Against the backdrop of the worsening Middle East crisis, global oil markets are being impacted, driving up oil prices. Many energy firms remained focused on returning money to investors and paying down debt rather than boosting oil and gas production. Going against the trend, energy firms added two oil and natural gas rigs for a second week in a row in early October, according to the Baker Hughes Rig Count. The oil and gas rig count, an early indicator of future output, rose two to 624 in the week to October 20. Despite the rig count increase, Baker Hughes said the total count was still down 147, or 19%, below this time last year.

The oil and gas rig count in the Permian Basin in West Texas is especially important for the flatbed market; drill pipe and casing demand is closely tied to freight volumes and spot rates. Around half of the national rig count comes from the Permian Basin in the Lubbock freight market, with Houston to Lubbock being one of the highest volume flatbed lanes nationwide. Consistent with a 19% lower rig count in October, spot rates on the Houston to Lubbock lane have decreased by 24% over the last 12 months. The volume of loads moving has also dropped by 21% over the same timeframe.

The Baker Hughes Rig Counts are an essential business barometer for the drilling industry and its suppliers. When drilling rigs are active, they consume products and services produced by the oil service industry. The active rig count is a leading indicator of demand for products used in drilling, completing, producing, and processing hydrocarbons.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

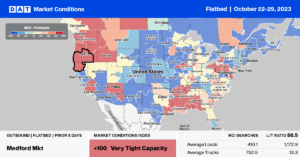

At $1.89/mile, outbound Texas state average rates are identical to this time in 2018 and only around $0.01/mile higher than in 2019. Linehaul rates have dropped by almost $0.50/mile since the start of June this year, which isn’t unusual based on trends observed in past years. In Houston, spot rates increased $0.05/mile last week to an outbound average of $2.06/mile, led by gains on the Lubbock lane. Houston to Lubbock paid flatbed carriers $2.28/mile last week, up $0.04/mile w/w. Regarding loads being moved on this lane, DAT sees around half the flatbed volume compared to last year.

Houston to El Paso paid carriers $2.25/mile last week, up $0.04/mile but $0.56/mile lower than last year. Loads moved last were also around half what they were in 2022. Houston to Dallas loads paid $2.06/mile last week, up $0.05/mile but $0.45/mile lower than the same time a year ago.

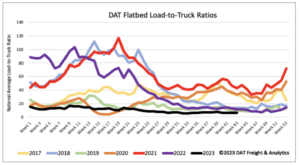

Load-to-Truck Ratio (LTR)

The volume of flatbed load posts (LP) followed the same dry van and flatbed downward trend, decreasing by just over 2% last week. Volumes remained around half what they were a year ago. Carrier equipment posts (EP) decreased 4% w/w, resulting in last week’s reefer load-to-truck ratio (LTR) increasing by 2% to 6.11, the lowest LTR in seven years.

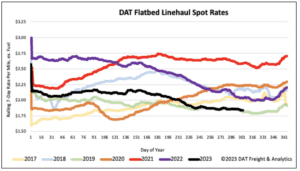

Spot Rates

After being flat for most of October, Flatbed linehaul rates decreased by $0.01/mile to a national average of $1.87/mile, $0.20/mile lower than last year, and just $0.02/mile higher than in 2019. Compared to the pre-pandemic average for Week 41, last week’s national average was $0.09/mile lower and $0.35/mile lower than in 2018.