In normal times, there would be zero — or one at most — container ships waiting at anchor off the San Pedro Complex in California. This week there are 21 container vessels at anchor, which is about twenty more vessels waiting to unload compared to this time last year. However, it’s a massive improvement on the 40 vessels waiting to unload on Feb 1.

“Another 16 container ships are due to arrive over the next 3 days,” says Kip Loutitt from The Marine Exchange. “Which is one fewer than the ‘normal’ level of 17 arrivals based on 2018 and 2019 pre-COVID levels”.

The 21 container ships at anchor awaiting at berth include 11 mega-container ships over 10,000 TEUs (twenty-foot equivalent units). The CSCL AUTUMN has been at anchor the longest, having arrived April 25. That’s 14 days compared to the current average of 6.6 days.

“Collectively, we have been able to significantly reduce the amount of container vessels awaiting offshore,” says Gene Seroka, Executive Director at the Port of Los Angeles. “I’m also proud of the steady progress being made to vaccinate waterfront workers at the Port’s on-site location and elsewhere.”

Overall, cargo volume has increased 44% since last year and is up 113% compared to March 2020, representing the busiest March in the Port’s 114-year history.

Find loads and trucks on the largest load board network in North America.

Note: All rates exclude fuel unless otherwise noted.

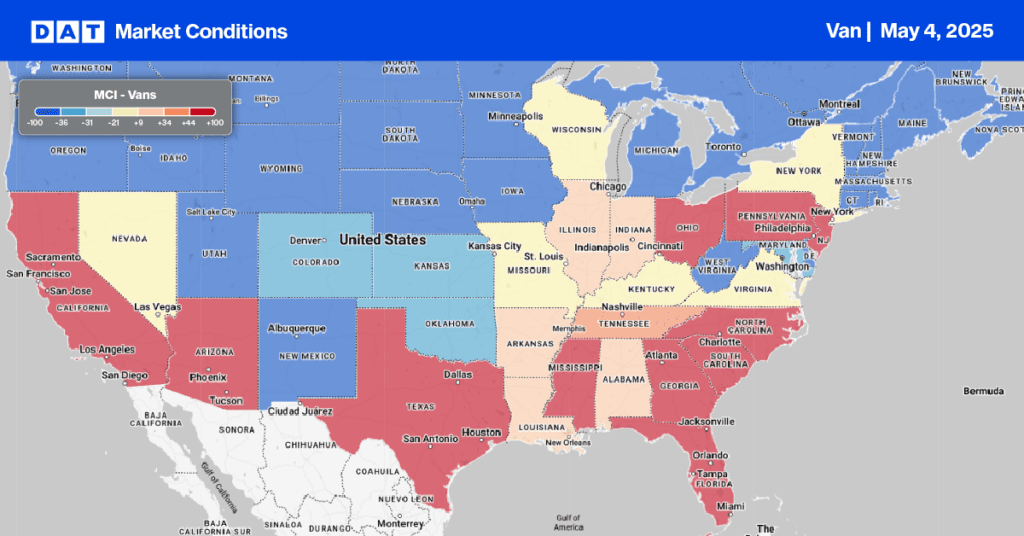

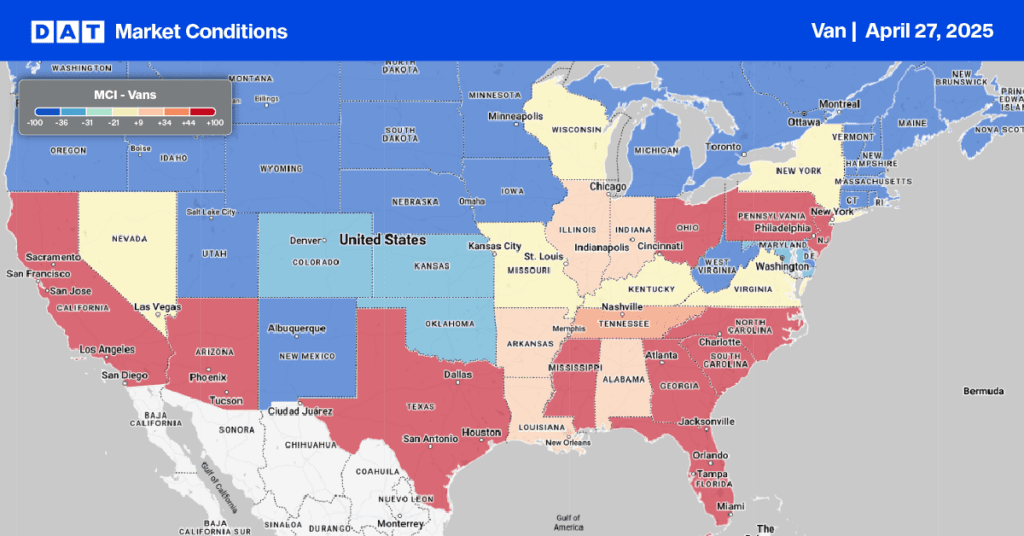

Although there was no change in capacity with rates remaining at an average of $2.39/mile, Atlanta remains the number one spot market following a 19% increase in load post volumes last week.

