Associated Builders and Contractors (ABC) reported recently that its Construction Backlog Indicator fell to 8.3 months in May, according to a member survey conducted from May 20 to June 4. The reading is down 0.6 months from May 2023. The ABC monthly Construction Backlog Indicator is a forward-looking national economic indicator that reflects the amount of work already under contract but has yet to be performed by commercial, industrial, and heavy highway/ infrastructure contractors.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

ABC’s economic dataset is a natural leading indicator incorporating more than a decade of responses from contractors throughout the United States. It is the only leading indicator that offers such an acute specificity regarding the future activity level among construction firms for flatbed carriers.

According to ABC Chief Economist Anirban Basu, “Although backlog has been lower in 2024 than in 2023, it has also been stable. While significant spending activity in manufacturing and infrastructure-related segments has kept contractors busy, input cost escalation has reemerged in recent months. As a result, contractor confidence regarding profit margins has fallen to the lowest level since November 2023.”

Market watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

The Fort McHenry Federal Channel has been restored by the U.S. Army Corps of Engineers and U.S. Navy Supervisor of Salvage and Diving. The channel is now 700 feet wide and 50 feet deep, allowing commercial maritime traffic through the Port of Baltimore. Rebuilding the span is estimated to take over four years and cost up to $1.9 billion, according to Maryland state authorities. After removing around 50,000 tons of bridge wreckage from the Patapsco River and reopening the port, outbound flatbed volumes have not fully recovered and are currently 35% lower than last year.

The rates for flatbed loads from Baltimore to Gary, IN, have settled at $1.80/mile, which is $0.40/mile lower than last year. Loads to Pittsburgh paid carriers an average of $847/load, around $15/load lower than last year. Loads to the farm machinery manufacturing center in Davenport, IA, are at their lowest since last October, averaging $1.66/mile last week.

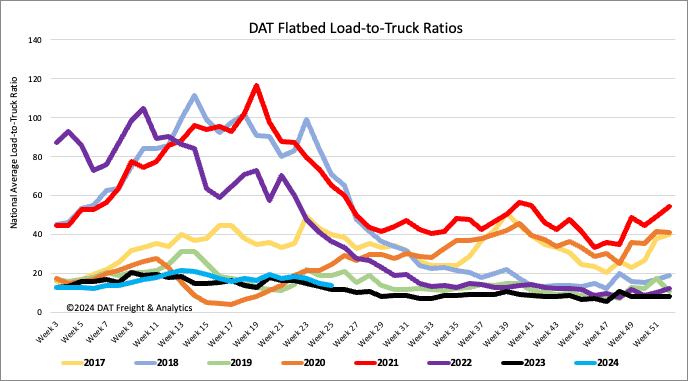

Load-to-Truck Ratio

Flatbed load post volumes follow seasonal patterns, declining by 13% and 12% y/y last week. Carrier equipment posts were 4% w/w and 24% y/y lower, decreasing last week’s flatbed load-to-truck ratio by 10% to 13.75, the second lowest since 2016 for Week 25.

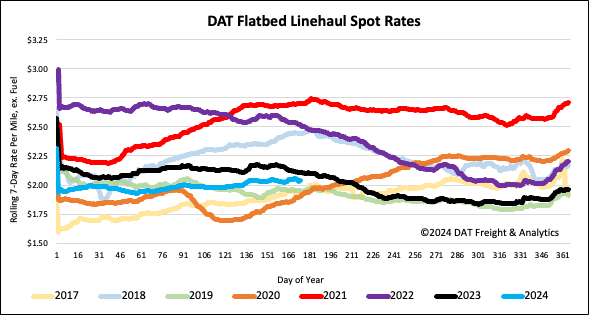

Spot rates

The national average flatbed rate dropped by $0.02/mile last week, the largest week-over-week decrease since the start of February. At $2.06/mile, flatbed spot rates are $0.07/mile lower than last year despite an 8% higher volume of loads moved in Week 25 last year.