There was some positive news for flatbed demand from the American Iron and Steel Institute (AISI) last week – raw steel production increased by 0.2% w/w and was up 3.8% compared to the same period in 2022. That news fell somewhat flat compared to prior years, including 2018, when flatbed demand came off a robust first-half bull market. Compared to October volumes in 2018, this year’s raw steel production numbers are 7.3% lower and 4.9% lower than in 2019, a poor year for flatbed carriers characterized by soft demand and an oversupply of trucks.

In other news, the U.S. Census Bureau reported construction spending during September 2023 is estimated at a seasonally adjusted annual rate of $1,996.5 billion, 0.4% higher than August’s estimate of $1,988.3 billion. The September figure is 8.7% above the September 2022 estimate of $1,836.9 billion. During the first nine months of this year, construction spending amounted to $1,463.5 billion, 4.6% above the $1,398.9 billion for the same period in 2022. Residential construction spending was understandably down 2.1% y/y, while highway and street construction, representing around 12% of total monthly spending in September, was up 10.4% y/y.

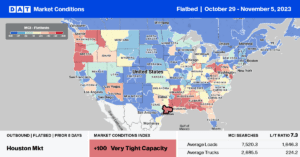

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

At $1.88/mile, outbound spot rates in Texas were $0.01/mile higher last week and identical to this time in 2018. Houston is the nation’s number one flatbed market; outbound rates averaged $2.02/mile, around $0.45/mile lower than last year. Houston to El Paso loads paid carriers $2.22/mile last week, down $0.03/mile w/w/, but $0.64/mile lower than last year. The volume of loads moved was also 45% lower than in 2022.

Available flatbed capacity tightened in Indiana last week, where spot rates jumped by $0.13/mile to $2.40/mile. In neighboring Illinois, spot rates increased by $0.03/mile to $2.33/mile, with similar weekly gains reported in Pennsylvania, where outbound loads paid carriers $2.19/mile. In Georgia, flatbed rates were $0.16/mile higher than in 2019, averaging $2.15/mile last week.

Load-to-Truck Ratio (LTR)

The volume of flatbed load posts (LP) has been relatively flat since July 4, with almost no change in volume last week. LP volumes remained around half what they were a year ago and 41% lower than in 2018. Carrier equipment posts (EP) decreased 10% w/w, resulting in last week’s reefer load-to-truck ratio (LTR) increasing by 11% to 6.65, the lowest LTR in seven years.

Spot Rates

Flatbed linehaul rates in October ended where they started at around $1.89/mile following last week’s $0.02/mile increase. At $1.89/mile, flatbed linehaul rates are $0.19/mile lower than last year and $0.04/mile higher than in 2019. Compared to the pre-pandemic average for Week 44, last week’s national average was $0.07/mile lower and $0.33/mile lower than in 2018.