Houston’s volume jumped 28% this week followed by a $0.01/mile increase in spot rates to an average of $2.15/mile. Dallas saw a 7% weekly increase in volume with a rate increase of $0.01/mile to $2.02/mile.

On the West Coast, capacity tightened slightly. Both Ontario, CA, and Los Angeles increased outbound rates by $0.01/mile. Ontario’s spot rates were $3.02/mile while Los Angeles were at $2.92/mile.

Spot rates

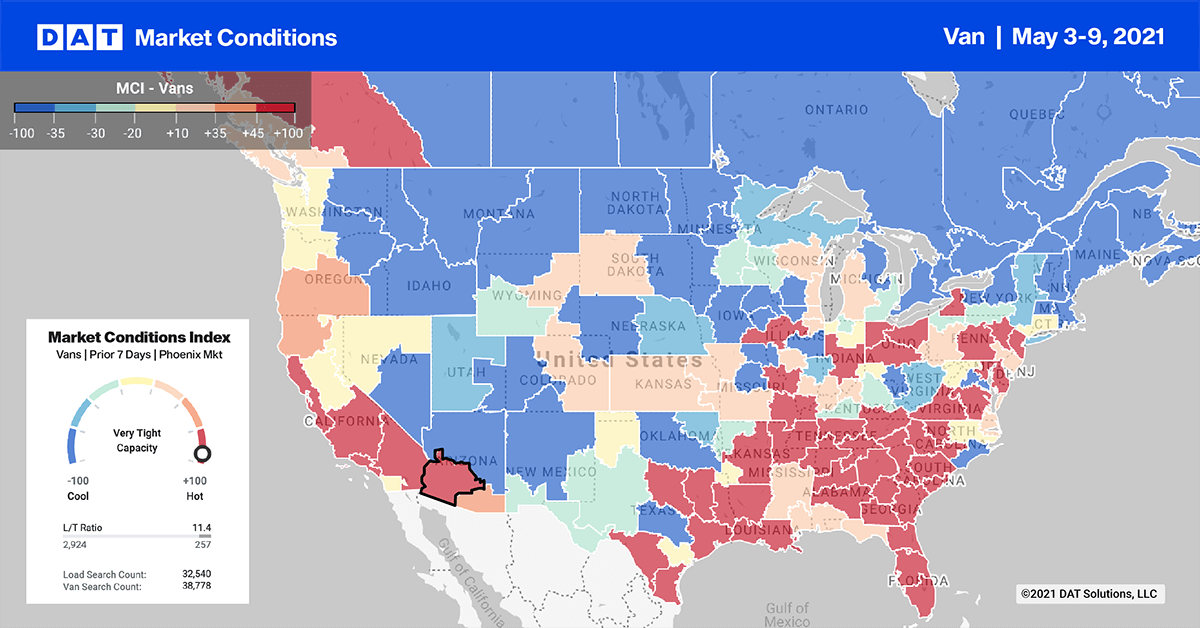

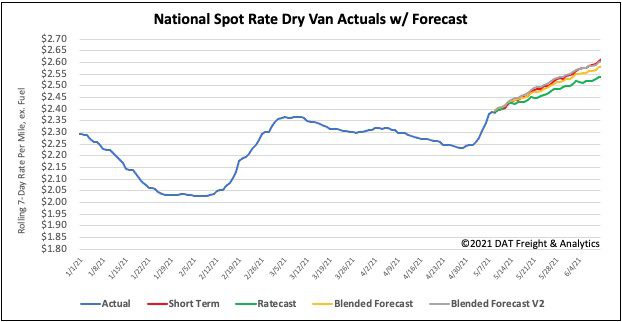

Dry van spot rates surged last week as another acute capacity crunch hit the freight market. During the annual Roadcheck Week, we typically see a 5% decrease on dry van equipment posts. But this year, that jumped to 12% last week.

Record-high spots rates gave carriers the comfort zone to spend the week off the road conducting much-needed maintenance after a busy 12 months. Spot rates jumped $0.13/mile to end the week at $2.42/mile, which is now $1.06/mile higher than this time last year and $0.65/mile higher than the same week in 2018.

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset

- Blended Scenario: More heavily weighted towards the longer-term models

- Blended Scenario v2: More heavily weighted towards the shorter-term models