Builder confidence in the market for newly-built single-family homes in May increased by five points to 50, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI). This marks the fifth straight month that builder confidence has increased and is the first time sentiment levels have reached the midpoint mark of 50 since July 2022. The NAHB HMI is a diffusion index where a reading above 50 indicates more builders view conditions as good than poor (below 50).

One of the main reasons for improving builder confidence in May is the limited existing inventory, which has put a renewed emphasis on new construction. This is despite the industry continues to face several challenges, including building material supply chain disruptions and tightening credit conditions for construction loans. “New home construction is taking on an increased role in the marketplace because many homeowners with loans well below current mortgage rates are electing to stay put, and this is keeping the supply of existing homes at a very low level,” said NAHB Chairman Alicia Huey, a custom home builder and developer from Birmingham, Ala.

In other news, the U.S. Census Bureau reported that single-family housing starts in April.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

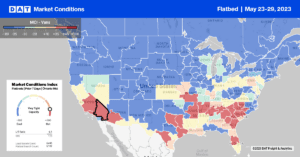

Outbound flatbed capacity on the West Coast cooled last week for the first time since the start of March. Regional linehaul rates decreased by $0.05/mile to $2.42/mile, driven by lower volumes in the Medford, OR, market, the largest flatbed market on the West Coast. Linehaul rates dropped by $0.11/mile to $2.70/mile for outbound Medford loads, which have decreased for the last three weeks. Medford to Denver loads paid carriers an average of $2.22/mile, around $0.40/mile lower than the previous year. Loads to Los Angeles at $2.50/mile were $0.20/mile higher than April last week. At $2.78/mile, outbound Oregon rates are $0.31/mile higher than in 2018 and only surpassed by 2021 and 2022.

Flatbed capacity was tighter last week across the Southeast Region, where spot rates averaged $2.51/mile, up $0.10/mile since April and around $0.25/mile lower than in 2018. In Texas, where state-level spot rates decreased by $0.08/mile last week to an average of $2.30, capacity was tight in the Ft. Worth market, where rates increased by $0.03/mile to $2.29/mile. Loads 270 miles south to Houston were the highest in 12 months at $2.10/mile, while loads to Lubbock in the Permian Basin oil field dropped to $2.61/mile, which was $0.26/mile lower than April and $0.35/mile lower than the previous year.

Load-to-Truck Ratio (LTR)

Last week’s spot market flatbed volume increased by just over 2% but has remained mostly flat since the start of the year as the flatbed market shifts sideways. Carrier equipment posts were up 5% last week but also at the highest level in seven years resulting in last week’s flatbed load-to-truck (LTR) ratio decreasing from 13.48 to 12.56, slightly above 2019 levels.

Spot Rates

Flatbed linehaul rates dropped by just over a penny-per-mile last week, erasing all the gains from the prior week’s surge. At $2.18/mile, flatbed spot rates remain almost identical to the average from the start of March. Linehaul rates are $0.42/mile lower than last year, $0.18/mile lower than in 2018, and $0.26/mile higher than in 2019.