By Christina Ellington

The U.S. Census Bureau residential construction statistics for May 2022 show that while homes under construction are up 24.5% y/y, single-family housing starts are down 4.3% y/y following last month’s 9.2% m/m decrease. Building permit applications followed a similar trend, dropping by 5.5% m/m and are now down by 7.6% y/y, reaching a new 5-month low in May. Single-family homes are more freight-intensive for flatbed truckload carriers, and while the building industry started 106,000 fewer homes in May compared to April, it’s still 5,000 more than in May 2020 as the pandemic took hold. The volume of new single-family homes completed in May also rose 2.8%, with 82,000 more homes finished compared to May 2020 (representing an 8.5% y/y increase.

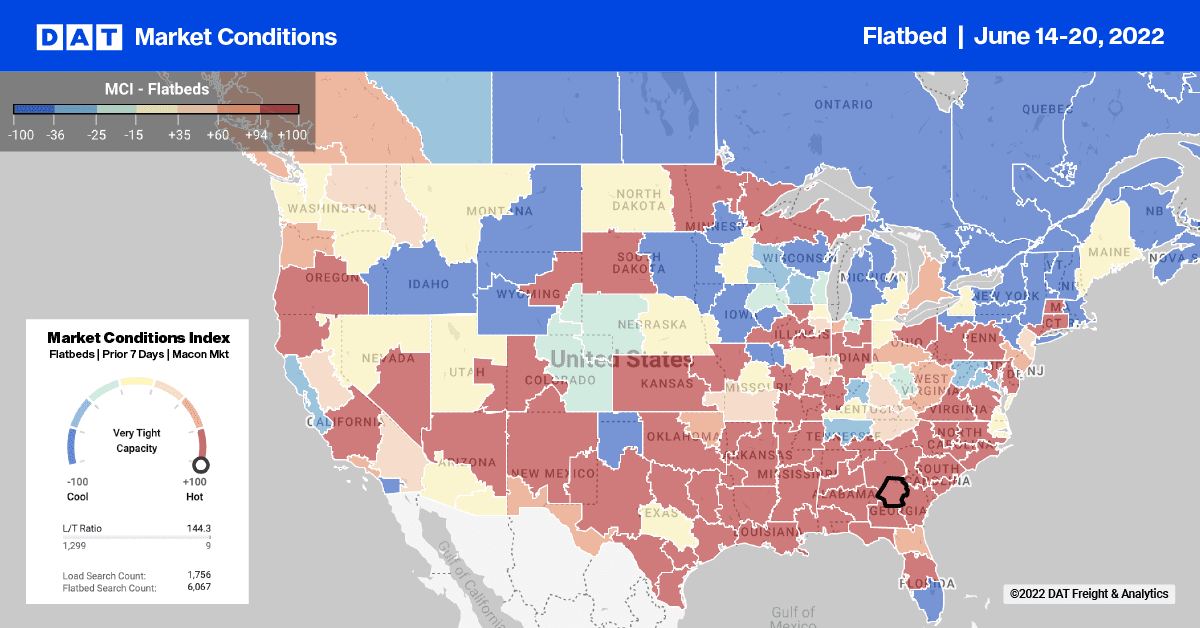

In the Southeast Region, where 57% of new single-family homes were started in May, volumes were flat year-over-year following last month’s 10% decrease. Volumes in the West Region, the second-largest, followed a similar trend dropping by 12% m/m and accounting for a third of May’s 106,000 decreases in new single-family home starts. Almost three-quarters of May’s lower volume of starts occurred in the Southeast Region. May’s poor result suggests the housing boom may be slowing, given that this economic sector is the most sensitive to rising interest rates, with building permits a leading indicator for the sector. According to Conrad DeQuadros, senior economic advisor at Brean Capital in New York, “Housing construction appears to be undergoing a transition, with the sector caught between sharply rising mortgage rates and declining affordability on the one hand and supply-chain constraints on the other that continue to result in rising backlogs of projects.”

All rates cited below exclude fuel surcharges unless otherwise noted.

Since imports in the Houston market have begun to increase as shippers look to divert imports away from congested West Coast ports, the volumes of flatbed freight moving have also increased. The busiest flatbed lane in the DAT network is Houston to Ft. Worth, where loads moved have jumped by 45% since the start of May. As a result, capacity has tightened, pushing up spot rates by 5% over the same time frame and at $3.85/mile this week are up by $0.46/mile YTD and $0.72/mile y/y. The second busiest lane is in the Southeast Region between Lakeland and Miami. Spot rates on this 270-mile haul are averaging $719/load or $128/load higher y/y and just over $50/load more than the May average, even though the volume of loads moved was flat last week.

In the Southwest Region, loads moved between Phoenix and Ontario last week are down by 13% following the annual peak in volumes, which typically occurs in March and April each year. That’s also consistent with steel production volumes being down 10% YTD. At $1.62/mile this week, flatbed linehaul rates on the Phoenix to Ontario 330-mile lane are $0.19/mile lower y/y. In the Pacific Northwest, linehaul rates from Medford to Stockton are averaging $4.15/mile this week or about $0.82/mile higher than the previous year. Loads further south to Los Angeles are averaging $2.83/mile this week, which is the same as the previous year.

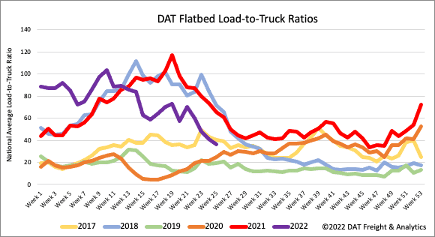

Flatbed load post volumes are just 11% lower than the same week in 2018, following last week’s 11% w/w decrease. Carrier equipment posts were flat w/w but were 6% higher than in 2019 when the market was oversupplied. As a result, the flatbed load-to-truck (LTR) ratio decreased 11% w/w to 36.49, which is 10% lower than in 2017.

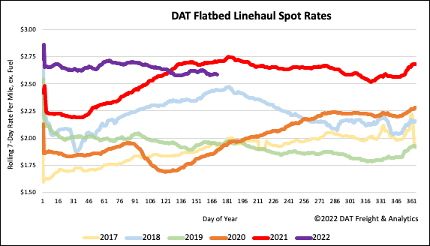

Flatbed linehaul rates remained close to the 13-month average following last week’s less than a penny per mile decrease to a national average spot rate of $2.62/mile. Flatbed spot rates are now $0.12/mile lower than the last year but still 6% or $0.14/mile higher than in 2018.