By Christina Ellington

Despite concerns over softening demand due to a massive backlog of vessels near China, distribution center space continues to be in high demand, according to the latest first-quarter Industrial outlook by JLL, a commercial real estate services firm.

Highlights of the report show that Industrial leasing volume increased 17% y/y; logistics & distribution companies and 3PL providers have been the leading demand drivers. 3PLs showed a 60% increase in leasing volume year-over-year. Retailers struggling to secure suitable space in the right place are more likely to outsource to 3PLs with footholds in strategic markets. Available vacancy continued to fall for the sixth consecutive quarter to 3.4%. Developers delivered 90 million square feet. of new inventory in Q1, and there is currently 531 million s.f. under construction. The south-central region has the highest percentage of square footage under construction at 6.4%, with a higher percentage of vacancies that can be found in the growing Texas market.

With the increased import volume into the port of Charleston, companies such as Walmart are setting down roots in the area. According to the JOC, Walmart has opened its newest distribution center (DC) in Ridgeville, South Carolina, with the Port of Charleston only 39 miles away. The retailer said that the 3-million-square-foot facility expects to increase Charleston’s import volumes by roughly 5 percent.

“Having this world-class company choose our market for their seventh import distribution center is the ultimate vote of confidence in SC Ports and in South Carolina, further solidifying SC Ports as a leader in retail distribution,” SC Ports CEO Jim Newsome said in a statement. “The strategic investments we have made in port infrastructure enable SC Ports to support global retailers’ supply chains.”

As we head into peak shipping season, it’s still unclear if demand will spike this year with the reopening of Shanghai from COVID lockdowns. The Georgia Ports Authority handled a record high volume of 495,782 TEU in April. However, Griff Lynch, CEO of the GPA, told JOC “Many, including myself, thought there was a massive backlog of vessels near China, but I’m seeing information now that may lead us to believe that the demand is softening. If that is true, maybe the peak season is still strong on the East Coast because of diversions from West Coast ports, but not overwhelming as we initially thought. We see some heavy volume coming at us, but we’ll have to wait to see what volume looks like beyond that.”

All rates cited below exclude fuel surcharges unless otherwise noted.

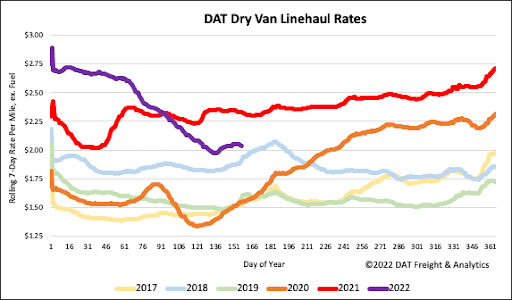

The lack of West Coast rail capacity and increasing container dwell times in the Ports of Los Angeles and Long Beach result in a repeat of what truckload carriers observed last year. Dry van spot rates in the port market of Los Angeles are up for the fourth week in a row following last week’s penny per mile increase to an outbound average of $2.19/mile. On the benchmark lane to Chicago, where truckload competes heavily with intermodal, spot rates reversed the six-month slide increasing by $0.01/mile last week to $1.65/mile. That’s still $0.89/mile lower than this time last year and a half of what linehaul rates were six months ago between Los Angeles and Chicago.

Further inland in Joliet and Chicago, where most intermodal trains hub, outbound truckload spot rates follow the same four-week trend as Los Angeles was increasing a penny per mile to $2.29/mile last week. Loads from Chicago to the Northeast intermodal hub in Worcester, MA, increased $0.11/mile the previous week to an average of $2.59/mile after decreasing for the five months prior. Outbound spot rates in the Midwest intermodal hub in Kansas City increased for the third week in succession by $0.02/mile to $2.11/mile. Capacity tightened slightly for loads to Lakeland, FL, with spot rates averaging around $2.00/mile after dropping by more than a dollar per mile since the start of the year.

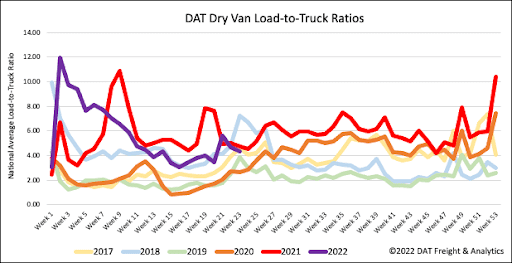

The short workweek following Memorial Day suppressed load post volumes last week and combined with more carriers on vacation this year, the dry van load-to-truck (LTR) ratio dropped slightly to 4.34 last week. That’s around 9% lower than this time last year when the LTR was at 4.77.

Dry van linehaul spot rates excluding fuel have been flat for the last three weeks after dropping $0.72/mile over the prior 19 weeks. We’ve been anxiously waiting for the seasonal correction in the spot rate decline, and it may have finally arrived. However, it remains to be seen if linehaul spot rates will increase by as much as $0.30/mile between now and July 4 as they’ve done in recent years. Linehaul spot rates (excluding fuel) increased by less than a penny per mile last week to a national average of $2.06/mile. Last week’s linehaul spot rate was $0.29/mile lower than the previous year and $0.12/mile higher than the same week in 2018.