The Fannie Mae Home Purchase Sentiment Index (HPSI) increased in April to its highest level since May 2022, jumping 5.5 points to 66.8. Year over year, the full index is down 1.7 points. All six of the HPSI’s components increased monthly, most notably the component associated with consumers’ expectations of mortgage rates. While the component remains negative on net – meaning more respondents than not expect mortgage rates to go up over the next year.

“This month’s increase in the HPSI was the largest in over two years, primarily driven by consumers’ more optimistic mortgage rate expectations,” said Doug Duncan, Fannie Mae Senior Vice President, and Chief Economist. “An increased number of respondents indicated they think mortgage rates will go down over the next year, a belief that could be due to a combination of factors, including an awareness of decelerating inflation, market suggestions that monetary conditions will ease in the not-too-distant future, and, of course, actual mortgage rate declines during the month.”

Fannie Mae’s National Housing Survey is conducted monthly with consumers focused primarily on housing. The responses of the nationally-representative sample of 1000 consumers each month to about 100 survey questions promptly provide information on a wide range of housing-related topics.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted

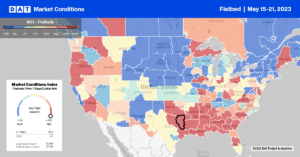

At $2.31/mile, outbound flatbed rates in California are around $0.20/mile higher than in 2018, with solid gains reported last week in Los Angeles, where rates increased by $0.23/mile to $2.16/mile. Flatbed rates in nearby Ontario increase by $0.18/mile to $2.22/mile for outbound loads. After a solid start to the year, Texas outbound flatbed rates cooled last week, dropping by $0.07/mile to $2.28/mile and lower by the same amount compared to 2018.

Outbound capacity was tight last week in Laredo’s largest border crossing market, where rates increased by $0.09/mile to $2,19/mile on 18% higher volume, up almost $0.02/mile in the last month. In Dallas, where volumes increased by 6% w/w, rates were flat at $2.22/mile after dropping by $0.12/mile in the prior three weeks. Volumes in Shreveport continue to climb following last week’s 18% w/w gain. Linehaul rates for outbound loads increased by $0.06/mile to $2.96/mile after dropping by $0.36/mile in the prior three weeks.

Load-to-Truck Ratio (LTR)

Volumes in the flatbed spot market are now 5% higher than last month, following last week’s 16% increase in load posts. Volumes are still 73% lower than last year and about half what we’d typically expect in Week 20 for pre-pandemic years going back to 2015. Flatbed carriers took time off during International Roadcheck Week, with carrier equipment posts dropping by 16% w/w. The capacity crunch resulted in last week’s flatbed load-to-truck (LTR) ratio increasing from 9.79 to 13.57.

Spot Rates

The combination of higher spot market volumes and carriers sitting out the 72-hour safety blitz during International Roadcheck resulted in tighter capacity last week. The national average flatbed linehaul rate increased by $0.07/mile and ended last week at $2.20/mile. That’s around $0.18/mile lower than in 2018 but $0.39/mile lower than the previous year.