The “shortage of everything” economy continues and one of the more unusual stories to emerge from the pandemic is the ongoing shortage of garage doors. Builders have been experiencing problems starting with the well-documented run on lumber early last year, followed by a lack of bricklayers and subcontractors, leading to a long backorder for electrical appliances tied up in the record-high port congestion on the West Coast.

If that wasn’t enough, the conversion of available space such as the garage into a remote office or home gym or even extra living quarters for multi-family homes has sent demand for garage doors through the roof. According to Rick Palacios Jr., the director of research at John Burns Real Estate Consulting, “Garage doors are a nightmare, and if you had to rank the headaches homebuilders face, garage doors are the worst right now.”

Adrian Foley, the president and C.E.O. of the Brookfield Properties development group, which develops thousands of single-family homes annually in North America, said, “It used to take us 20 weeks to build a house, and now it takes us 20 weeks to get a set of garage doors.” For flatbed carriers, more market volatility can be expected as supply chain disruptions continue to upset normal freight shipping patterns, but then that’s what we’ve been dealing with for the last 18-months anyway.

Available capacity and demand were flat last week for loads between Los Angeles and Phoenix as spot rates stayed around $3.92/mile excl. FSC and loads moved remained at the same level as the week prior. In the overall Los Angeles flatbed market, spot rates were relatively flat as spot rates stayed around an average of $2.71/mile excl. FSC to all destinations. Further south in the smaller San Diego flatbed market, capacity was very tight as spot rates jumped by $0.32/mile to an average of $2.69/mile excl. FSC last week. On the 1,500-mile haul east to Houston, rates jumped by $0.90/mile to $2.63/mile excl. FSC last week while capacity loosened for loads north to Salt Lake City, dropping by around $0.30/mile to an average of $2.71/mile excl. FSC.

Flatbed capacity continues to tighten in Houston as spot rates increased again last week, increasing by $0.04/mile to $2.98/mile. FSC last week. Even though loads moved decreased by 2% w/w on the busiest lane north out of Houston to Ft. Worth, capacity tightened, pushing up spot rates to a new 12-month high of $3.81/mile excel. FSC. That’s just over $1.00/mile higher than the previous year. A similar story continues just east in New Orleans, where spot rates increased by $0.09/mile last week to $3.17/mile excl. FSC for all outbound loads. Loads 500-miles west to Dallas increased by $0.12/mile to $2.76/mile excl. FSC is now around $0.30/mile higher than the previous year.

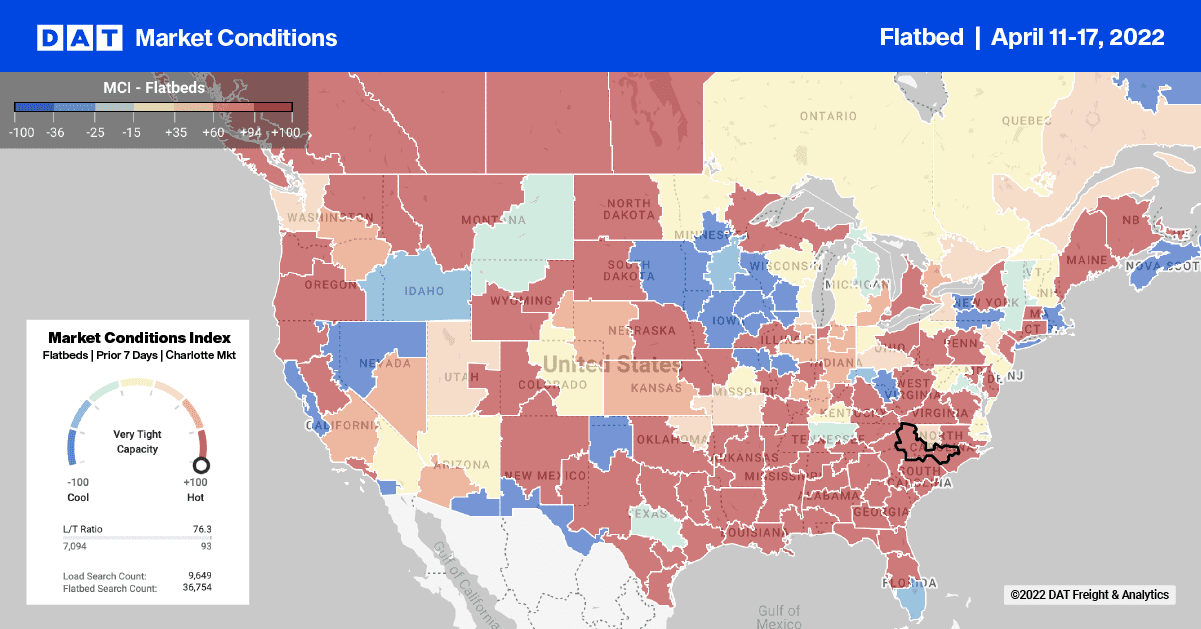

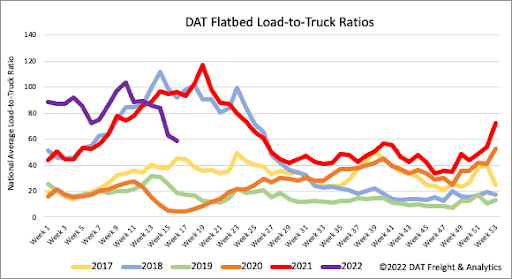

Flatbed load post volumes dropped 6% last week and are now down 26% in the previous four weeks and 20% compared with the year earlier. There was very little change in carrier equipment posts the last week, resulting in the flatbed load-to-truck ratio decreasing from 62.98 to 58.73. That’s now 39% lower than this time in 2021 and 39% lower than the booming flatbed market in 2018.

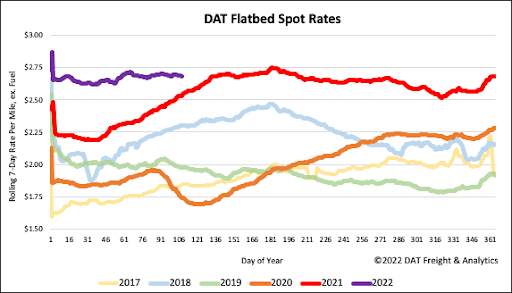

For the last two months, flatbed spot rates have averaged around $2.70/mile excl. FSC is precisely where they ended last week following a $0.02/mile w/w decrease. Spot rates are still 6% or $0.15/mile higher than the previous year, and compared to the 2018 bull market; flatbed spot rates are now 17% or $0.38/mile higher than the same week that year.