Following a recent decline in farm machinery sales, John Deere is making strategic changes, including layoffs at its factories in Iowa and Illinois. The estimated number of job losses stands at around 890 employees this year. As part of its global expansion plans, Deere is considering a new factory location in Ramos, Mexico, to manufacture its mid-frame skid steer and compact track loaders. This move will bring new opportunities and growth for the company and its stakeholders. The company anticipates the new factory to be operational in 2026.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Farm Progress reports that the downturn in tractor sales has also impacted tractor tire manufacturer Bridgestone-Firestone, which downsized by about 100 workers due to declining agricultural equipment demand. AGCO, an agricultural machinery manufacturer headquartered in Duluth, Georgia, also laid off many employees from its Hesston, Kan., manufacturing plant in May. At the end of 2023, Case New Holland (CNH) reduced the size of its senior leadership team and trimmed its salaried workforce by 5%. AGCO also is expected to cut production by 10%.

According to the USDA, net farm income is expected to drop by 25% in 2024. The latest report anticipates a decrease from 2023’s forecast of $155 billion to $116 billion—a drop of nearly $40 billion, or 25.5%, and the largest recorded year-to-year dollar decrease in net farm income.

Market watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

Now, the flatbed market is past the peak in steel production in March each year; we’re seeing volumes fall off much faster than in prior years. According to the AISI (American Iron & Steel Institute), steel production In the week ending on June 22, 2024, was 1,710,000 net tons, while the capability utilization rate was 77%. The current week’s production represents a 1.6% decrease from the same period in the previous year. In Indiana, the largest producer of steel nationally, June tonnage volumes were down 9.4% y/y, dragging down truckload volumes and spot rates out of Ft. Wayne and Gary freight markets.

Outbound linehaul rates from these markets are 5.6% lower year over year (y/y), averaging $2.38/mile last week. On regional lanes to Cleveland, OH, linehaul rates are down 3.6% y/y. Linehaul rates are the lowest in 12 months on the South Bend to Toronto lane, averaging $1.79/mile last week.

Load-to-Truck Ratio

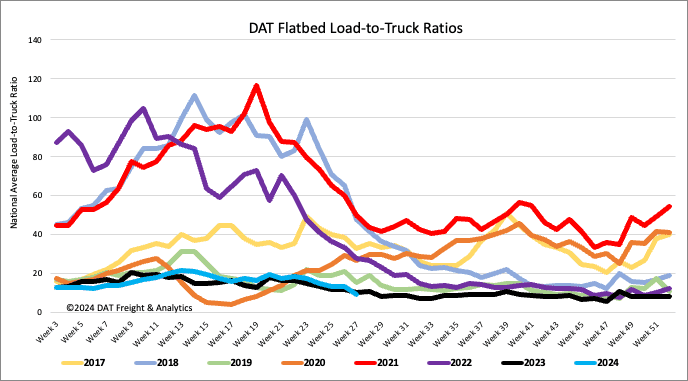

Flatbed load post volumes dropped 49% w/w and 24% year-over-year as the flatbed market began facing stiff headwinds. Carrier equipment posts were down 25% w/w and 14% y/y lower, decreasing last week’s flatbed load-to-truck ratio by 31% to 9.14, 11% lower than last year.

Spot rates

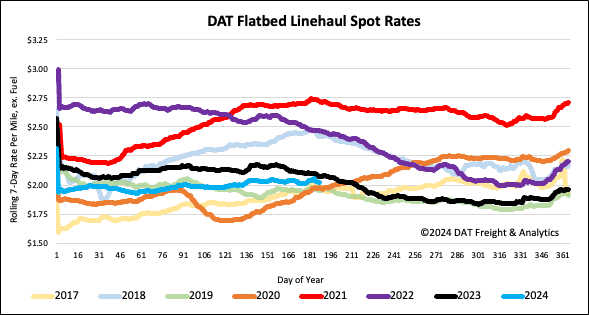

After increasing by $0.02/mile in the lead-up to July 4, the national average flatbed spot rate dropped by $0.03/mile last week as loads moved plunged by 32% week-over-week (w/w). At $2.05/mile, flatbed linehaul rates are $0.06/mile lower than last year but higher by the same amount compared to 2019.