According to the latest release from the U.S. Census Bureau, U.S. homebuilding rebounded in February after weather and omicron-related worker absences dampened activity in January. Total housing starts jumped 6.8% m/m while the flatbed-intensive single-family housing sector 5.7% sequentially or an additional 146,000 new homes compared to the previous year. Building permit applications, a reliable indicator of future flatbed demand, decreased by 0.49% m/m but remained 13.7% higher y/y.

Single-family housing starts, which account for the most significant share of homebuilding, increased in the Northeast (up 65% m/m), Midwest (up 6%), and Southeast (up 5%), but decreased by 3% m/m in the West. The gains in the Southeast are significant, considering 57% of new home construction occurred in this region in February. New single-family home starts are now up 18.4% y/y or an additional 107,000 units compared to the previous year.

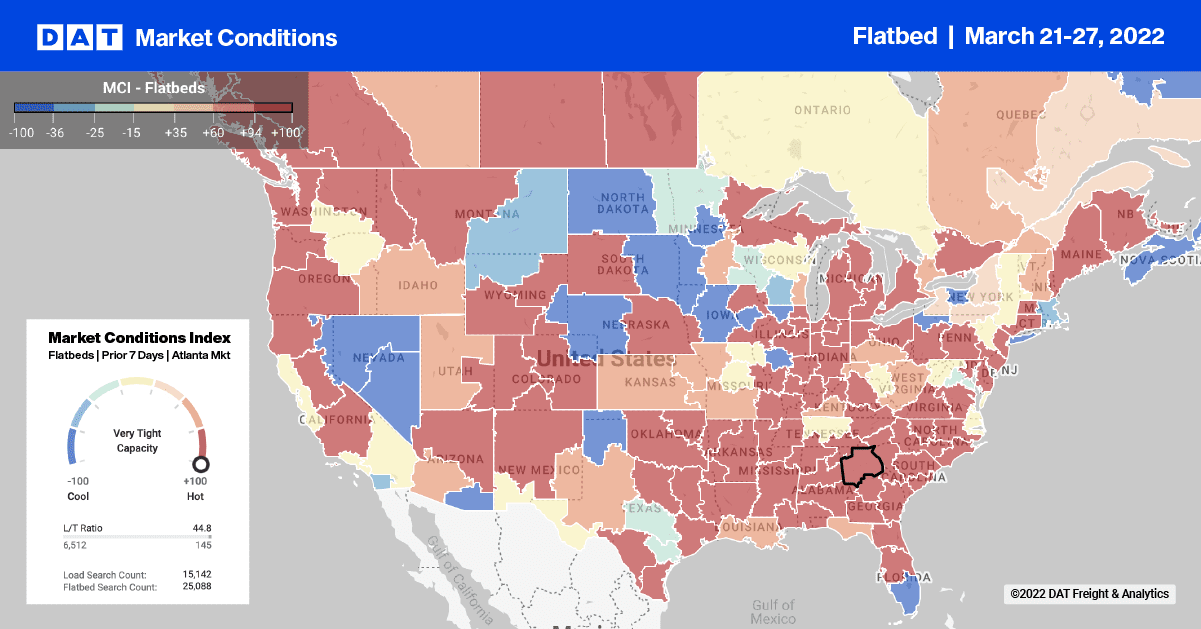

Flatbed spot rates in the Southeast Region have increased by $0.14/mile to an average outbound rate of $3.31/mile excl. FSC in the last week as home construction ramps up. Flatbed capacity is very tight in the Montgomery, AL, market, where rates jumped from $0.47/mile the previous week to $3.68/mile excl. FSC. Loads north to Green Bay averaged $2.51/mile excl. FSC last week was $0.03/mile higher than the February average and $0.12/mile higher than the previous year.

In DAT’s largest flatbed market in Houston, rates increased by $0.02/mile to an average of $2.81/mile excl. FSC while rates dropped on the number one lane north to Ft. Worth where rates average $3.15/mile excl. FSC last week, which is still $0.71/mile higher than the same week the previous year. In Gary, IN, the largest steel-producing state in the U.S., flatbed capacity eased as spot rates dropped by $0.20/mile to an average of $3.60/mile excl. FSC.

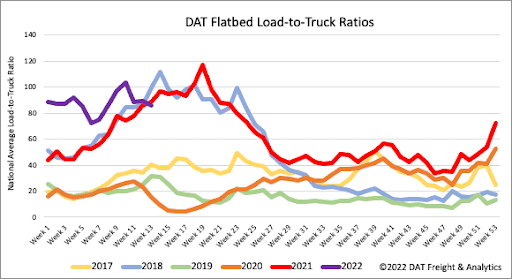

Flatbed load post volumes cooled last week following a 5% w/w decrease. Volumes are still 12% higher y/y and 39% higher than in the same period in 2018. Carrier equipment posts remained flat last week, resulting in the previous week’s flatbed LTR decreasing by 4% w/w from 89.26 to 85.64.

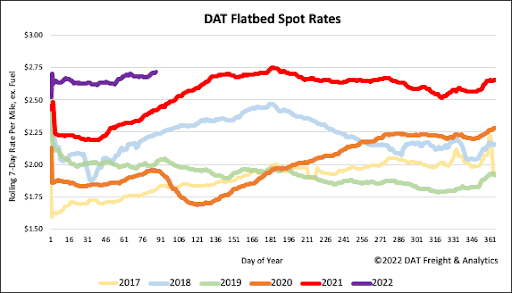

Flatbed spot rates clawed back the prior week’s losses, increasing by just over $0.03/mile to a national average of $2.71/mile excl. FSC last week. Spot rates have increased by $0.03/mile in the previous four weeks, which is $0.30/mile higher than the previous period last year and $0.57/mile higher than the same week in 2018.