The last remnants of the nearly 67-year-old Tropicana were reduced to rubble on October 9, 2024, to make way for the construction of the new Oaklands A’s Major League Baseball stadium. The 33,000-seat $1.5 billion ballpark will be built on 9 acres of the 35-acre Tropicana site, requiring a substantial amount of demand for long-haul flatbed carriers, including machinery, steel, cabling, and lumber, when the A’s begin construction on the ballpark in April 2025.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Family-owned Controlled Demolition Inc. (CDI), the subcontractor tasked with ensuring the implosion, has it down to a science, having leveled 32 other Las Vegas buildings, from the Dunes in 1993 to the most recent, the Riviera, in 2016. CDI president Mark Loizeaux said, “Typically, we take down structures in Las Vegas, if they’re on the Strip, on Tuesdays, which is the lowest ebb of activity according to Las Vegas officials. And we do it at 2:30 in the morning when tourist activity is low along with the lowest winds that would disperse the dust.”

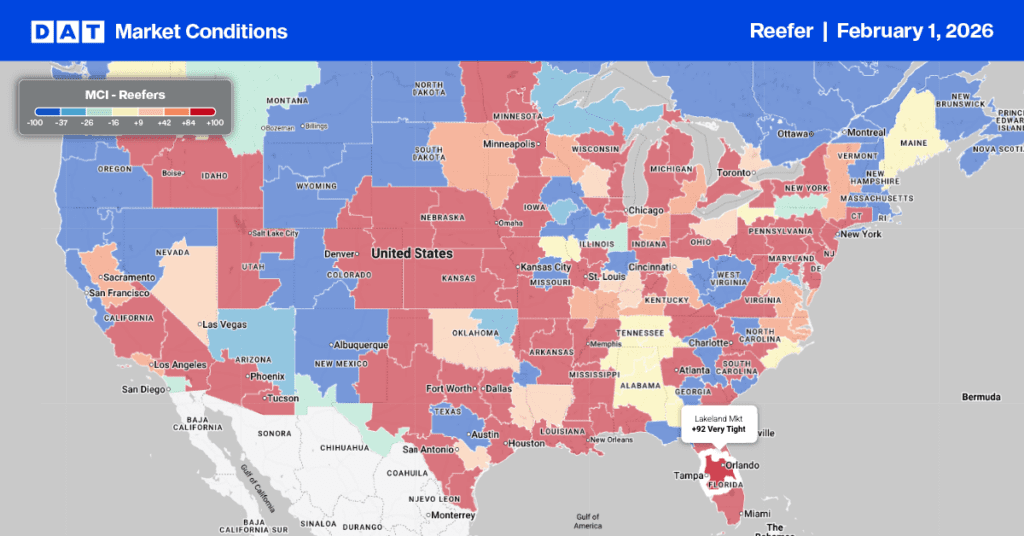

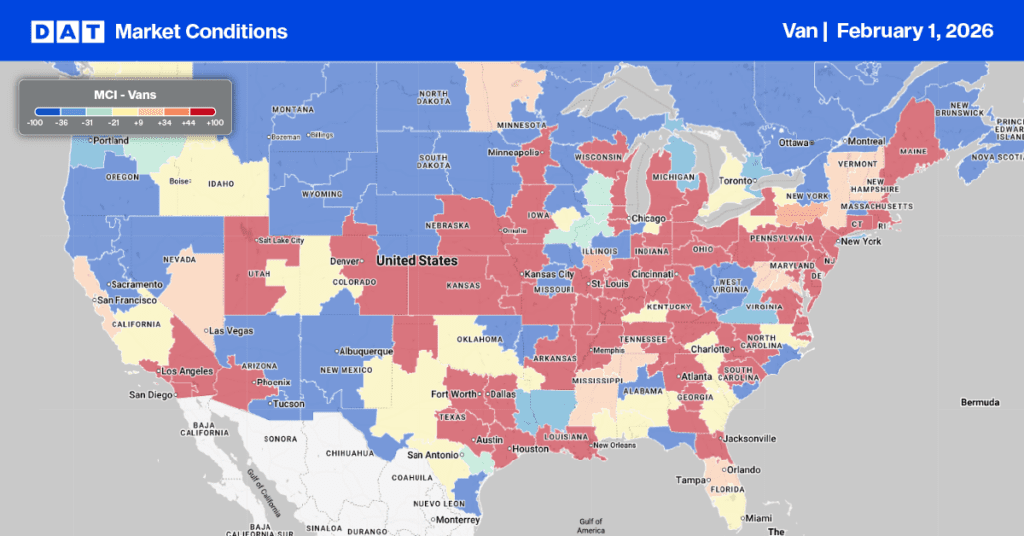

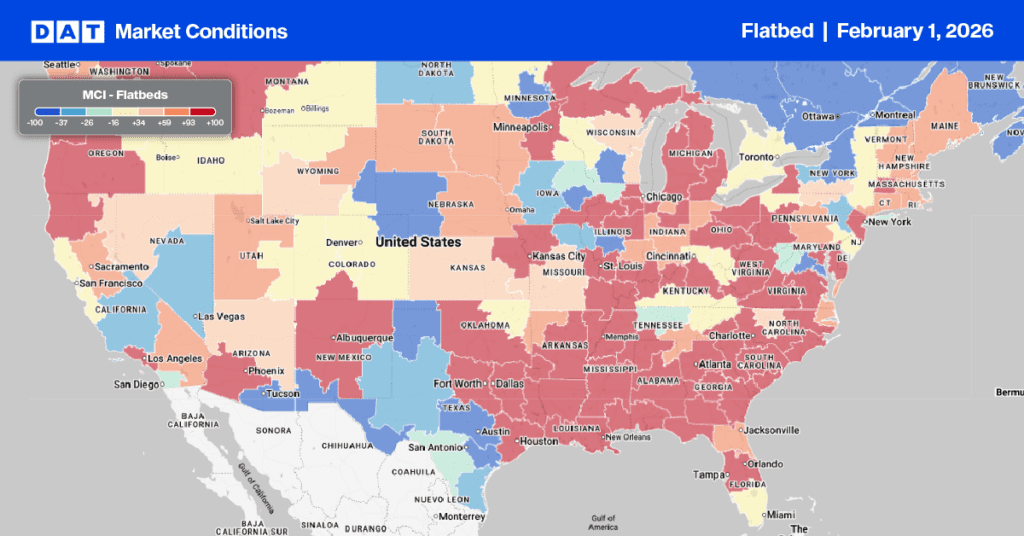

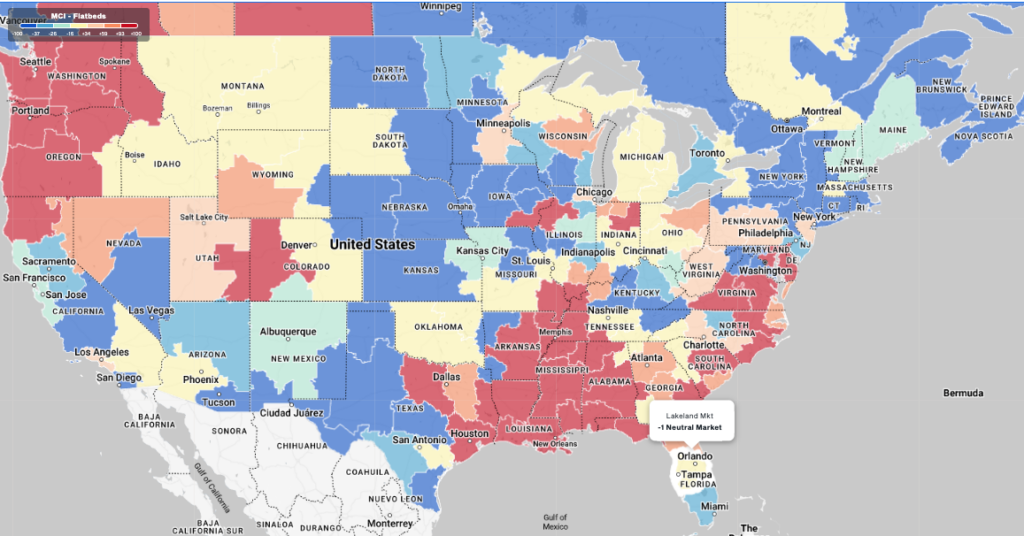

Market Watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

This week, we are focusing on the flatbed market in Lakeland, FL, which Hurricane Milton most impacted. The Lakeland area in Central Florida is home to a diverse range of building industry manufacturers due to its strategic location along the I-4 corridor, providing easy access to Tampa and Orlando. This includes the biggest manufacturer of roofing shingles in Florida and one of the largest in the U.S.

As recovery efforts begin, analysts expect that the state’s homebuilding sector will absorb an estimated $1.7 billion to $2.5 billion hit, according to a report from Goldman Sachs analyst Susan Maklari. The good news for builders is that many homes are already in later construction stages as they aim to hit year-end targets, and most builders tend to avoid constructing in floodplains.

“Reconstruction demand typically spans several months,” Maklari said, citing past hurricanes. Cleanup and insurance claims processing often delay actual repairs, with the full rebuilding efforts sometimes extending over 4 to 6 months. For example, Owens Corning reported that Hurricane Ian in 2022 resulted in 4 million squares of roofing damage, representing approximately 2.5% of annual roofing shipments.

Goldman Sachs does not foresee a sharp rise in overall building product volumes from Hurricane Milton. Instead, they expect a “pull-forward” in demand, meaning that short-term rebuilding activity might be strong, but it won’t significantly raise long-term volumes.

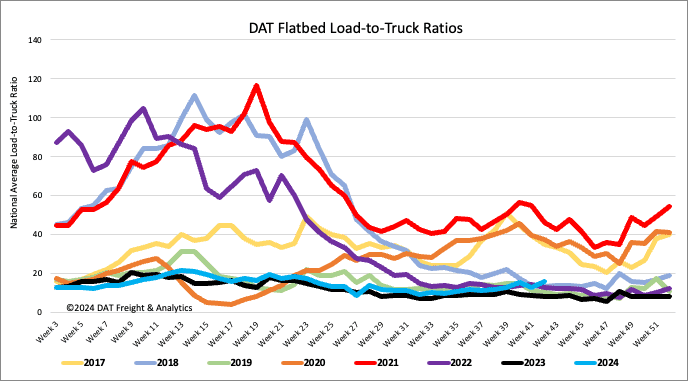

Load-to-Truck Ratio

Last week, the number of national flatbed load posts increased by 10%, 44% higher than last year. Meanwhile, carriers’ equipment decreased by 9% week-over-week. Consequently, the flatbed load-to-truck ratio increased by 21%, reaching 15.92, almost double last year’s LTR for Week 42.

Spot rates

After remaining flat the prior week, flatbed linehaul rates lost ground last week, decreasing by just $0.02/mile to a national average of $1.98/mile. This is $0.10/mile higher than last year and identical to the 3-month trailing average.

Flatbed volumes nationally increased by 1% w/w and almost 13% w/w in the large Atlanta freight distribution hub. On the high-volume lane between Atlanta and Lakeland, where Hurricane Milton made landfall, volumes more than doubled, resulting in a 4% increase in spot rates to an average of $2.95/mile.

In Lakeland, outbound volumes increased by 42% w/w, with inbound volumes up by 50% w/w. At $2.74/mile, inbound loads to Lakeland are 28% higher than last year, following last week’s $0.20/mile surge to an average of $2.74/mile, the highest in just over two years.