According to Fastmarkets 2023 Outlook, “widespread economic turmoil, including interest rates that soared to the highest levels in more than a decade, overshadowed the fact that 2022 was a banner year in the U.S. softwood lumber industry by historical standards. Fastmarkets’ latest projections indicate U.S. housing starts will drop 12.8% from last year due to eroding consumer confidence and higher mortgage rates undermining demand for single-family housing, especially in the first half of 2023.”

There may be good news on the horizon, though, as mortgage rates and home prices ease, providing a slight boost to consumer confidence to start the year. According to Fannie Mae, the Home Purchase Sentiment Index (HPSI) increased by 3.7 points in December to 61.0, and the index remains slightly above its all-time low set in October. “Only 21% of survey respondents believe it’s a good time to buy, likely owing to the ongoing affordability challenges posed by elevated mortgage rates and home prices. Year over year, the total index is down 13.2 points”, according to Fannie Mae.

“In December, the HPSI inched upward slightly, as consumers reported increased expectations that mortgage rates and home prices may decrease over the next year – perhaps reflecting recently observed declines in mortgage rates and average home prices,” said Doug Duncan, Fannie Mae Senior Vice President, and Chief Economist. “However, the HPSI remains very low by historical standards, particularly the ‘good time to buy’ component. Respondents cite high home prices and unfavorable mortgage rates as the primary reasons for their pessimism.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

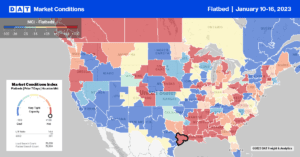

Flatbed capacity was tight in Illinois last week as the state average outbound rates jumped by $0.27/mile to $2.99/mile, exactly where rates were in 2018. In the combined Bloomington and Joliet markets, spot rates increased by $0.08/mile to $3.20/mile, with regional loads from Joliet to Eau Claire, WI, jumping to $3.78/mile, which is $0.53/mile higher than in December.

The Top 10 flatbed markets, which accounted for 30% of national volume last week, all reported an increase in volume, with Houston remaining the number one flatbed market by a long way. Volumes in Houston were up 36% w/w, but with sufficient capacity to meet demand, spot rates dropped for the third week to $2.33/mile for all outbound loads. The opposite was the case further north in Dallas and Ft. Worth markets, where rates increased by $0.11/mile to an average outbound rate of $2.12/mile. Loads from Dallas to Houston were paying $521/load, which was almost $100/load more than in December to compensate for decreasing rates in the opposite direction.

Load-to-Truck Ratio (LTR)

Even though flatbed load posts increased 21% w/w, they remain 73% lower than this time the previous year, the weakest in seven years, and just under 50% lower than the average week-two volume over the prior six years. Flatbed carrier equipment posts remained at their highest level in seven years and even 41% higher than in 2019, resulting in last week’s load-to-truck (LTR) ratio decreasing from 15.36 to 12.69.

Spot Rates

Flatbed national average linehaul rates at $2.14/mile begin the year at $0.60/mile lower y/y and $0.04/mile higher than this time in 2018, an excellent year for flatbed carriers by all accounts. The national average flatbed rate decreased by $0.02/mile last week and is now $0.22/mile higher than in pre-pandemic years for Week 2 of the shipping year.