What a difference a year makes. Last year at the end of May there were about 90 flatbed load posts for every truck post, and the national average flatbed rate was $2.72 per mile. Last week we ended May with a load-to-truck ratio of 13 loads per truck and a national average rate of $2.28/mi. — that’s 5¢ lower than last month and 44¢ lower than last year.

Adverse weather conditions in many parts of the country have delayed construction and oil field activity has slowed, which hurts the flatbed market. Still, there is some good news to report. Some individual lanes and markets are still relatively strong, and load-to-truck ratios that had been falling throughout May reversed course last week and turned upward. Last week rates rose on 49 lanes, dropped on 27, and stayed the same in 2 of the top 78 flatbed lanes.

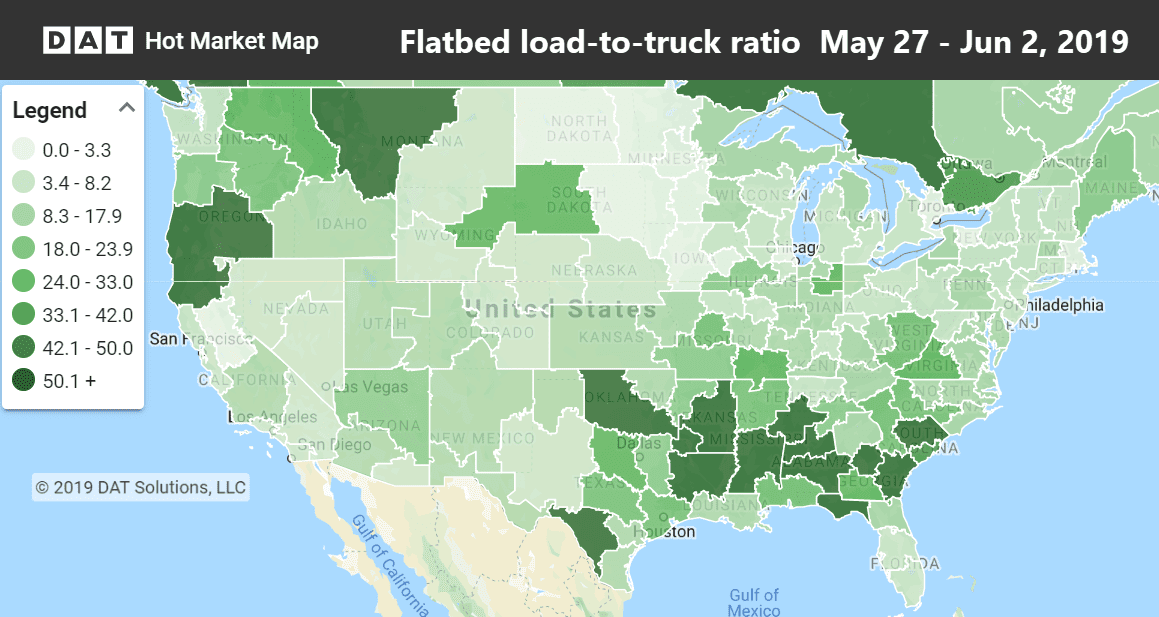

The national flatbed load-to-truck ratio increased to 14.4 last week. Several markets in the Southeast had load-to-truck ratios over 50. See how you can view similar maps using DAT’s Hot Market Maps.

Rising rates

Compared to van and reefer rates, flatbed rates are improving out of Florida, specifically Tampa and Jacksonville. The biggest rate increase for flatbeds last week was out of Phoenix, followed by Ft. Worth, TX, with Rock Island, IL, Pittsburgh, and Roanoke, VA also trending up. The biggest number of loads moved out of Houston, as always.

- Phoenix to Ontario, CA rates rose 11¢ to $1.87

- Ft. Worth to Houston had a 9¢ increase last week, to $2.30/mi.

- Rock Island, IL to Minneapolis added 17¢ to $2.72/mi.

Falling rates

Las Vegas rates dropped like a rock last week, and there were a lot fewer loads, holiday week notwithstanding. Birmingham also had a bad week.

- Las Vegas to Sacramento lost 4¢, but it’s still a pretty good rate at $2.73/mi. •

- Birmingham to Raleigh dropped 28¢ to $2.63/mi.

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView