The flatbed sector is off to a bustling start in 2023, boosted by significant projects resulting from the Infrastructure Bill and warmer weather, particularly in the Northeast. While the housing construction sector remains the wild card for flatbed carriers assessing the 2023 demand outlook, recent earnings calls from home improvement companies Lowes and Home Depot offered some warning signals. On a recent DAT iQ show, Fastmarkets Dustin Jalbert told listeners the repair and remodeling sector accounts for as much as 40% of lumber demand, which will funnel through home improvement centers.

Home Depot recorded another record year on its recent earnings call with fourth-quarter sales of $35.8 billion, an increase of $112 million, or 0.3%, from the fourth quarter of fiscal 2021. Sales for fiscal 2022 were $157.4 billion, an increase of $6.2 billion, or 4.1 percent, from fiscal 2021. Home Depot expects that even though consumer spending is holding up, it expects a flat sales-growth year overall as demand for home improvement projects moderates.

Lowe’s Companies, Inc. reported total sales for the fourth quarter were $22.4 billion compared to $21.3 billion in the fourth quarter of 2021. Comparable sales for the fourth quarter decreased by 1.5%, and comparable sales for the U.S. home improvement business decreased by 0.7%. Lowe’s 2022 total fiscal year sales were over $97 billion, of which approximately $92 billion of sales were generated in the U.S. The company’s 2023 outlook calls for total sales of roughly $88 – $90 billion, with sales to be flat to down -2% as compared to the prior year.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

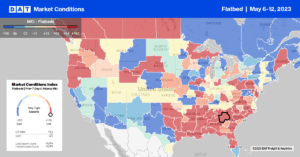

Flatbed capacity in Texas was flat last week at $2.20/mile for outbound loads, the second-highest spot rate in seven years, surpassed only by last year’s record high of $2.61/mile. Solid gains were reported along Texas’s southern border markets (El Paso, Laredo, and McAllen), where volumes increased by 21% last week. In Laredo, spot rates increased by $0.02/mile to $2.03/mile, while in nearby McAllen, spot rates increased by $0.11/mile to $2.21/mile. Flatbed loads from McAllen to Tulsa paid $1.49/mile, up $0.04/mile in the last two weeks, while loads east to Miami were flat at $2.23/mile.

Spot rates in Alabama were up $0.05/mile last week to $2.58/mile, boosted by gains in the Mobile market, where rates increased by $0.11/mile. In Montgomery, loads posts were higher last week for loads to McAllen in southern Texas, although linehaul rates eased to $1.78/mile, down $0.03/mile in the previous two weeks. In the Dallas/Ft. Worth metroplex, outbound rates were up $0.05/mile to $2.15/mile on 15% lower volumes last week.

In San Francisco, flatbed volumes have been growing over the last six weeks following last week’s 4% increase. In contrast, capacity tightened for the first time in a month as spot rates jumped by $0.24/mile the previous week to $1.90/mile. Most of the gains came from 700-mile loads east to Salt Lake City, paying $1.93/mile, which is $0.30/mile higher than the February average.

Load-to-Truck Ratio (LTR)

Flatbed volumes were flat last week and at the second-highest level this year, which was recorded the prior week. Even though volumes were more than triple this time last year, they have increased 16% in the previous month and continue to track closely with 2019 and 2020 levels. Carrier equipment posts are still at their highest level in seven years and were 56% higher than last year. As a result, last week’s flatbed load-to-truck (LTR) ratio decreased from 17.11 to 15.82, also the lowest in seven years.

Spot Rates

Flatbed spot rates continue to increase following last week’s penny-per-mile gain to a national average of $2.17/mile. Flatbed rates are still $0.53/mile lower than the previous year and identical to 2018, which was an excellent year for the flatbed sector regarding demand and spot rates.