Sales of new single-family houses in March 2021 were up 20.7% from February and 66.8% above March 2020. The report noted new houses for sale at the end of March was 307,000, which represents a supply of 3.6 months at the current sales rate compared to 6.5 months in March 2020 — a 44.6% decrease in supply.

For flatbed carriers in the lumber and building materials sectors, demand remains strong considering permit applications for new single-family homes. Flatbeds are up 26% this year, following a 15% month-over-month increase in March. Compared to the same time last year, the industry added 358,000 new single-family homes with just over half of those built in the South Region.

The National Association of Homebuilders (NAHB) noted that building prices have soared due to increased demand. For example, lumber prices have tripled over the past 12 months. Increased prices are adding nearly $36,000 to the price of the average, new single-family home. Multi-family homes also saw an increase of $9,000 since April 2020.

“Even though the housing sector continues to be a leader in the nation’s economic recovery, these sharp price increases threaten housing affordability for all Americans,” wrote NAHB in a letter to Congress. “Home builders and construction firms that have signed fixed-price contracts are forced to absorb these crippling increases in materials prices and costly delays in deliveries; there is a significant risk that many of these firms will be forced out of business.”

If the steam goes out of the building industry, carriers will see lower demand and flatbed volumes.

Find loads and trucks on the largest load board network in North America.

All rates exclude fuel unless otherwise noted.

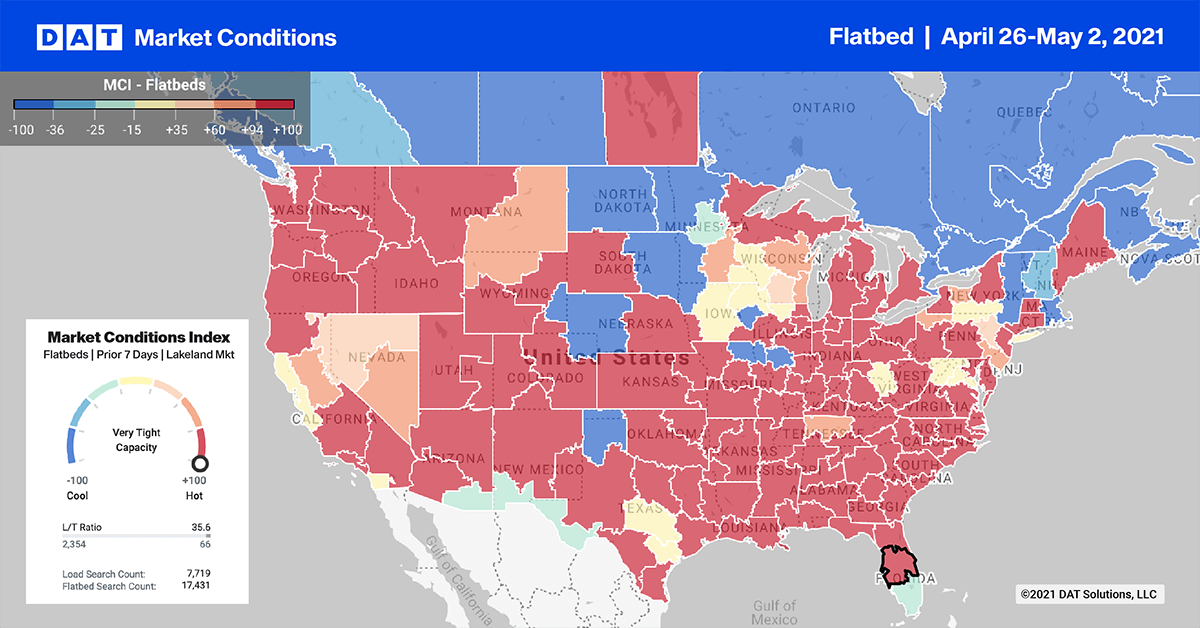

The flatbed sector is having an unprecedented year as rates in the Top 10 markets increase by $0.18/mile on average while volumes dropped by 7% last week. This just shows how tight capacity is in the flatbed sector.

- Memphis is the largest logistics freight hub in the U.S., where volumes increased by 3% last week and pushed rates up by $0.13/mile to $2.53/mile.

- Houston volumes were down 5% while spot rates went up $0.17/mile to $2.70/mile.

- Savannah, GA, volumes dropped 9%, and rates increased $0.13/mile to $3.13/mile.

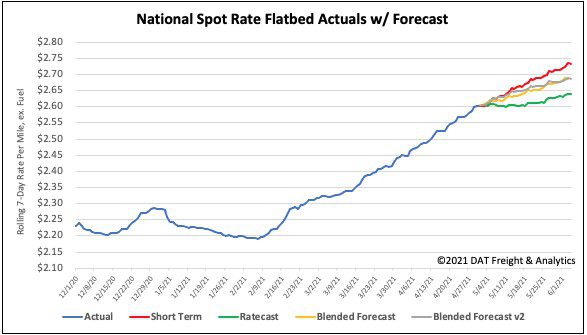

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset

- Blended Scenario: More heavily weighted towards the longer-term models

- Blended Scenario v2: More heavily weighted towards the shorter-term models

> Learn more about rate forecasts from DAT iQ