf Coast volumes continue to trend higher; the East coast was up 8.2% m/m and 13.0% y/y, and the Gulf coast increased 1.6% m/m and 11.8% y/y for the month of August.

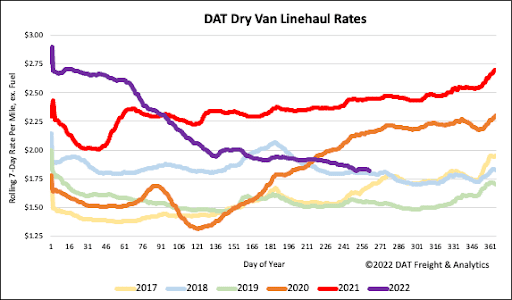

All rates cited below exclude fuel surcharges unless otherwise noted.

Last week, the railroad strike threat was enough to send shippers to the truckload market just in case the railroads and unions could not reach an agreement before the “cooling off” period expired last Friday. President Biden announced that an agreement had been reached pending union member ratification came as welcome relief to almost everybody involved, with only minimal impact observed on spot rates on key intermodal lanes. On the high-volume lane from Los Angeles to Chicago, where at least 30% of all intermodal moves occur, dry van spot rates decreased from $0.07/mile to $1.67/mile and are $1.14/mile lower than the previous year. Loads moved on that lane were up 47% last week, but this was partly due to a return to normal levels given the short week following the Labor Day Weekend.

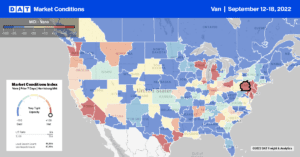

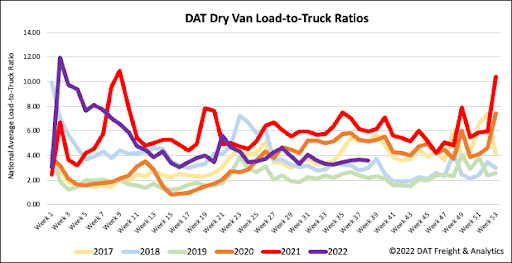

Last week was a return to relatively normal shipping patterns after the short work week after Labor day. An increase in dry van load posts increased 13% w/w; while this is down from 2021 levels, dry van load post volume is 41% higher than in 2018. Truck posts also saw a rebound from last week and were up 14% w/w. As a result, the truck postings were incrementally more significant than the available loads, and this drove the dry van load-to-truck ratio (LTR) to decrease by 1% from 3.64 to 3.60 last week.

Dry van spot rates have seen a relatively flat trend this month, and the national average dry van linehaul rate dropped $0.01/mile last week to $1.82/mile. Compared to the top 50 lanes which averaged at $2.24/mile, the national average was $0.42/mile lower last week. Dry van linehaul rates are $0.63/mile lower than the previous year’s spot rate surge but are still $0.21/mile higher than the average of pre-pandemic years.