The second quarter of 2022 was another excellent one for Daseke, Inc. (NASDAQ: DSKE), the largest flatbed and specialized transportation and logistics company in North America. As of June 30, Daseke’s fleet consists of 4,649 tractors (down 4.1% y/y) and 11,050 flatbed and specialized trailers (down 1.9% y/y) and has operations throughout the United States, Canada, and Mexico. The Texas-based carrier reported second-quarter revenue of $481.3 million, up 19.1% y/y. The adjusted operating ratio for the 2nd quarter was 89.6%, improving on the 88.0% operating ratio recorded in the same quarter last year.

According to Jonathan Sepko, Chief Executive Officer of Daseke, “Benefitting from continued strength in the industrial-facing freight markets we serve, we are pleased to report another solid quarter of financial results. We expect our continued strategic shift of allocating resources in support of end-market prioritization, as well as our ongoing transformational initiatives, to position Daseke to perform well across economic cycles.”

Daseke’s Flatbed Solutions segment benefitted from continued strength in demand across the construction, steel, and manufacturing industries, contributing to the strong rate environment. Despite a decrease in total miles year-over-year due to delays in the supply chain for new equipment, revenue increased 19.4% compared to the same quarter last year. Flat rates excluding fuel averaged $2.74/mile for the quarter, up 9.6% or $0.24/mile from the second-quarter average of $2.50/mile in 2021. In Daseke’s Specialized Solutions segment, a healthy freight rate environment, primarily in the high-security cargo, construction, and manufacturing end-markets, pushed linehaul rates up 15.1% y/y to $3.59/mile from $3.12/mile this time last year.

The company was also very upbeat about the second half of 2022 and raised its full-year consolidated 2022 revenue outlook to between 12% and 15% year-over-year. According to

Jason Bates, Chief Financial Officer of Daseke, “We continue to see strength in freight rates and have flexed our asset-light service offering to capture additional freight throughout the year. While the first half of 2022 has been plagued by equipment delays, we expect that a majority of the equipment will be delivered in the second half of the year and are therefore reaffirming our full-year 2022 net capital expenditures outlook of $145 to $155 million.”

All rates cited below exclude fuel surcharges unless otherwise noted.

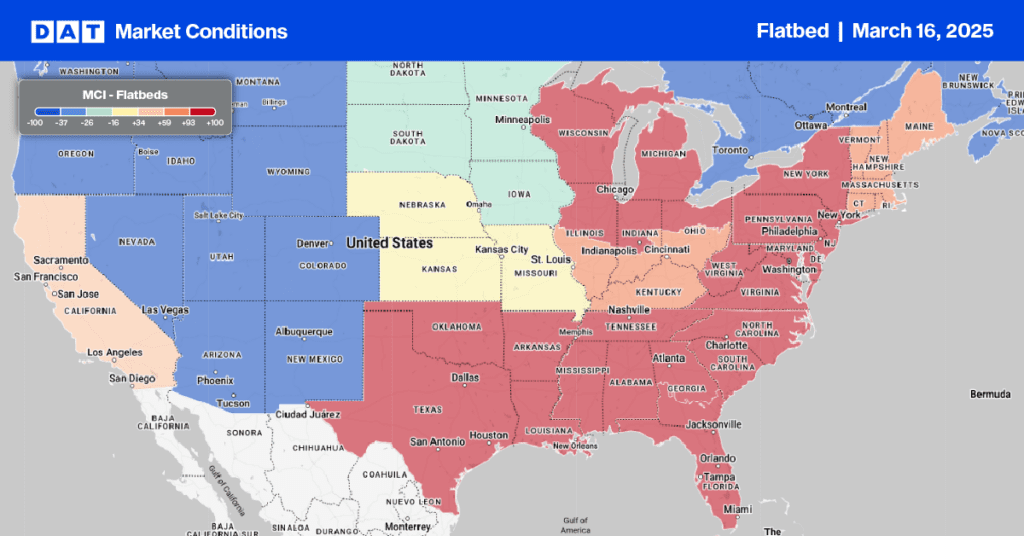

Flatbed capacity continues to loosen on the popular Los Angeles to Las Vegas lane, where spot rates reached a 12-month low of $3.65/mile – almost $0.60/mile lower than the previous year. At $2.35/mile, loads from Los Angeles to Salt Lake City are now $1.43/mile lower y/y, while loads to the same destination from San Diego are around $0.40/mile higher at $2.74/mile. In the Pacific Northwest, flatbed capacity is tighter, with spot rates for loads to Salt Lake City at $3.06/mile this week, just $0.06/mile short of the 12-month high set in March this year.

On the Portland to Stockton, CA, haul, spot rates are around $0.45/mile higher y/y at an average of $2.51/mile this week and $2.08/mile for loads to Los Angeles. After decreasing by around $0.20/mile since May, spot rates for loads from Houston to Ft. Worth increased by $0.04/mile last week to an average of $3.77/mile the previous week. Loads 350 miles east to New Orleans averaged $2.66/mile last week after decreasing by $0.42/mile since April this year. Loads east to Lakeland, FL, from New Orleans dropped to the second lowest level in 12 months at $3.00/mile, while loads from Lakeland to Atlanta were flat at $1.45/mile last week.

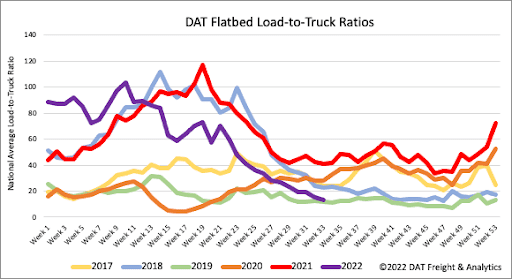

Flatbed load posts have dropped almost 40% in the last month following last week’s 7% w/w decrease. Volumes are now 51% lower than last year and 9% lower than the hot flatbed market in 2018. Carrier equipment posts remain at all-time high levels and 6% higher than the prior record-high in 2019. As a result, the flatbed load-to-truck (LTR) ratio decreased by 11% w/w to 13.35, which is very close to LTR levels in 2019.

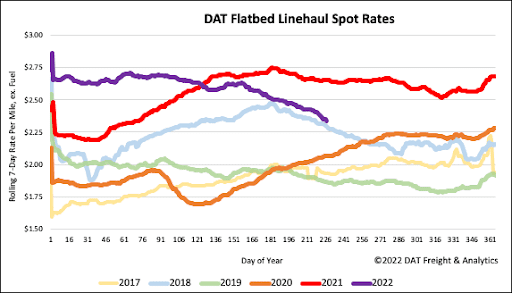

Flatbed linehaul rates continue to track seasonally, with 2018 levels following last week’s $0.04/mile decrease and are now just $0.04/mile above those levels. The national average flatbed rate excluding fuel dropped to $2.38/mile last week, which is $0.32/mile lower y/y and compared to prior non-pandemic years, is still $0.38/mile higher. Flatbed linehaul spot rates have dropped $0.29/mile YTD, with $0.28/mile of that occurring since the end of May.