For flatbed carriers looking to demand indicators through year-end and into 2023, the recent Association of Equipment Manufacturers (AEM) October report and fourth-quarter results for Deere & Company (DE (NYSE) are important indicators to evaluate. According to the AEM, construction and agriculture equipment manufacturers face supply chain disruption for input components. However, a resolution of those disruptions is expected towards the end of 2023. Total farm equipment sales in October decreased by 10% y/y to 26,695 units, driven primarily by two-wheel-drive (2WD) sales, the largest farm tractor segment (97% of total tractor sales), which dropped 11.2% y/y. Sales of drop-deck trailer-specific 4WD tractors increased by 9.4% y/y, while combine harvesters surged in October, rising by 77.4% y/y. Total sales continue to track around 7% higher than the 5-year average.

During a recent earnings call, the leading agriculture and construction equipment manufacturer, John Deere, reported a solid end to their 2022 financial year. For the fourth quarter that ended October 30, net sales increased by 40% despite continued supply-chain constraints. The report notes favorable industry fundamentals and strong demand for farm and construction equipment bolster the market environment. According to John C. May, chairman, and chief executive officer, “Deere is looking forward to another strong year in 2023 based on positive farm fundamentals and fleet dynamics as well as increased investment in infrastructure. These factors are expected to support healthy demand for our equipment. John Deere forecasts a 5-10% y/y increase in large agriculture and turf equipment in 2023 but flat to down 5% y/y in the smaller category. For construction and forestry equipment, volumes are forecast to be flat to up 5% y/y.

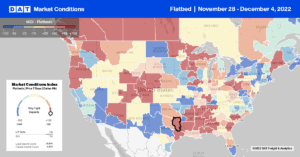

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

In Oregon, the number one state for Christmas Trees, flatbed capacity tightened last week following a $0.55/mile spike in linehaul rates, which averaged $2.60/mile the previous week. Load posts jumped 57% w/w in Portland, driving up outbound spot rates by $0.26/mile to $2.59/mile. Loads south to Los Angeles were paying $2.13/mile, up by $0.10/mile w/w, while loads to Stockton increased $0.08/mile to $2.34/mile last week.

Flatbed capacity was very tight in Reno, NV, following last week’s 120% w/w increase in load posts and $0.51/mile gain in spot rates. Overall market rates for outbound loads averaged $1.77/mile while loads 3,000 miles east to Miami increased by $0.30/mile to $1.42/mile. Short haul loads to nearby Stockton increased by $120/load last week to an average of $824/load, which is almost $75/load higher than the previous year. In DATs largest spot market, loads posts jumped, increasing by 50% w/w in Houston, while capacity loosened with rates dropping by $0.15/mile to $2.25/mile after rising for the prior three weeks. At a state level, outbound linehaul rates in Texas were up by $0.02/mile last week to $2.16/mile, which is $0.22/mile lower than the previous year but the second highest December rate in the past six.

Load-to-Truck Ratio (LTR)

Flatbed load posts more than doubled last week and unexpectedly were at the highest monthly levels. Volumes are still 69% lower y/y and around 6% higher than the oversupplied 2019 market. Carrier equipment posts remained at their highest level in six years, 5% higher than in 2019 and 42% higher than last year. As a result, last week’s load-to-truck (LTR) ratio increased by 110% from 2.14 to 4.49, which is 11% above 2019 LTR levels.

Spot Rates

Flatbed linehaul rates increased for the second week following last week’s $0.02/mile gain to a national average of $2.07/mile. Flatbed spot rates have dropped by $0.61/mile year-to-date, but almost all of that has occurred since June 1. Compared to the previous year, last week’s average spot rate is 21% or $0.53/mile lower, identical to this time in 2017 but still $0.17/mile higher than the oversupplied 2019 flatbed market.