The housing industry is one of the first to react to the continual Federal Reserve interest rate hikes. The low-interest mortgage rates of the past years have fueled an imbalance in the demand and supply of the housing market. House prices have risen 17.5% y/y in March 2022. The lumber industry has been the first to experience the effects of the high demand and softening of the housing market.

Lumber commodity prices hit the 2nd all-time high in February at $1,216 per thousand board/feet and now have been nearly cut in half and are showing prices at $640.

“Inflation pressures have led to rising interest rates and a slowing of housing starts, and lumber buyers have…started to slow their orders,” says Scott Reaves, director of forest operations at Domain Timber Advisors. Lumber prices have fallen from the “extreme levels seen throughout the pandemic,” but they remain significantly higher than levels seen before the pandemic, says Reaves. While the reality is that while single-family housing demand is slowing, there is still a “tremendous amount of business in the pipeline, and many builders have [three to five] months of solid backlog as they attempt to finish projects that are already in play,” said Steve Loebner, director of risk management at Sherwood Lumber. So, “we are faced with a market that is gradually slowing overall, but by no means falling off a cliff,” says Loebner.

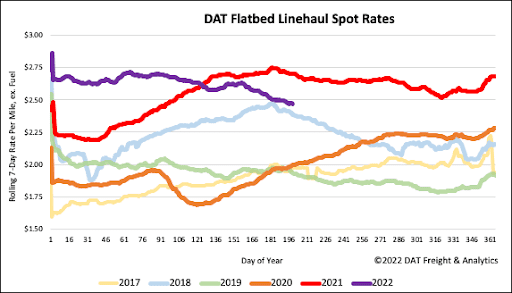

Transportation issues have also lessened for the lumber industry, according to Michael Wisnefski, CEO of MaterialsXchange. “Transportation has loosened up; the product is moving. Lumber never really had a production issue. Where they did have an issue was moving the product from the production facility to the market.” Evidence of this can also be found in the flatbed market, where spot linehaul rates have declined by $0.21 per mile since the beginning of 2022.

All rates cited below exclude fuel surcharges unless otherwise noted.

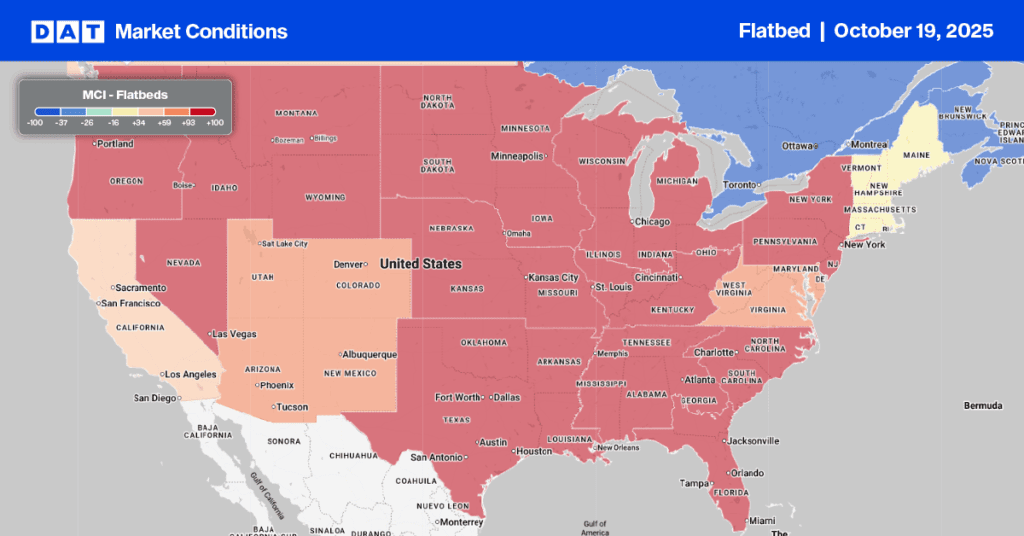

Flatbed capacity tightened in Seattle last week following a surge in load post volumes, which increased by 35% w/w. Outbound spot rates were also up, rising by $0.12/mile to an average of $2.48/mile. Loads to Reno, 750 miles to the south, were up slightly to an average of $2.32/mile and, despite dropping for the prior four months, are now $0.06/mile higher than the previous year.

