For flatbed and specialized carriers, construction spending reveals how much the government and private companies spend on projects, from housing to highways. The more the U.S. spends on construction, the higher the level of economic activity. According to the Commerce Department, spending on construction projects increased 0.5% in August to $1.98 trillion, falling short of market expectations of a 0.6% increase. Over the past year, construction spending is up 7.4%.

In terms of residential real estate, private residential construction increased by 0.6% to $879 billion in August compared to the prior month. Single-family construction rose 1.7% in August, totaling $396 billion, while multifamily rose 0.6% to $135 billion.

Public construction spending was $431.6 billion, up 0.6% from July and 14.1% compared to the same period in 2022. Public non-residential construction comprised 98% of the monthly total and was 14.4% higher than last year. Highway construction was at a seasonally adjusted annual rate of $130.4 billion, increasing by 0.4% m/m (month-over-month) and 12.9% year-over-year.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

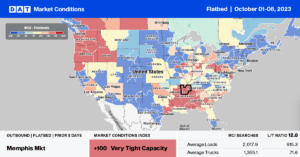

Flatbed capacity tightened in Gary, IN, the nation’s largest flatbed market for steel production. Load post volume increased 16% last week, with spot rates up $0.01/mile to $2.30/mile, reversing a three-week decline. In the largest spot market in Houston, outbound rates dropped $0.03/mile to $1.97/mile, impacted by declining energy exploration activity. According to Baker Hughes, the number of oil and natural gas rigs operating declined for a third week and are now 143 drilling rigs, or 19% lower than last year. On the Houston to Lubbock lane serving the Permian Basin oilfield, flatbed rates were the lowest in a year last week, paying carriers $2.24/mile.

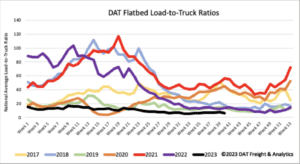

Load-to-Truck Ratio (LTR)

Flatbed load post (LP) volume erased the prior week’s gains, falling by 11% last week. Carrier equipment posts increased by 7% w/w, resulting in last week’s flatbed load-to-truck ratio (LTR) decreasing by 16% to 6.6.

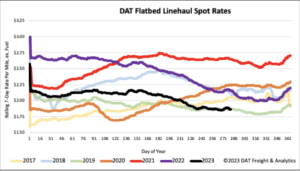

Spot Rates

After being primarily flat for the last two months, flatbed linehaul rates dropped below the short-term average, decreasing by just over $0.03/mile last week. The flatbed national average of $1.88/mile is $0.30/mile lower than last year and almost identical to 2019.