Over the past two months, hundreds of wildfires have spread across Canada, resulting in mass evacuations and the destruction of millions of acres. From May to September, Canadian wildfires or forest fires are common in forested and grassland regions. According to locals in British Columbia, such widespread destruction this early in the season is rare. According to lumber experts Fastmarkets, “In the past seven weeks, blazes have swallowed more than 11.6 million acres of forest and prairie, nearly as large as the state of West Virginia. Quebec, Alberta, Saskatchewan, Nova Scotia, and Manitoba are all experiencing large fires”.

“Projections indicate the potential for continued higher-than-normal fire activity across most of the country throughout the 2023 wildland fire season,” according to Natural Resources Canada. For flatbed carriers concerned about the impact of wildfires on lumber volumes, Canada accounts for about 25 to 30% of total lumber consumption in the U.S., with British Columbia being a large lumber producer, as are Ontario and Quebec. DAT freight markets impacted the most are expected in Washington’s Seattle and Portland markets in the Pacific Northwest and New England states, including Maine and Vermont.

With the demand for lumber lower due to the housing construction industry’s slowdown, the longer-term implication on lumber supply from wildfires and reduced sawlogs could mean higher lumber prices and fewer truckloads when the housing industry picks up again.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

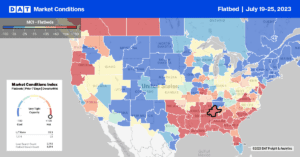

Flatbed capacity in the Southeast remained tight last week, with regional spot rates up $0.04/mile to $2.32/mile. Solid gains were reported in Jacksonville, where linehaul rates increased by $0.14/mile to $2.61/mile last week. At $2.66/mile, Savannah spot rates were $0.06/mile higher w/w. Lakeland to Atlnata loads paid carriers $1.28/mile, the highest since last September and $0.23/mile lower than the previous year.

Flatbed capacity tightened rapidly last week in Chicago and Joliet markets, with spot rates jumping by $0.26/mile to $2.78/mile. State-level flatbed rates in Illinois at $2.45/mile were flat last week and around $0.01/mile lower than in 2019. Further west, in Nebraska and Kansas flatbed markets, spot rates increased by $0.18/mile to a combined $1.98/mile, almost identical to 2019. In New England, outbound spot rates at $2.26/mile were up $0.20/mile w/w and $0.10/mile higher than in 2018. In Mississippi, flatbed capacity tightened last week following a $0.14/mile w/w increase to an average of $2.77/mile, just $0.03/mile lower than in 2018.

Load-to-Truck Ratio (LTR)

After a solid first quarter due to a warmer winter, flatbed spot market volumes have dropped 35% since the start of April. Load posts were 42% lower than in 2019 and 71% lower than the previous year. Carrier equipment posts were down 5% last week, resulting in last week’s flatbed load-to-truck (LTR) ratio decreasing from 9.31 to 9.01, the lowest since 2016.

Spot Rates

Flatbed linehaul rates were flat for the second week leaving the national average at just over $2.13/mile last week. Compared to the previous year, linehaul rates are $0.39/mile lower but $0.18/mile higher than in 2019 and $0.33/mile lower than in 2018.