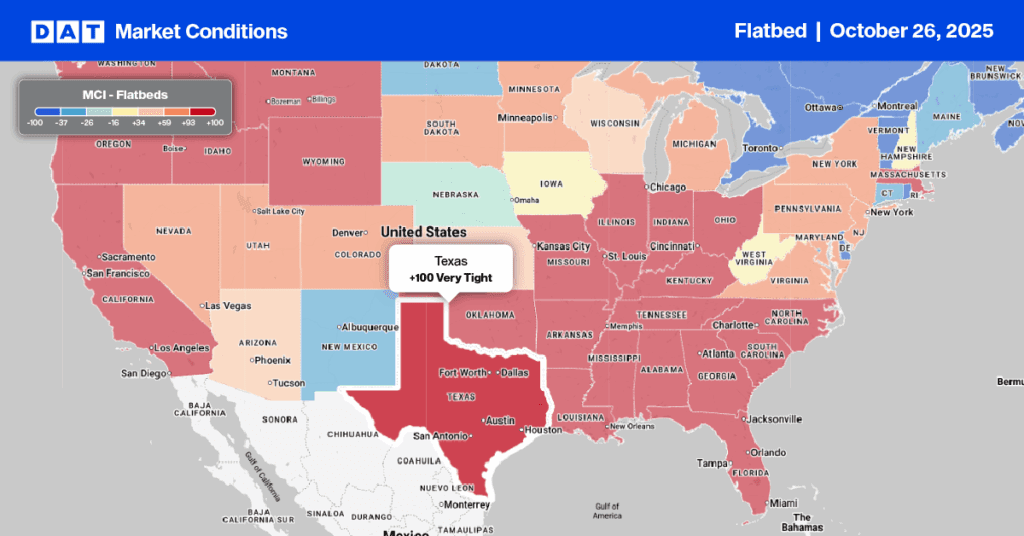

Following the 12% m/m increase in June, Houston import volumes are now up 20% y/y pushing more loads into the flatbed spot market, which was up 32% last week. After tightening the prior week rapidly, capacity eased the previous week following a $0.14/mile decrease to an average of $2.87/mile. On the short-haul lane north to Ft. Worth, spot rates dropped by $0.32/mile below the June average to $3.58/mile last week. That’s still $0.28/mile higher than the previous year on DAT’s number one flatbed lane in the spot market. In the manufacturing center of Massachusetts in Springfield, capacity was tight last week following a 62% surge in load posts resulting in outbound spot rates jumping by 34% to an average of $2.68/mile.

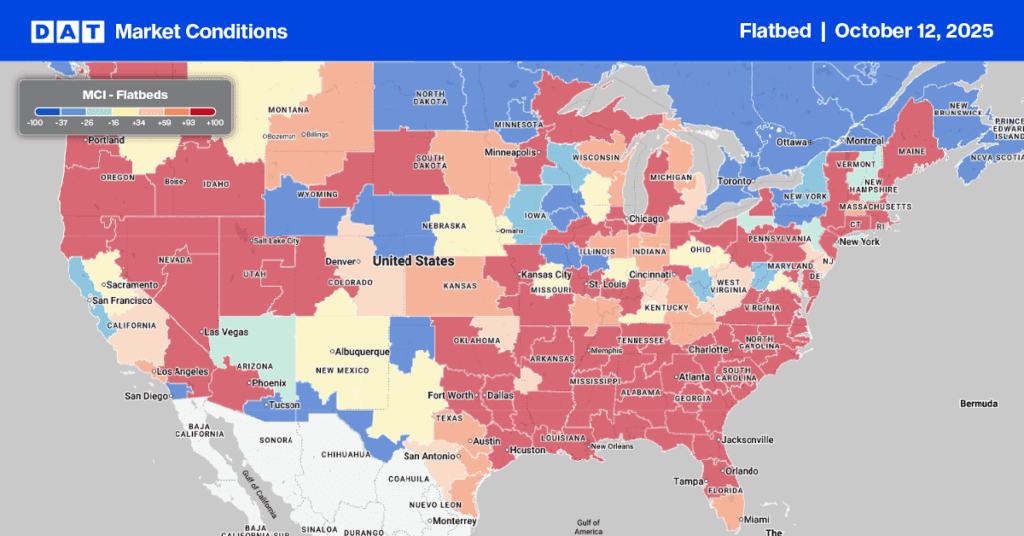

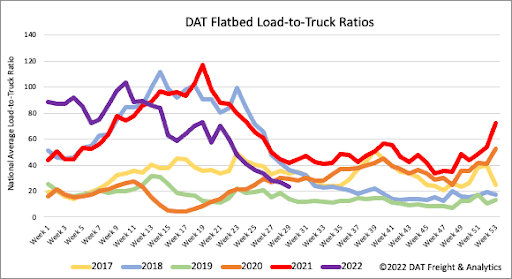

Flatbed load posts (LP) are almost identical to mid-July 2018, following last week’s 12% w/w increase. Like dry van and reefer, the flatbed spot market is seeing capacity loosened rapidly after the previous week’s 29% w/w increase in carriers posting their equipment for loads. While equipment post levels are also at record highs for this time of the year, they are less than one percent below the highest ever recorded level in late 2019. As a result of much higher equipment posts last week, the flatbed load-to-truck (LTR) ratio decreased to 23.27.

As the heat goes out of the flatbed spot market, linehaul rates are now down for seven weeks in succession following last week’s $0.02/mile decrease. Spot rates have dropped $0.09/mile in the previous month and $0.18/mile since the start of the year but remain $0.08/mile higher than in 2018. Compared to prior non-pandemic years, flatbed linehaul rates are $0.45/mile higher.