The third quarter of 2022 was another excellent one for Daseke, Inc. (NASDAQ: DSKE), the largest flatbed and specialized transportation and logistics company in North America. As of September 30, Daseke’s fleet consists of 4,649 tractors (up 3.1% y/y) and 11,028 flatbed and specialized trailers (down 2.1% y/y) and has operations throughout the United States, Canada, and Mexico. The Texas-based carrier reported second-quarter revenue of $462.8 million, up 8.2% y/y. The adjusted operating ratio for the 3rd quarter was 90.8%, improving on the 88.7% operating ratio recorded in the same quarter last year.

According to Jonathan Sepko, Chief Executive Officer of Daseke, “With no other publicly traded peer quite like Daseke, our differentiated model, focused on diversified, industrial end markets, as well as our continuing transformational initiatives, uniquely positions Daseke for what should be another solid year in 2023, despite macro ambiguity.”

Daseke’s Specialized Solutions continued to benefit from the strength within high-security cargo, aerospace, and agriculture, which drove a 10.8% y/y revenue improvement and offset lower wind energy volumes. This strength in the freight environment supported margins, despite inflationary cost pressures. The average rate per mile in the third quarter was up 7.3% y/y to an average of $3.66/mile.

In the Flatbed Solutions business unit, improvements in construction and manufacturing more than offset a decrease in steel volumes. Despite softening in the overall freight market, the flatbed segment continued to capture rates at a premium to the market, contributing to a revenue increase of 5.8% compared to the same quarter last year. The average flatbed rate per mile in the third quarter was up 1.2% y/y to an average of $2.60/mile.

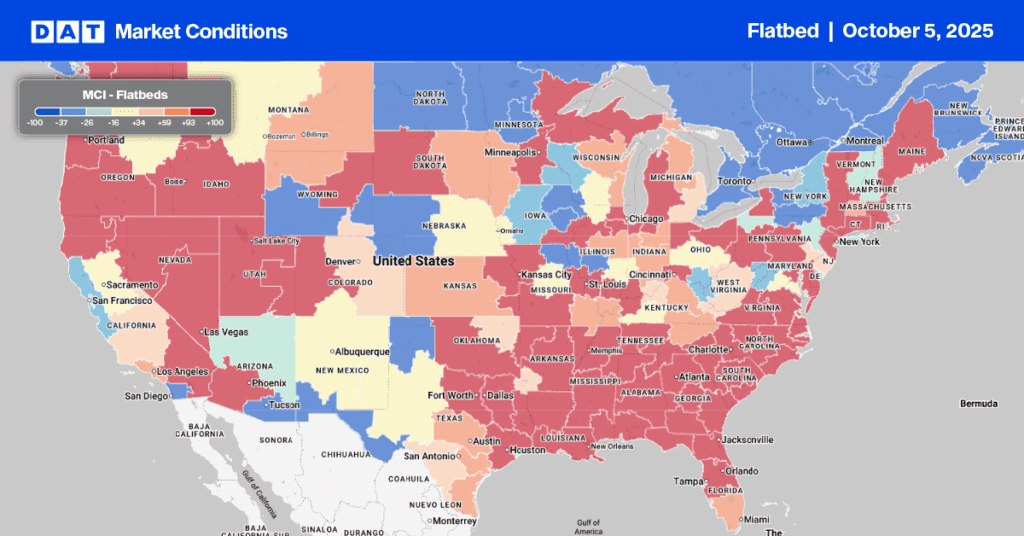

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

New York state flatbed capacity was tight last week following a $0.16/mile w/w increase to $2.88/mile. In the state’s largest flatbed spot market in Albany, linehaul rates increased by $0.44/mile to $2.63/mile, with loads south to Baltimore flat at $2.72/mile or almost $1.00/mile lower than the previous year. In neighboring Connecticut, capacity was also tight following last week’s $0.25/mile increase to $1.82/mile, the second-lowest December rate in seven years.

Flatbed rates in Texas turned the corner last week, increasing by $0.02/mile to $2.15/mile after being flat for the previous few weeks. At that rate, flatbed carriers are seeing the second-highest December outbound rate in seven years. In the largest market in the state, spot rates in Houston increased by a penny-per-mile to $2.26/mile. In contrast, on the high-volume lane north to Ft. Worth, loads moved decreased by 1% w/w, with linehaul rates continuing their downward trend. At $2.40/mile, rates on this lane are $0.80/mile lower than the previous year and $1.55/mile lower than May’s peak of $3.95/mile. Lower breakbulk import tonnage in Houston, which peaked in May this year, contributed to the decline in outbound spot rates. Since then, import volumes have dropped 25% following November’s 11% m/m decrease.

Load-to-Truck Ratio (LTR)

Flatbed load posts dropped back by 18% last week to volumes observed throughout November, although they’re still 75% lower y/y. Like dry van and reefer equipment types, flatbed carrier equipment posts remained at their highest level in six years, 31% higher than in 2019 and 40% higher than last year. As a result, last week’s load-to-truck (LTR) ratio decreased from 11.15 to 7.83, the lowest LTR level for flatbeds in the past six years.

Spot Rates

Flatbed linehaul rates dropped close to November’s monthly average following last week’s $0.02/mile decrease to a national average of $2.04/mile. Compared to the previous year, last week’s average spot rate is 21% or $0.55/mile lower, identical to this time in 2017 and 2018 but still $0.19/mile higher than the oversupplied 2019 flatbed market.