According to the USDA, net farm income is expected to drop by 25.5 % from 2023’s forecast of $155 billion to $116 billion in 2024 – a decrease of nearly $40 billion. This will likely lead to reduced agricultural machinery expenses, with tractor sales already 30% below the five-year average in May. However, the shift in production to Mexico, coupled with the layoffs by large manufacturers like AGCO, also presents new market opportunities for cross-border truckload carriers, signaling potential growth in this sector.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

AGCO recently announced a significant workforce reduction, with around 6% of its employees being laid off due to ‘weak demand in the agriculture industry,’ as a spokesperson from the company’s headquarters in Duluth, Georgia, explained. The company is also shifting some of its production to another AGCO plant, producing small square balers, round balers, and rotary mowers. This plant will be relocated to its Querétaro, Mexico, facility starting in 2025.

The company’s first-quarter results showed net sales decreased by 12.1% compared to the first quarter of 2023. AGCO demonstrated strong execution of its Farmer First strategy in the first quarter,” said Eric Hansotia, AGCO’s Chairman, President, and Chief Executive Officer. “Our results reflect the declining global demand for the agricultural equipment industry and, as anticipated, significant production cuts that still led to solid results. The reductions were aimed at helping reduce dealer inventories.

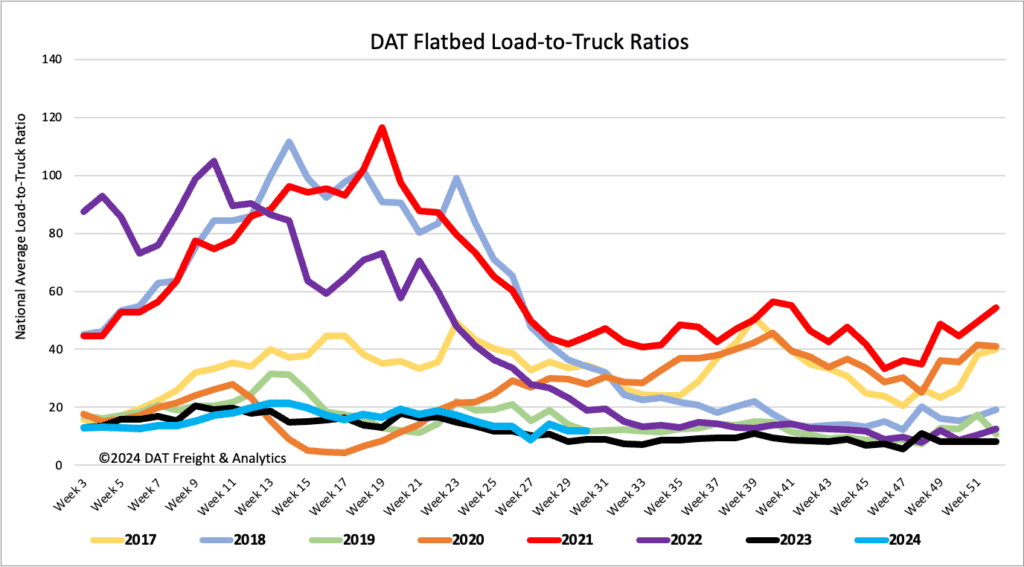

Load-to-Truck Ratio

Flatbed load post volumes dropped by 5% last week and remain 8% higher than last year and 37% lower than the Week 30 eight-year average, excluding years impacted by the pandemic. Carrier equipment posts were again down 4% w/w, resulting in last week’s flatbed load-to-truck ratio down slightly to 11.9, which is identical to this time in 2019.

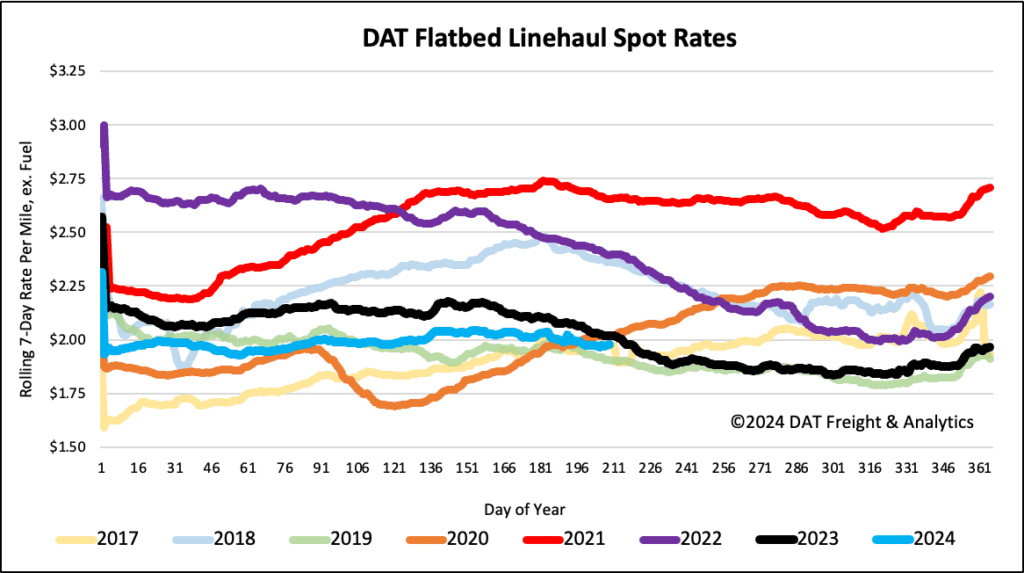

Spot rates

Flatbed linehaul rates dropped by $0.02/mile last week, averaging slightly over $2.00/mile. Flatbed spot rates are $0.04/mile lower than last year but $0.07/mile higher than 2019.