According to the latest data from the Association of Equipment Manufacturers (AEM), Four-Wheel-Drive Tractors and Combine Harvesters continue to grow while some other segments continue to decline. Compared to the 5-year average, 2-4WD Tractors and Combine Harvester sales were 6% lower in May. Total farm tractor sales in the U.S. fell 0.7% versus May 2022 and are down 12.2% YTD. 2WD tractors were down 1% y/y for May and down 12.8% YTD, while 4WD tractors were up 51% y/y and 52% YTD. Self-propelled Combine Harvester sales were up 55% y/y and 68% YTD.

“The trends seen here are still being informed by the pandemic-driven highs in past years, especially in the sub-40 horsepower segment that, this month, makes up nearly seventy percent of total unit sales volume in agriculture tractors,” said Curt Blades, senior vice president, industry sectors and product leadership at the Association of Equipment Manufacturers. “The continued growth in bigger units and harvesters indicates two trends. First, farmers see enough improvement in the technology to make a clear business case for this investment, and second, they feel confident that positive commodity prices will continue, allowing them to afford the expense.”

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

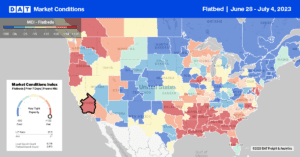

Flatbed capacity tightened in the Atlanta market last week following a $0.03/mile increase to $2.49/mile. Georgia state average rates at $2.56/mile were $0.04/mile higher w/w. Loads moved between Atlanta and Lakeland increased by 4% last week but with plenty of available capacity. Loads paid carriers an average of $2.31/mile, the lowest in 12 months and $1.14/mile lower than last June. In Memphis, flatbed linehaul rates increased by $0.08/mile the previous week to an average of $2.67/mile for all outbound loads.

At $2.26/mile, outbound loads in the Dallas/Ft Worth metroplex were $0.04/mile higher last week, reversing the 4-week slide in state average spot rates. Texas average flatbed rates at $2.25/mile increased by $0.08/mile last week and are now just $0.29 lower than in 2018. In the Pacific Northwest, regional linehaul rates averaged $2.54/mile the previous week, with solid gains reported in Oregon, where spot rates increased by $0.06/mile to $2.69/mile. Washington State spot rates averaged $2.56/mile last week, up $0.07/mile w/w.

Load-to-Truck Ratio (LTR)

Flatbed spot market volumes continue to drift sideways following last week’s 12% decrease. Loadposts are 71% lower than the previous year and around half the volume in 2018 and 2019. Carrier equipment posts were down 11% last week, resulting in last week’s flatbed load-to-truck (LTR) ratio decreasing slightly from 8.93 to 8.82, the lowest since 2016.

Spot Rates

Flatbed linehaul rates were flat for the third week leaving the national average at just under $2.14/mile last week. Compared to the previous year, linehaul rates are $0.35/mile lower but $0.14/mile higher than in 2019 and $0.35/mile lower than in 2018.