U.S. single-family homebuilding hit a 10-month high in December, signaling improved housing activity. However, rising mortgage rates and an oversupply of new properties may limit recovery. According to the Commerce Department, permits for future single-family home construction rose 1.6% month-over-month, reaching the highest level since February.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Single-family housing starts increased by 3.3% to an annual rate of 1.050 million units, also the highest since February 2024. Notable increases included 14.3% in the Northeast, 8.3% in the Midwest, and 7.1% in the West, while the South saw no change. Year-over-year, single-family starts fell by 2.6% in December.

Market watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

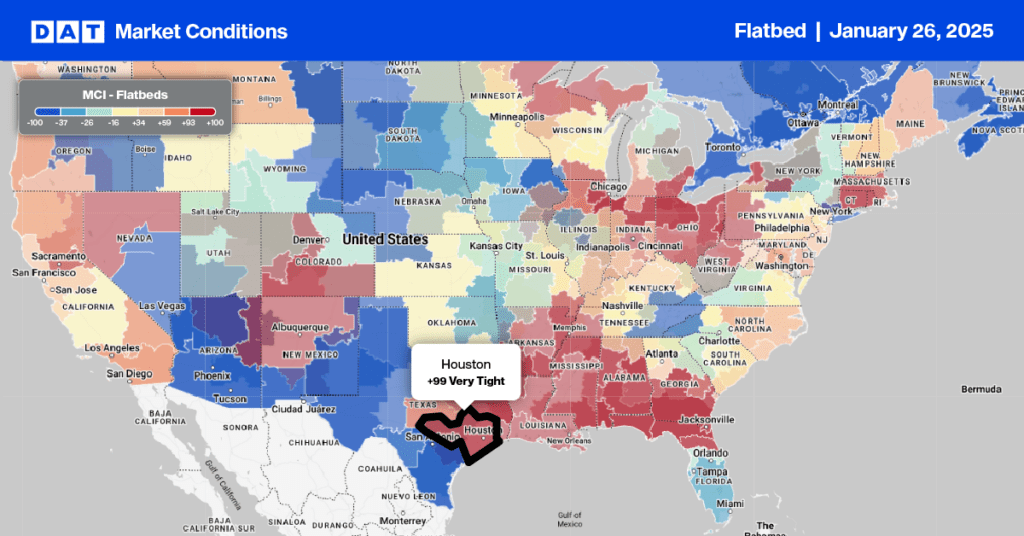

This week, we focus on the Houston freight market, where DATs Market Condition Index (MCI) expects outbound flatbed capacity to remain tight into next week. Houston experienced up to four inches of snow, marking the highest snowfall in the area since 1960. Temperatures dropped to unprecedented lows, with some areas recording temperatures in the teens (°F). The heavy snowfall and icy conditions led to hazardous travel, resulting in road closures and dangerous driving conditions, disrupting supply chains and causing delays in freight deliveries.

Houston is the energy capital of the world, home to many oil and gas companies, refineries, and industrial plants. Flatbed trucks are essential for transporting drilling equipment, pipes, machinery, and other energy-related freight. Houston is also the number one for flatbed spot market freight movement, including high-volume lanes to Lubbock in the Permian Basin oilfield and El Paso on the southern border.

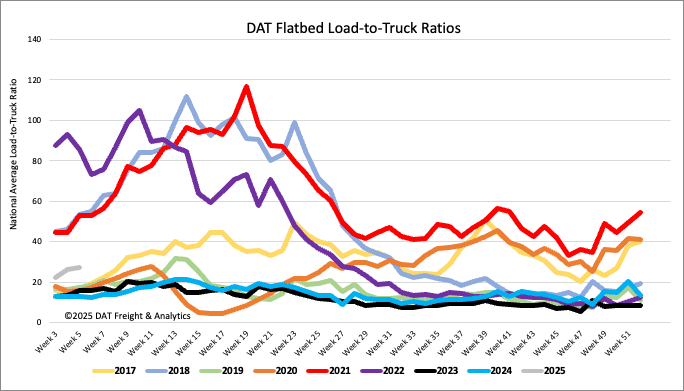

Load-to-Truck Ratio

The record-cold temperatures and snowfall in the South last week resulted in some regional markets grinding to a halt. This along with cold weather in other larger markets including Illinois, Indiana, and Ohio recording a 17% lower volume last week. Fewer load and equipment posts were the net result, with the flatbed load-to-truck ratio (LTR) ending the week at 21.43.

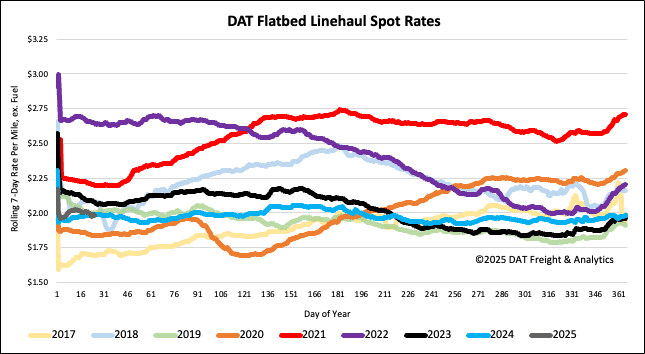

Spot rates

The 7-day rolling flatbed rate has averaged $2.00/mile for the last two years, and that’s exactly where flatbed spot rates ended last week. At $2.00/mile, linehaul rates were down $0.02/mile and remain almost identical to where they were in 2019.