For flatbed carriers looking for signals that demand will improve, two reliable indicators point to more of the same in the short term. The Fannie Mae Home Purchase Sentiment Index (HPSI) was unchanged in April at 71.9 and shows signs of plateauing once consumers adjust to the higher interest rate and home price environment.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Homebuilders and buyers share the gloomy outlook for residential construction, creating some headwinds for flatbed carriers. The National Association of Home Builders (NAHB) Housing Market Index (HMI), based on the sentiment of NAHB members, was flat in April as mortgage rates remained close to 7% over the past month, and the latest inflation data failed to show improvement during the first quarter of 2024. Builder confidence in the market for newly-built single-family homes was 51 in April, unchanged from March. This breaks a four-month period of gains for the index, which remains above the critical breakeven point of 50.

NAHB Chief Economist Robert Dietz’s insights are valuable for flatbed carriers in shaping their business strategies. He suggests that while April’s flat reading indicates potential for demand growth, buyers are cautious due to uncertainty about future interest rates. However, with the market adjusting to higher rates and the expectation of future rate cuts, Dietz anticipates a moderation in mortgage rates in the second half of 2024.

Market watch

All rates cited below exclude fuel surcharges unless otherwise noted.

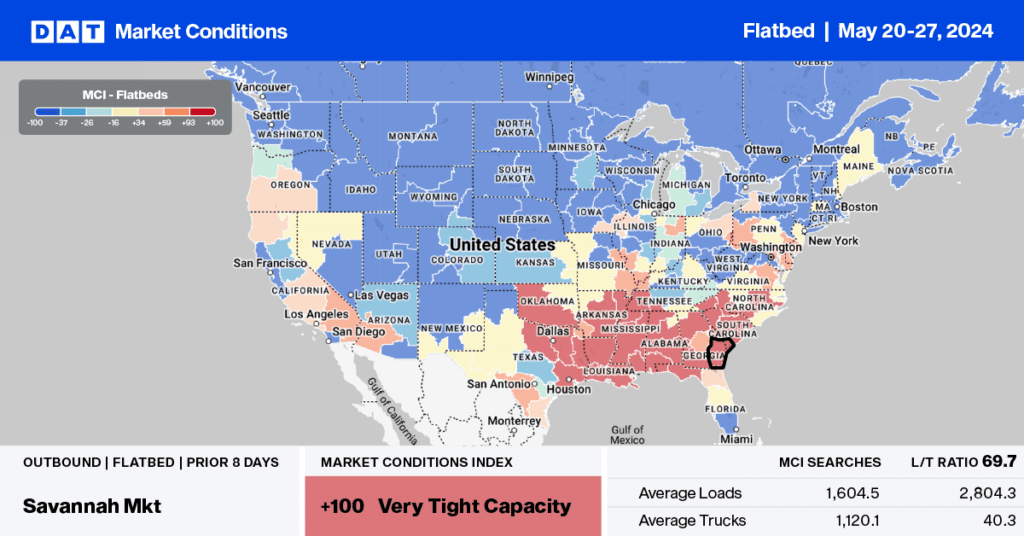

Flatbed capacity continues to tighten across the Southeast Region following last week’s 6% increase in loads moved. The eleven-state regional linehaul rate averaged $2.49/mile last week, up $0.05/mile w/w. In Savannah, linehaul rates were up $0.03/mile to $2.59 on a 20% higher w/w volume, while in Atlanta, capacity was very tight following last week’s $0.19/mile spike to an average outbound rate of $2.66/mile. Atlanta’s outbound load moved volume was up 9% w/w and 11% in the last month, while carriers are being paid $0.15/mile more than last year.

In Birmingham, AL, loads moved increased by 7% w/w, while rates increased by $0.12/mile to $2.66/mile, with similar gains reported on the high-volume lane south to Lakeland. After increasing by around $0.30/mile since the start of the year in the Lakeland market, outbound linehaul rates leveled off last week at $1.53/mile on a 15% higher volume of loads moved.

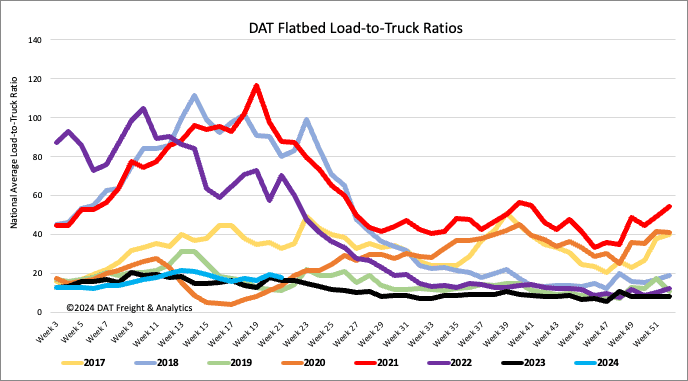

Load-to-Truck Ratio

Year-to-date load post volumes have been on par with 2019 and last year but are at the inflection where the market starts to cool in a soft freight market. Flatbed load post volumes decreased by 3% w/w and 10% y/y, while equipment posts increased by 3% w/w, decreasing the load-to-truck ratio by 6% to 18.29.

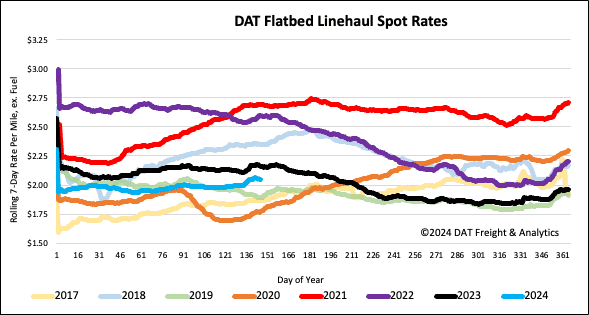

Spot rates

Following the prior week’s $0.03/mile increase, flatbed linehaul rates remained mostly flat at a national average of $2.07/mile. The national average is $0.12/mile lower than last year on a 36% higher volume of loads moved in Week 21 last year.